Official Rt 6A Florida Template

Understanding the importance of accurate and timely tax reporting for employers in Florida is critical, especially when it involves the Rt 6A Florida form, a crucial document for businesses. Administered by the Florida Department of Revenue, this Employer’s Quarterly Report Continuation Sheet ensures that employers comply with state tax laws by reporting wages paid to their employees every quarter. This compliance is mandatory, irrespective of the level of employment activity or whether any tax is due. The form serves a dual purpose: it assists in the administration of Florida’s tax laws and safeguards sensitive information under strict confidentiality provisions. With social security numbers acting as unique identifiers for tax administration, the form meticulously underscores the importance of privacy, adhering to both state and federal laws concerning data collection and usage. The guidelines for filling out the form are straightforward, focusing on each employee's social security number, name, gross wages for the quarter, and the taxable wages applicable. It’s essential for employers to understand that only the first $7,000 of each employee's annual wages is taxable, highlighting the form's role in calculating due taxes accurately. The Rt 6A form, thus, not only complies with tax reporting obligations but also emphasizes the protection of personal information, reflecting a comprehensive approach to tax administration in Florida.

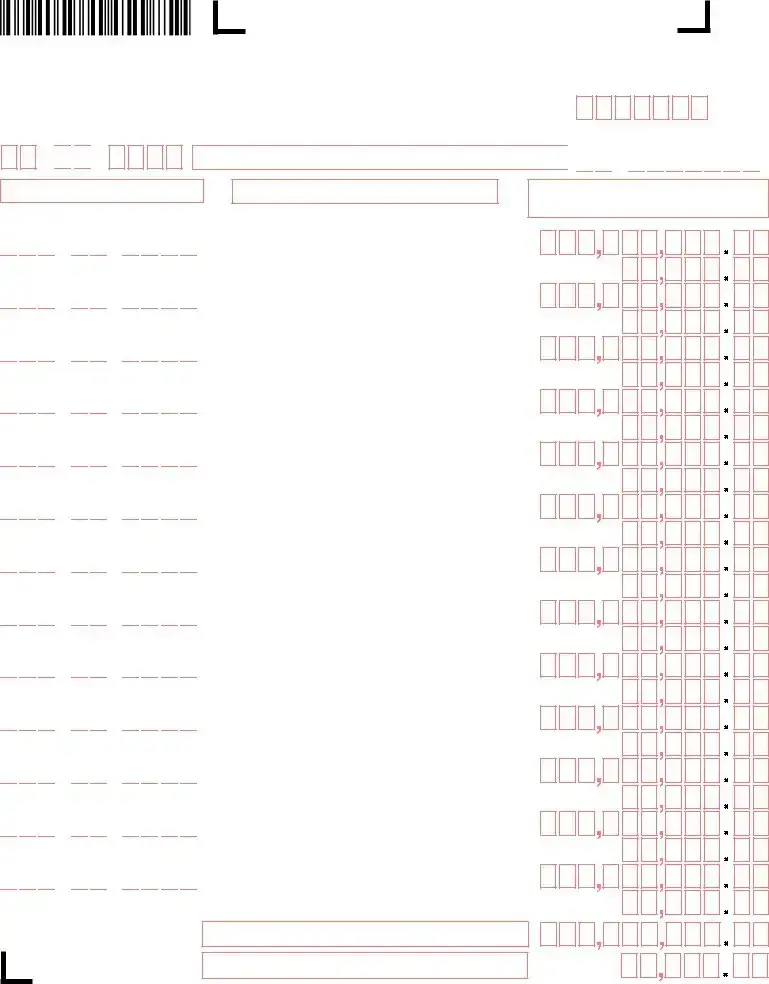

Example - Rt 6A Florida Form

Florida Department of Revenue

Employer’s Quarterly Report Continuation Sheet

Employers are required to ile quarterly tax/wage reports regardless of employment activity or whether any taxes are due.

Social security numbers (SSNs) are used by the Florida Department of Revenue as unique identiiers for the administration of Florida’s taxes. SSNs

obtained for tax administration purposes are conidential under sections 213.053 and 119.071, Florida Statutes, and not subject to disclosure as public RT ACCOUNT NUMBER records. Collection of your SSN is authorized under state and federal law. Visit our website at www.mylorida.com/dor and select “Privacy Notice” for

more information regarding the state and federal law governing the collection, use, or release of SSNs, including authorized exceptions.

QUARTER ENDING |

EMPLOYER’S NAME |

F.E.I. NUMBER |

/

/

/

-

-

10. EMPLOYEE’S SOCIAL SECURITY NUMBER

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

TC

Rule

Florida Administrative Code

Effective Date 11/14

11. EMPLOYEE’S NAME (please print irst twelve characters of last name and irst eight characters of irst name in boxes)

Last |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Name |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

12a. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

First |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Middle |

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

Name |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Initial |

|

|

12b. |

||

Last |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Name |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

12a. |

First |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Middle |

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

Name |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Initial |

|

|

12b. |

||

Last |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Name |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

12a. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

First |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Middle |

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

Name |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Initial |

|

|

12b. |

||

Last |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Name |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

12a. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

First |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Middle |

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

Name |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Initial |

|

|

12b. |

||

Last |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Name |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

12a. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

First |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Middle |

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

Name |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Initial |

|

|

12b. |

||

Last |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Name |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

12a. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

First |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Middle |

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

Name |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Initial |

|

|

12b. |

||

Last |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Name |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

12a. |

First |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Middle |

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

Name |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Initial |

|

|

12b. |

||

Last |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Name |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

12a. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

First |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Middle |

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

Name |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Initial |

|

|

12b. |

||

Last |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Name |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

12a. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

First |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Middle |

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

Name |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Initial |

|

|

12b. |

||

Last |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Name |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

12a. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

First |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Middle |

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

Name |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Initial |

|

|

12b. |

||

Last |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Name |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

12a. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

First |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Middle |

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

Name |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Initial |

|

|

12b. |

||

Last |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Name |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

12a. |

First |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Middle |

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

Name |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Initial |

|

|

12b. |

||

Last |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Name |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

12a. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

First |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Middle |

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

Name |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Initial |

|

|

12b. |

||

13a. Total Gross Wages (add Lines 12a only). Total this page only. Include this and totals from additional pages in Line 2 on page 1 of the

13b. Total Taxable Wages (add Lines 12b only). Total this page only. Include this and totals from additional pages in Line 4 on page 1 of the

12a. EMPLOYEE’S GROSS WAGES PAID THIS QUARTER

12b. EMPLOYEE’S TAXABLE WAGES PAID THIS QUARTER

Only the irst $7,000 paid to each employee per calendar year is taxable.

File Specifications

| Fact Number | Fact Details |

|---|---|

| 1 | The RT-6A Form is a continuation sheet for the Employer’s Quarterly Report in Florida. |

| 2 | Employers in Florida are mandated to file quarterly tax/wage reports irrespective of employment activity or tax dues. |

| 3 | Social Security Numbers (SSNs) are utilized by the Florida Department of Revenue as unique identifiers for tax administration. |

| 4 | Confidentiality of SSNs is guaranteed under sections 213.053 and 119.071, Florida Statutes, and they are not deemed public records. |

| 5 | Collection of SSNs for the form is authorized by both state and federal laws. |

| 6 | The website for the Florida Department of Revenue features a Privacy Notice that explains the laws governing SSN collection, use, or release. |

| 7 | The form is governed by TC Rule 73B-10.037 in the Florida Administrative Code. |

| 8 | It was made effective as of November 14th, without specifying the year in the provided details. |

| 9 | The form includes fields for entering employee names, Social Security Numbers, and wages both gross and taxable. |

| 10 | Only the first $7,000 paid to each employee per calendar year is considered taxable income for the purposes of this report. |

Instructions on Filling in Rt 6A Florida

Getting ready to tackle the RT-6A Florida form involves providing detailed employee wage information for a given quarter. This continuation sheet is essential for businesses large enough that the primary Employer’s Quarterly Report form (RT-6) does not suffice. It helps ensure that all employee wages are accurately reported to the Florida Department of Revenue, fulfilling state tax obligations. Here’s a straightforward guide on how to fill it out properly.

- Start by inputting your RT ACCOUNT NUMBER in the designated space at the top of the form. This number is unique to your business and identifies your account with the Florida Department of Revenue.

- Enter the QUARTER ENDING date that this continuation sheet corresponds to, ensuring it matches the quarter indicated on your primary RT-6 form.

- Provide your EMPLOYER’S NAME exactly as it appears on your RT-6 form to ensure consistency across your tax documents.

- Next, fill in your F.E.I. NUMBER (Federal Employer Identification Number), which is used by the IRS for tax purposes.

- For each employee, enter their EMPLOYEE’S SOCIAL SECURITY NUMBER in the spaces provided under item 10. Make sure these numbers are accurate to preserve employee confidentiality and comply with legal requirements.

- In the fields under item 11, print the EMPLOYEE’S NAME, starting with the last name (up to the first twelve characters) and then the first name (up to the first eight characters). If they have a middle name, include the initial.

- Under item 12a, input each EMPLOYEE’S GROSS WAGES PAID THIS QUARTER in the designated area. These should align with the gross wages before any deductions are made.

- In the corresponding fields under item 12b, specify the EMPLOYEE’S TAXABLE WAGES PAID THIS QUARTER. Remember, only the first $7,000 paid to each employee per calendar year is taxable.

- For item 13a, TOTAL GROSS WAGES, you'll add up all the entries from 12a (this page only) to get the sum of gross wages paid out. This step requires careful arithmetic to ensure accuracy.

- Similarly, in item 13b, TOTAL TAXABLE WAGES, total the amounts from 12b (this page only). This figure represents the sum of all taxable wages from this sheet and will be included in your main RT-6 form.

After thoroughly completing the RT-6A form for each employee not listed on the primary RT-6, review all the provided information for accuracy. These detailed steps help ensure that you meet Florida’s tax reporting requirements, maintaining compliance and contributing to the efficient processing of your forms.

Understanding Rt 6A Florida

What is the RT-6A Florida form used for?

The RT-6A Florida form is a continuation sheet used by employers to report quarterly tax and wage details for their employees. It accompanies the primary RT-6 form, which is the Employer's Quarterly Report. Employers must file these reports every quarter, detailing both gross wages paid and taxable wages paid to each employee.

Who is required to file the RT-6A form?

All Florida Employers who file an RT-6 Employer's Quarterly Report and have more employees than can fit on the primary RT-6 form must use the RT-6A form. It's specifically for enumerating additional employees not included on the first page of the RT-6.

How often do I need to submit the RT-6A form?

Employers are required to submit the RT-6A form quarterly, alongside the RT-6 form. The specific due dates for these reports are April 30, July 31, October 31, and January 31, covering the previous quarter's employment activity.

Is there a penalty for not filing the RT-6A?

Yes, employers who fail to file the RT-6A, along with the RT-6 form, on time may face penalties. These could include fines and interest on any unpaid taxes. Timely filing is crucial to avoid these penalties.

Can the RT-6A form be filed electronically?

Yes, the Florida Department of Revenue encourages employers to file both the RT-6 and RT-6A forms electronically through their online portal. This method is faster and often more convenient for both filing and record-keeping.

What should I do if I made a mistake on my RT-6A form?

If you realize you've made an error on your RT-6A form after submission, you should contact the Florida Department of Revenue as soon as possible. They can guide you on the steps to correct the error, which may involve amending the form.

Are Social Security Numbers required on the RT-6A form?

Yes, employers must provide the Social Security Numbers (SSNs) of each employee listed on the RT-6A form. These SSNs are used by the Florida Department of Revenue as unique identifiers for tax administration purposes.

How is the information on the RT-6A form used by the state?

The information provided on the RT-6A form, including gross wages and taxable wages for each employee, is used by the state to compute unemployment taxes owed by the employer. It also aids in the administration of Florida's tax laws and ensures compliance with state employment regulations.

What are the key sections of the RT-6A form?

The key sections of the RT-6A form include the employer's account number, the quarter ending date, employer's name, F.E.I. number, each employee's Social Security Number, name, gross wages paid this quarter, and taxable wages paid this quarter. These details are crucial for accurately calculating taxes and maintaining employment records.

How can I get help with filling out the RT-6A form?

For assistance with the RT-6A form, employers can visit the Florida Department of Revenue's website for guidelines or contact their customer service. Additionally, there are resources and tax professionals available who specialize in employment tax reporting that can offer help.

Common mistakes

Filling out legal tax documents requires careful attention to detail. The Rt 6A Florida form, which employers must complete for quarterly tax/wage reports, is no exception. Errors in this process can lead to unnecessary complications, ranging from delayed processing to potential penalties. To help employers navigate this process more effectively, here's a list of six common mistakes made when filling out the Rt 6A form:

-

Incorrect Social Security Numbers: One of the most critical pieces of information on the Rt 6A form is the employee's Social Security Number (SSN). Errors in the SSN can lead to misfiled taxes and potential identity issues. Ensure SSNs are double-checked against official documents.

-

Failure to Include All Names: The form requires the first twelve characters of the employee's last name and the first eight characters of the first name. Omitting or inaccurately entering names can lead to processing delays and a failure to accurately report wages.

-

Miscalculating Gross and Taxable Wages: Employers must correctly differentiate and report gross wages paid this quarter (Line 12a) and taxable wages paid this quarter (Line 12b). Remember, only the first $7,000 paid to each employee per calendar year is taxable. Miscalculations can affect tax liabilities.

-

Overlooking the Continuation Sheets: When reporting for multiple employees, it’s essential to use continuation sheets correctly. Ensure that totals from these additional pages are included in Line 2 and Line 4 on page 1 of the RT-6. Missing this step can lead to underreported wages.

-

Incorrect Rt Account Number or F.E.I. Number: The RT Account Number and Federal Employer Identification (F.E.I.) Number facilitate the correct association of the report with your account. Errors in these numbers can misdirect your filing, leading to unrecognized reports.

-

Not Updating Address or Contact Information: Changes in employer address or other contact information should be updated promptly. Failure to do so might result in missed communications from the Florida Department of Revenue, potentially including requests for additional information or clarification.

To ensure accuracy and compliance, it’s advisable for employers to review these common pitfalls carefully before submitting their Rt 6A Florida form. Accurate and timely submission supports smooth tax administration and avoids unnecessary complications.

Documents used along the form

Completing the Rt 6A form, part of the Florida Department of Revenue Employer's Quarterly Report, is a significant aspect of managing a business's payroll taxes in Florida. This form is crucial for reporting wages paid, and taxes withheld on a quarterly basis. Apart from the Rt 6A, there are other essential forms and documents employers need to maintain a compliant and efficient payroll system. Below is a list of six such forms, each with a succinct description.

- Form RT-6: This is the main Employer’s Quarterly Report form that complements the Rt 6A. It provides the Florida Department of Revenue with a summary of total wages paid, taxable wages, and the taxes due for the quarter.

- Form W-4: Completed by employees at the beginning of their employment, this federal form dictates how much federal income tax to withhold from an employee’s paycheck.

- Form W-2: Employers must complete this form annually for each employee, documenting the employee’s total yearly earnings, tax deductions, and other withholdings. It's vital for employees' personal tax filings.

- Form I-9: This form verifies an employee's eligibility to work in the United States. Employers are required to complete and retain Form I-9 for every person they hire.

- Form UCT-6: Florida employers use this form to report unemployment tax. This state-specific form is essential for businesses to comply with Florida Unemployment Tax Law.

- New Hire Reporting Form: This form is part of Florida’s new hire reporting requirements, where employers must report new employees to the state to assist in locating parents who owe child support.

It’s important for employers to familiarize themselves with each of these forms, understanding not just their purpose but also their deadlines and specific filing instructions. Staying informed and organized with these documents can help manage payroll responsibilities smoothly and ensure compliance with both state and federal regulations.

Similar forms

The Form W-3, also known as the "Transmittal of Wage and Tax Statements," is similar to the RT-6A Florida form because both are used for reporting total wages paid to employees. However, while the RT-6A focuses on state tax reporting in Florida, the Form W-3 is used to submit federal wages and taxes information to the Social Security Administration.

Form 941, the "Employer's Quarterly Federal Tax Return," shares similarities with the RT-6A form in that both require employers to report on wages paid and taxes owed on a quarterly basis. Form 941 pertains to federal income tax, Social Security, and Medicare taxes, whereas the RT-6A is specific to state-level taxation in Florida.

The State Unemployment Tax Act (SUTA) Report is a state-specific form that, like the RT-6A, necessitates the reporting of wages paid to employees to calculate unemployment insurance taxes. While the RT-6A serves this purpose in Florida, other states have their own versions of the SUTA report to manage unemployment tax reporting within their jurisdictions.

Form UC-2, "Employer's Quarterly Report," for unemployment compensation is another document with a functionality similar to that of the RT-6A. It is used in certain states for reporting employee wages and calculating unemployment insurance contributions. Like the RT-6A, Form UC-2 is crucial for compliance with state labor and tax collection laws.

Lastly, the Form W-2, "Wage and Tax Statement," although primarily a year-end document given to employees, relates to the RT-6A as it involves the detailed reporting of wages paid and taxes withheld for each employee. The data compiled quarterly through the RT-6A contributes to the annual totals reported on the W-2 forms.

Dos and Don'ts

When filling out the RT-6A Florida form, an employer’s quarterly report continuation sheet, it's essential to follow specific guidelines to ensure accuracy and compliance with the Florida Department of Revenue requirements. Below is a list of dos and don’ts to assist you in completing this form correctly.

Do:- Review the form instructions carefully before you start filling it out to ensure you understand all requirements.

- Use black ink or type the information electronically for clarity and legibility.

- Ensure that the employee's social security number is accurately entered, as this is a critical piece of information used for identification purposes.

- Provide the first twelve characters of the employee's last name and the first eight characters of the first name in the spaces provided to ensure proper identification.

- Accurately calculate and report total gross wages and total taxable wages for each employee listed.

- Include the RT account number and quarter ending date at the top of the form to ensure it is processed correctly and timely.

- Verify all information for accuracy before submitting the form to the Florida Department of Revenue.

- Leave any fields blank; if a section does not apply, indicate with "N/A" (not applicable) or "0", where numerical values are required.

- Use pencil or non-permanent writing tools that can smudge or be erased, leading to errors or unreadable submissions.

- Forget to include totals on page 1 of the RT-6, as totals from the RT-6A need to be included in the calculation on the main form.

- Miss the submission deadline provided by the Florida Department of Revenue, as this can lead to penalties or interest charges.

- Misreport wages, as only the first $7,000 paid to each employee per calendar year is taxable. Ensure accuracy to avoid over or underpayment.

- Disregard privacy notices concerning the collection and use of Social Security Numbers (SSNs); handle this information with the utmost care.

- Guess on information; verify all details for accuracy to prevent potential issues with employee records or tax obligations.

Misconceptions

There are several misconceptions regarding the Rt 6A Florida form, a continuation sheet for the Employer's Quarterly Report. Let's clarify these to ensure accurate and compliant reporting:

It's optional to file: Some believe the Rt 6A form is optional. However, employers are required to file quarterly tax/wage reports regardless of employment activity or whether any taxes are due.

SSNs are publicly accessible: People often think Social Security Numbers (SSNs) provided are public records. In reality, SSNs are confidential under Florida Statutes and are used uniquely for tax administration, safeguarded from unauthorized disclosure.

Any state or federal law does not authorize collecting SSNs: Contrary to this belief, the collection of SSNs is authorized under both state and federal law, primarily for tax administration purposes.

Filling out employee names fully: There's a misconception that full names need to be entered. The form actually requires only the first twelve characters of the last name and the first eight characters of the first name.

All wages are taxable: Some employers might think all wages paid are taxable. The truth is, only the first $7,000 paid to each employee per calendar year is taxable.

The form is the same as the RT-6: While related, the RT-6A serves as a continuation sheet for the RT-6, meant for detailing additional employees or corrections, not as a replacement or equivalent of the main form.

Electronic submission isn't allowed: Many are under the impression that this form must be submitted in paper format, but electronic submission options are available and encouraged for efficiency and environmental reasons.

Privacy concerns over website information: Concerns about privacy when visiting the provided website for information are often misplaced. The website includes a comprehensive "Privacy Notice" explaining the safeguarding of personal information.

Unlimited corrections allowed: It's mistakenly thought that corrections to information on the Rt 6A can be made indefinitely. While corrections are permissible, they are subject to time constraints and verification processes.

Doesn't affect tax liability: A common misconception is that the details filled out on Rt 6A don’t impact tax liability. In fact, accurate reporting of gross and taxable wages directly affects the calculation of an employer's tax liability.

Understanding and correcting these misconceptions ensures compliance with Florida's Department of Revenue requirements, facilitating a smoother process for employers while protecting employee information.

Key takeaways

Filling out and using the RT-6A Florida form, the Employer’s Quarterly Report Continuation Sheet, plays a crucial role in the administration of taxes and compliance for businesses. Understanding the key points about this form can ensure accurate and efficient handling of wage reporting for employers within Florida. Here are five critical takeaways:

- All employers are required to file quarterly tax/wage reports, which is a mandate regardless of employment activity or whether any taxes are payable for that period.

- The use of Social Security Numbers (SSNs) is a significant element of the RT-6A form. SSNs are utilized as unique identifiers for tax administration purposes by the Florida Department of Revenue, ensuring confidentiality and protection under specific Florida Statutes.

- Accuracy in reporting is paramount, with particular emphasis on ensuring that employee details, such as their SSNs, names, and gross and taxable wages paid during the quarter, are correctly entered. This precision is crucial for both the employer's and employees' tax records.

- The form distinguishes between gross wages paid and taxable wages paid within the quarter. It's important to note that only the first $7,000 paid to each employee per calendar year is taxable, affecting the way calculations are made for reporting purposes.

- Completion and submission of the RT-6A must be considered as part of a broader process that ties back to the RT-6 form. Totals from the RT-6A, such as total gross wages and total taxable wages, must be included on page 1 of the RT-6 form, highlighting the interconnectedness of these documents in reporting to the Florida Department of Revenue.

Understanding and adhering to these key aspects when filling out the RT-6A form can help streamline the tax reporting process, ensure compliance with Florida's tax laws, and prevent potential issues with tax administration for employers.

Popular PDF Templates

Family Law Financial Affidavit (short Form Pdf) - By mandating detailed financial reporting, the form deters concealment of assets and promotes honesty in legal proceedings.

Florida Dot Physical Requirements - A systematic approach for checking drivers for alcoholism or substance abuse issues that could endanger road safety.