Official Notice Florida Template

In the intricate and highly personal realm of family law, the Notice Florida Form 12.902(c), known as the Family Law Financial Affidavit (Long Form), emerges as a critical document for those navigating through financial disclosures in cases where an individual's gross annual income is $50,000 or more. It is meticulously designed to ensure a thorough and transparent account of one's financial status, painting a comprehensive picture that is vital for resolving various issues that lie at the heart of family law proceedings. Whether it concerns matters of alimony, child support, or the equitable distribution of marital assets, this affidavit serves as a foundational pillar, providing the court with essential information to make informed decisions. Participants in these proceedings are required to detail their income, expenses, assets, and liabilities, following the conversion instructions provided for different income schedules to monthly amounts, thereby standardizing the information for easier assessment and comparison. Particularly noteworthy is the form's adaptability in catering to specific circumstances by excluding certain applicants under well-defined conditions and its emphasis on confidentiality for victims of domestic violence or related offenses. Furthermore, the advent of electronic filing and service as stipulated by the Florida Rules of General Practice and Judicial Administration adds layers of efficiency and accessibility to the process, although traditional methods remain in place for those who choose or need them. With detailed instructions, this form not only guides the filer through its completion but also underscores the legal obligations for accurate and honest disclosure, marking its significance in the quest for fairness and justice in family law cases.

Example - Notice Florida Form

INSTRUCTIONS FOR FLORIDA FAMILY LAW RULES OF PROCEDURE

FORM 12.902(c)

FAMILY LAW FINANCIAL AFFIDAVIT (LONG FORM)

(10/21)

When should this form be used?

This form should be used when you are involved in a family law case which requires a financial affidavit and your individual gross income is $50,000 OR MORE per year unless:

(1)You are filing a simplified dissolution of marriage under rule 12.105 and both parties have waived the filing of financial affidavits;

(2)you have no minor children, no support issues, and have filed a written settlement agreement disposing of all financial issues; or

(3)the court lacks jurisdiction to determine any financial issues.

This form should be typed or printed in black ink. After completing this form, you should sign the form. You should then file this document with the clerk of the circuit court in the county where the petition was filed and keep a copy for your records.

What should I do next?

A copy of this form must be served on the other party in your case within 45 days of being served with the petition, if it is not served on him or her with your initial papers. Service must be in accordance with Florida Rule of General Practice and Judicial Administration 2.516.

A copy of this form must be filed with the court and served on the other party or his or her attorney. The copy you are serving to the other party must be either mailed,

Where can I look for more information?

Before proceeding, you should read “General Information for

IMPORTANT INFORMATION REGARDING

The Florida Rules of General Practice and Judicial Administration now require that all petitions, pleadings, and documents be filed electronically except in certain circumstances.

Instructions for Florida Family Law Rules of Procedure Form 12.902(c), Family Law Financial Affidavit (Long Form) (10/21)

IMPORTANT INFORMATION REGARDING

After the initial service of process of the petition or supplemental petition by the Sheriff or certified process server, the Florida Rules of General Practice and Judicial Administration now require that all documents required or permitted to be served on the other party must be served by electronic mail (e- mail) except in certain circumstances. You must strictly comply with the format requirements set forth in the Florida Rules of General Practice and Judicial Administration. If you elect to participate in electronic service, which means serving or receiving pleadings by electronic mail

To serve and receive documents by

Special notes . . .

If you want to keep your address confidential because you have been found by a judge to be the victim of sexual battery, aggravated child abuse, aggravated stalking, harassment, aggravated battery, or domestic violence do not enter the address, telephone, and fax information at the bottom of this form. Instead, file Request for Confidential Filing of Address, Florida Supreme Court Approved Family Law Form 12.980(h).

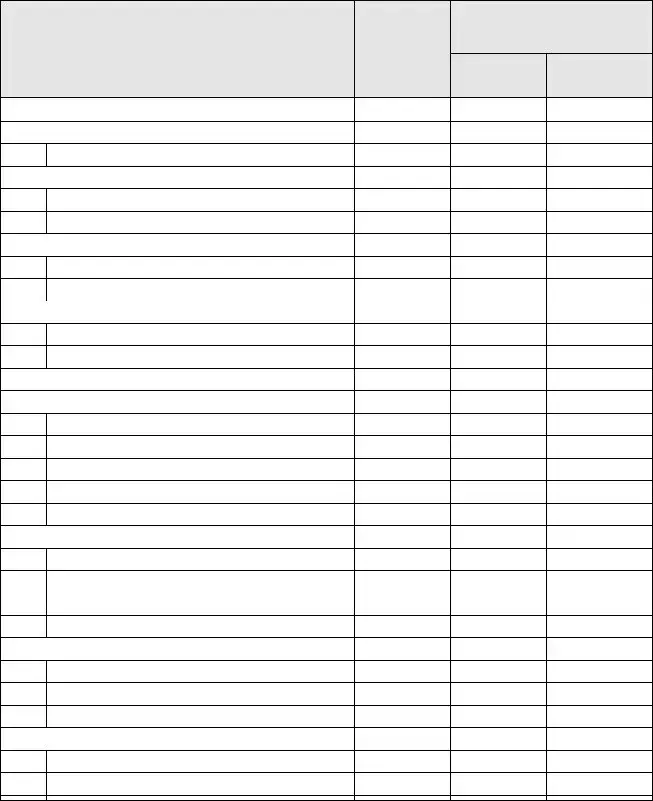

The affidavit must be completed using monthly income and expense amounts. If you are paid or your bills are due on a schedule which is not monthly, you must convert those amounts. Hints are provided below for making these conversions.

Instructions for Florida Family Law Rules of Procedure Form 12.902(c), Family Law Financial Affidavit (Long Form) (10/21)

Hourly - If you are paid by the hour, you may convert your income to monthly as follows:

Hourly amount |

x |

Hours worked per week |

= |

Weekly amount |

Weekly amount |

x |

52 Weeks per year |

= |

Yearly amount |

Yearly amount |

÷ |

12 Months per year |

= |

Monthly Amount |

Daily - If you are paid by the day, you may convert your income to monthly as follows: |

||||

Daily amount |

x |

Days worked per week |

= |

Weekly amount |

Weekly amount |

x |

52 Weeks per year |

= |

Yearly amount |

Yearly amount |

÷ |

12 Months per year |

= |

Monthly Amount |

Weekly - If you are paid by the week, you may convert your income to monthly as follows:

Weekly amount |

x |

52 Weeks per year |

= |

Yearly amount |

Yearly amount |

÷ |

12 Months per year |

= |

Monthly Amount |

x |

26 |

= |

Yearly amount |

|

Yearly amount |

÷ |

12 Months per year |

= |

Monthly Amount |

follows: |

|

|

|

2 |

= |

Monthly Amount |

Expenses may be converted in the same manner.

Remember, a person who is NOT an attorney is called a nonlawyer. If a nonlawyer helps you fill out these forms, that person must give you a copy of a Disclosure from Nonlawyer, Florida Family Law Rules of Procedure Form 12.900(a), before he or she helps you. A nonlawyer helping you fill out these forms also must put his or her name, address, and telephone number on the bottom of the last page of every form he or she helps you complete.

Instructions for Florida Family Law Rules of Procedure Form 12.902(c), Family Law Financial Affidavit (Long Form) (10/21)

IN THE CIRCUIT COURT OF THE |

JUDICIAL CIRCUIT, |

IN AND FOR |

COUNTY, FLORIDA |

Case No.:

Division:

,

Petitioner,

and

,

Respondent.

FAMILY LAW FINANCIAL AFFIDAVIT (LONG FORM)

($50,000 or more Individual Gross Annual Income)

I, {full legal name} |

, being sworn, certify |

that the following information is true: |

|

SECTION I. INCOME

1.My age is:

2.My occupation is:

3.I am currently

[Check all that apply]

a.Unemployed

Describe your efforts to find employment, how soon you expect to be employed, and the pay you expect to receive:

b.Employed by:

Address: |

|

|

City, State, Zip code: |

Telephone Number: |

|

Pay rate: $ |

( ) every week ( |

) every other week ( ) twice a month |

( ) monthly ( |

) other: |

|

If you are expecting to become unemployed or change jobs soon, describe the change you expect and why and how it will affect your income:

.

_______Check here if you currently have more than one job. List the information above for the

second job(s) on a separate sheet and attach it to this affidavit.

Florida Family Law Rules of Procedure Form 12.902(c), Family Law Financial Affidavit (Long Form) (10/21)

c._ Retired. Date of retirement: Employer from whom retired: Address:

City, State, Zip code: |

|

Telephone Number: |

LAST YEAR’S GROSS INCOME: |

Your Income |

Other Party’s Income (if known) |

YEAR _____ |

$ _______ |

$ _______ |

PRESENT MONTHLY GROSS INCOME:

All amounts must be MONTHLY. See the instructions with this form to figure out money amounts for anything that is NOT paid monthly. Attach more paper, if needed. Items included under “other” should be listed separately with separate dollar amounts.

1.$______ Monthly gross salary or wages

2._______ Monthly bonuses, commissions, allowances, overtime, tips, and similar payments

3._______ Monthly business income from sources such as

4._______ Monthly disability benefits/SSI

5._______ Monthly Workers’ Compensation

6._______ Monthly Unemployment Compensation

7._______ Monthly pension, retirement, or annuity payments

8._______ Monthly Social Security benefits

9._______ Monthly alimony actually received (Add 9a and 9b)

9a. From this case: $________

9b. From other case(s): $________

10._______ Monthly interest and dividends

11._______ Monthly rental income (gross receipts minus ordinary and necessary expenses required to produce income) (Attach sheet itemizing such income and expense items.)

12._______ Monthly income from royalties, trusts, or estates

13._______ Monthly reimbursed expenses and

14._______ Monthly gains derived from dealing in property (not including nonrecurring gains)

_______ Any other income of a recurring nature (identify source):

15._______________________________________________________________________________

16._______________________________________________________________________________

17.$_________ TOTAL PRESENT MONTHLY GROSS INCOME (Add lines 1 through 16.)

PRESENT MONTHLY DEDUCTIONS:

All amounts must be MONTHLY. See the instructions with this form to figure out money amounts for anything that is NOT paid monthly.

18.$_______ Monthly federal, state, and local income tax (corrected for filing status and allowable dependents and income tax liabilities)

a.Filing Status

b.Number of dependents claimed

19. _______ Monthly FICA or

Florida Family Law Rules of Procedure Form 12.902(c), Family Law Financial Affidavit (Long Form) (10/21)

20._______ Monthly Medicare payments

21._______ Monthly mandatory union dues

22._______ Monthly mandatory retirement payments

23._______ Monthly health insurance payments (including dental insurance), excluding portion paid for any minor children of this relationship

24._______ Monthly

25._______ Monthly

25a. from this case: $ _________

25b. from other case(s): $ _________

26.$______ TOTAL DEDUCTIONS ALLOWABLE UNDER SECTION 61.30, FLORIDA STATUTES (Add lines 18 through 25.)

27.$______ PRESENT NET MONTHLY INCOME

(Subtract line 26 from line 17.)

SECTION II. AVERAGE MONTHLY EXPENSES

Proposed/Estimated Expenses. If this is a dissolution of marriage case and your expenses as listed below do not reflect what you actually pay currently, you should write “estimate” next to each amount that is estimated.

HOUSEHOLD:

1.$______ Monthly mortgage or rent payments

2._______ Monthly property taxes (if not included in mortgage)

3._______ Monthly insurance on residence (if not included in mortgage)

4._______ Monthly condominium maintenance fees and homeowner’s association fees

5._______ Monthly electricity

6._______ Monthly water, garbage, and sewer

7._______ Monthly telephone

8._______ Monthly fuel oil or natural gas

9._______ Monthly repairs and maintenance

10._______ Monthly lawn care

11._______ Monthly pool maintenance

12._______ Monthly pest control

13._______ Monthly misc. household

14._______ Monthly food and home supplies

15._______ Monthly meals outside home

16._______ Monthly cable t.v.

17._______ Monthly alarm service contract

18._______ Monthly service contracts on appliances

19._______ Monthly maid service

Other:

20.__________________________________________________________________________________

21.__________________________________________________________________________________

22.__________________________________________________________________________________

23.__________________________________________________________________________________

24.__________________________________________________________________________________

25.$__________ SUBTOTAL (Add lines 1 through 24.)

Florida Family Law Rules of Procedure Form 12.902(c), Family Law Financial Affidavit (Long Form) (10/21)

AUTOMOBILE:

26.$______ Monthly gasoline and oil

27._______ Monthly repairs

28._______ Monthly auto tags and emission testing

29._______ Monthly insurance

30._______ Monthly payments (lease or financing)

31._______ Monthly rental/replacements

32._______ Monthly alternative transportation (bus, rail, car pool, etc.)

33._______ Monthly tolls and parking

34._______ Other: _________________________________________________

35.$_______ SUBTOTAL (Add lines 26 through 34.)

MONTHLY EXPENSES FOR CHILDREN COMMON TO BOTH PARTIES:

36.$______ Monthly nursery, babysitting, or day care

37._______ Monthly school tuition

38._______ Monthly school supplies, books, and fees

39._______ Monthly after school activities

40._______ Monthly lunch money

41._______ Monthly private lessons or tutoring

42._______ Monthly allowances

43._______ Monthly clothing and uniforms

44._______ Monthly entertainment (movies, parties, etc.)

45._______ Monthly health insurance

46._______ Monthly medical, dental, prescriptions (nonreimbursed only)

47._______ Monthly psychiatric/psychological/counselor

48._______ Monthly orthodontic

49._______ Monthly vitamins

50._______ Monthly beauty parlor/barber shop

51._______ Monthly nonprescription medication

52._______ Monthly cosmetics, toiletries, and sundries

53._______ Monthly gifts from child(ren) to others (other children, relatives, teachers, etc.)

54._______ Monthly camp or summer activities

55._______ Monthly clubs (Boy/Girl Scouts, etc.)

56._______ Monthly

57._______ Monthly miscellaneous

58.$_______ SUBTOTAL (Add lines 36 through 57.)

MONTHLY EXPENSES FOR CHILD(REN) FROM ANOTHER RELATIONSHIP (other than

59.$________________________________________________________________________________

60.__________________________________________________________________________________

61.__________________________________________________________________________________

62.__________________________________________________________________________________

63.$_______ SUBTOTAL (Add lines 59 through 62.)

Florida Family Law Rules of Procedure Form 12.902(c), Family Law Financial Affidavit (Long Form) (10/21)

MONTHLY INSURANCE:

64.$______ Health insurance (if not listed on lines 23 or 45)

65._______ Life insurance

66._______ Dental insurance.

Other:

67.________________________________________________________________________________

68.________________________________________________________________________________

69. $_______ SUBTOTAL (Add lines 66 through 68, exclude lines 64 and 65.)

OTHER MONTHLY EXPENSES NOT LISTED ABOVE:

70.$______ Monthly dry cleaning and laundry

71._______Monthly clothing

72._______ Monthly medical, dental, and prescription (unreimbursed only)

73._______ Monthly psychiatric, psychological, or counselor (unreimbursed only)

74._______ Monthly

75._______ Monthly grooming

76._______ Monthly gifts

77._______ Monthly pet expenses

78._______ Monthly club dues and membership

79._______ Monthly sports and hobbies

80._______ Monthly entertainment

81._______ Monthly periodicals/books/tapes/CDs

82._______ Monthly vacations

83._______ Monthly religious organizations

84._______ Monthly bank charges/credit card fees

85._______ Monthly education expenses

86._______ Other: (include any usual and customary expenses not otherwise mentioned in the items

listed above)________________________________________________________________

87.__________________________________________________________________________________

88.__________________________________________________________________________________

89.__________________________________________________________________________________

90. $_______ SUBTOTAL (Add lines 70 through 89.)

MONTHLY PAYMENTS TO CREDITORS: (only when payments are currently made by you on outstanding balances). List only last 4 digits of account numbers.

MONTHLY PAYMENT AND NAME OF CREDITOR(s):

91.$_________________________________________________________________________________

92.__________________________________________________________________________________

93.__________________________________________________________________________________

94.__________________________________________________________________________________

95.__________________________________________________________________________________

96.__________________________________________________________________________________

97.__________________________________________________________________________________

98.__________________________________________________________________________________

99.__________________________________________________________________________________

100._________________________________________________________________________________

101._________________________________________________________________________________

Florida Family Law Rules of Procedure Form 12.902(c), Family Law Financial Affidavit (Long Form) (10/21)

102._________________________________________________________________________________

103.______________________________________________________________________________

104. $_______ SUBTOTAL (Add lines 91 through 103.)

105. $_______ TOTAL MONTHLY EXPENSES:

(Add lines 25, 35, 58, 63, 69, 90, and 104 of Section II, Expenses.)

SUMMARY

106. $_______ TOTAL PRESENT MONTHLY NET INCOME (from line 27 of SECTION I. INCOME)

107. $_______ TOTAL MONTHLY EXPENSES (from line 105 above)

108. $_______ SURPLUS (If line 106 is more than line 107, subtract line 107 from line 106. This is the

amount of your surplus. Enter that amount here.)

109. ($______) (DEFICIT) (If line 107 is more than line 106, subtract line 106 from line 107. This is

the amount of your deficit. Enter that amount here.)

SECTION III. ASSETS AND LIABILITIES

A.ASSETS (This is where you list what you OWN.)

INSTRUCTIONS:

STEP 1: In column A, list a description of each separate item owned by you (and/or your spouse, if this is a petition for dissolution of marriage). Blank spaces are provided if you need to list more than one of an item.

STEP 2: If this is a petition for dissolution of marriage, check the line in Column A next to any item that you are requesting the judge award to you.

STEP 3: In column B, write what you believe to be the current fair market value of all items listed.

STEP 4: Use column C only if this is a petition for dissolution of marriage and you believe an item is “nonmarital,” meaning it belongs to only one of you and should not be divided. You should indicate to whom you believe the item belongs. (Typically, you will only use Column C if property was owned by one spouse before the marriage. See the “General Information for

Florida Family Law Rules of Procedure Form 12.902(c), Family Law Financial Affidavit (Long Form) (10/21)

A

ASSETS: DESCRIPTION OF ITEM(S)

LIST ONLY LAST FOUR DIGITS OF ACCOUNT NUMBERS. Check the line next to any asset(s) which you are requesting the judge award to you.

Cash (on hand)

Cash (on hand)

Cash (in banks or credit unions)

Cash (in banks or credit unions)

Stocks/Bonds

Stocks/Bonds

Notes (money owed to you in writing)

Notes (money owed to you in writing)

Money owed to you (not evidenced by a note)

Money owed to you (not evidenced by a note)

Real estate: (Home)

Real estate: (Home)  (Other)

(Other)

Business interests

Business interests

Automobiles

Automobiles

Boats

Boats

B |

C |

|

Current |

Nonmarital |

|

Fair |

(Check correct column) |

|

Market |

|

|

Value |

|

|

|

Petitioner |

Respondent |

$ |

|

|

Florida Family Law Rules of Procedure Form 12.902(c), Family Law Financial Affidavit (Long Form) (10/21)

File Specifications

| Fact | Detail |

|---|---|

| Governing Law | Florida Family Law Rules of Procedure |

| Form Number | 12.902(c) |

| Form Title | Family Law Financial Affidavit (Long Form) |

| Income Requirement | $50,000 OR MORE per year |

| Usage Condition | Required in family law cases needing a financial affidavit |

| Exceptions | Simplified dissolution of marriage, no minor children/support issues, court lacks jurisdiction on financial issues |

| Filing Requirement | Filed with the clerk of the circuit court in the county where the petition was filed |

| Service Requirement | Serve on the other party within 45 days of being served with the petition |

| Service Methods | Mail, e-mail, or hand-delivery in accordance with Florida Rule 2.516 |

| Electronic Filing and Service | Allowed and regulated by Florida Rules of General Practice and Judicial Administration 2.525 and 2.516 |

Instructions on Filling in Notice Florida

Filling out the Family Law Financial Affidavit (Long Form) is a critical step in your family law case if your annual gross income is $50,000 or more. This document requires a detailed account of your income and expenses, providing the court with a clear financial snapshot. The completion and submission of this affidavit play a significant role in proceedings related to alimony, child support, and the division of marital property. To ensure accuracy and compliance, follow these steps diligently:

- Read the general information for self-represented litigants at the beginning of the form instructions to familiarize yourself with the process and terms.

- Type or print in black ink all required information.

- Begin by entering the case's circuit court information, including case number and division, and your full legal name.

- In Section I. Income, detail:

- Your age and occupation.

- Employment status and employer information, if applicable.

- Efforts to find employment if unemployed, or information about retirement if retired.

- Last year’s gross income and list all sources of your present monthly gross income, converting non-monthly payments to their monthly equivalents using the provided formulas.

- Continue to list your monthly deductions, including taxes and FICA, under "PRESENT MONTHLY DEDUCTIONS."

- Sign the affidavit after completing all sections with true and accurate information.

- File the document with the clerk of the circuit court in the county where your case is being heard and keep a copy for your records.

- Ensure a copy of the form is served on the other party within 45 days of being served with the petition, following the correct service procedures.

After submission, the next steps will involve waiting for a response from the other party or proceeding with the next stages of your case, such as mediation or court hearings, depending on your specific circumstances. The information provided in this affidavit will be crucial in shaping the outcomes related to financial matters in your case. Remember, accurate and honest disclosure is essential for a fair resolution.

Understanding Notice Florida

When is the Family Law Financial Affidavit (Long Form) required in Florida?

This form is necessary when one is part of a family law case requiring a financial affidavit and the individual's gross income is $50,000 or more per year. Exceptions include filing for a simplified dissolution of marriage where financial affidavits are waived, there are no minor children and support issues, and all financial issues have been settled by agreement, or the court cannot determine any financial issues.

How should this form be completed and submitted?

The form must be typed or printed in black ink. After completion, the individual should sign it, file it with the clerk of the circuit court where the petition was filed, and keep a copy for their records. A copy must also be served on the other party within 45 days of being served with the petition, unless it was already served with the initial papers.

What is the requirement for serving this form on the other party?

Service must comply with Florida Rule of General Practice and Judicial Administration 2.516. The copy for the other party must be mailed, e-mailed, or hand-delivered the same day as indicated on the certificate of service. If mailed, it must be postmarked on that date.

Where can more information be found before proceeding?

Before proceeding, it's advised to read the “General Information for Self-Represented Litigants” available at the beginning of the forms packet. Definitions for terms in bold underline in the instructions can also be found there. For additional information, reference Florida Family Law Rule of Procedure 12.285.

What are the requirements for e-filing this form?

The Florida Rules of General Practice and Judicial Administration now mandate electronic filing (e-filing) of all petitions, pleadings, and documents, with some exceptions for self-represented litigants. If choosing to e-file, one must follow Florida Rule of General Practice and Judicial Administration 2.525 and comply with the procedures of the judicial circuit where the documents are filed.

Is electronic service (e-service) allowed for this form?

After initial service of process, all documents that must be served on the other party are required to be served by electronic mail (e-mail) except in certain situations, in line with Florida Rule of General Practice and Judicial Administration. Participation in e-service means serving or receiving pleadings through email or the Florida Courts E-Filing Portal. Compliance with specific format requirements is mandatory.

What about keeping addresses confidential in cases of domestic violence or other harm?

Individuals who are victims of sexual battery, aggravated child abuse, aggravated stalking, harassment, aggravated battery, or domestic violence, and have been found as such by a judge, can request their address, telephone, and fax information be kept confidential. They shouldn't enter their address details on this form but instead file a Request for Confidential Filing of Address.

How should income and expenses be calculated for this affidavit?

All monthly income and expense amounts must be provided. For income or bills not paid monthly, conversions should be made as outlined in the instructions, using formulas provided for hourly, daily, weekly, bi-weekly, and semi-monthly incomes. Expenses are converted similarly. Specific guidelines are provided for converting various payment schedules to a monthly amount.

Common mistakes

Filling out the Notice Florida Form, specifically the Family Law Financial Affidavit (Long Form), is critical for individuals engaged in family law cases with an annual gross income of $50,000 or more. However, the process can sometimes be complex and prone to errors. Here are seven common mistakes individuals make when completing this form:

- Incorrectly reporting income types: Individuals often misinterpret the income categories, either by omission or incorrect calculations, particularly when converting irregular income to the monthly equivalent.

- Failing to disclose all sources of income: It's crucial to include all income sources, such as secondary jobs, bonuses, or rental income, which are frequently overlooked or intentionally omitted.

- Incorrect calculations: Miscalculations in converting weekly, bi-weekly, or semi-monthly payments to their monthly equivalents can lead to inaccurate financial reporting.

- Neglecting to attach required documentation: Additional sheets itemizing income and expenses related to business operations, rental activities, or unusual income sources are often missing.

- Improper documentation of expenses: Just as with income, expenses must be calculated on a monthly basis, yet individuals often fail to adjust their expenses accordingly or forget to include significant outgoings.

- Omitting information about anticipated changes in employment: Expected changes in job status or income are not adequately reported, despite the form’s specific request for this information.

- Failure to update personal contact information: Individuals occasionally neglect to provide updated mailing or email addresses for e-service, hindering efficient communication and document service.

Avoiding these mistakes is paramount. Accurate and complete financial disclosure ensures fairness and efficiency in resolving financial matters within family law cases. Always double-check entries, consult the conversion instructions provided in the form, and ensure all income and expenses are thoroughly documented. When in doubt, seeking assistance can prevent errors that may impact the outcome of your case.

Documents used along the form

When dealing with family law cases, especially those involving financial matters, a comprehensive set of documents often supports the core Family Law Financial Affidavit (Long Form) in Florida. This collection ensures that all necessary details are meticulously documented, providing a clearer picture of each party’s financial standing. Though it might seem daunting at first, understanding these documents can significantly streamline the legal process for the parties involved.

- Uniform Child Custody Jurisdiction and Enforcement Act (UCCJEA) Affidavit: This document is required in cases involving child custody, establishing the jurisdiction over the child custody case.

- Marital Settlement Agreement for Dissolution of Marriage with Dependent or Minor Child(ren): Couples who have reached an agreement on all issues related to their divorce, including child support, custody, and property division, use this form to outline their arrangements officially.

- Parenting Plan: A detailed document required in all cases involving time-sharing with minor child(ren). It outlines how parents will share the responsibilities of raising their children and the time-sharing schedule.

- Child Support Guidelines Worksheet: In cases where child support is an issue, this worksheet is used to calculate the amount of child support pursuant to the state’s guidelines.

- Petition for Dissolution of Marriage: This is the initial document filed by one party to begin the divorce proceedings, outlining the basic information about the marriage and the grounds for divorce.

- Financial Affidavit (Short Form): For individuals with an annual gross income of less than $50,000, this simplified version of the financial affidavit outlines their financial situation.

Each document has its unique purpose, playing a critical role in ensuring fairness and clarity throughout the legal proceedings. For those navigating through the complexities of a family law case, understanding and properly completing these forms can pave the way for a smoother process, helping protect the interests of all parties involved.

Similar forms

Divorce Decree or Agreement: Similar to the Florida Family Law Financial Affidavit, a divorce decree or settlement agreement also addresses financial issues between parties, including the division of assets, debts, and possibly the allocation of alimony and child support, providing a detailed financial breakdown and obligations of each party.

Child Support Financial Affidavit: This document, like the Family Law Financial Affidavit, requires detailed disclosure of income, expenses, assets, and debts to calculate child support obligations accurately, ensuring the child or children's financial needs are met.

Alimony Affidavit: Similar to the Notice Florida form, an alimony affidavit details a party’s financial status to establish the necessity and amount of alimony during or after divorce proceedings, focusing on the ability of one spouse to pay and the other's financial need.

Pre and Postnuptial Agreements: These agreements, while entered into before or after marriage, share similarities with the Family Law Financial Affidavit as both require full financial disclosure of assets and liabilities by both parties to outline the distribution of marital assets in the event of a divorce.

Bankruptcy Schedules: In bankruptcy cases, individuals must file schedules that detail their finances, including assets, liabilities, income, and expenses, akin to the Family Law Financial Affidavit, to provide the court with a comprehensive picture of the filer’s financial situation.

Loan Applications: Similar to the financial affidavit, loan applications require detailed financial information from the applicant to assess their creditworthiness and ability to repay the loan, encompassing income, expenses, assets, and liabilities.

Means Test Form (Bankruptcy): The means test form, used in bankruptcy filings to determine eligibility for Chapter 7 or Chapter 13 bankruptcy, requires detailed income and expense information similar to the Family Law Financial Affidavit to assess the filer’s financial capacity.

Income Declaration in Civil Litigation: In certain civil litigation cases, parties may need to declare their income to calculate damages or settlements. This requirement is similar to the financial affidavit's purpose in family law to ensure fair financial resolution.

Financial Statement for Public Assistance: Applications for public assistance or benefits often require a detailed financial statement similar to the Family Law Financial Affidavit, where applicants must disclose their income, expenses, assets, and liabilities to determine eligibility for assistance.

Dos and Don'ts

When filling out the Notice Florida Family Law Financial Affidavit (Long Form), it's important to follow specific do's and don'ts to ensure the process is completed accurately and efficiently. Below is a list to guide you through the process:

- Do carefully read the instructions before starting, ensuring you understand each requirement.

- Do type or print the form in black ink to maintain clarity and legibility.

- Do convert all income and expenses to monthly amounts, making use of the provided conversion instructions if you're not paid monthly.

- Do file the completed form with the clerk of the circuit court in the county where your case is and keep a copy for your records.

- Do serve a copy of this form on the other party within 45 days of being served with the petition, following the rules for service meticulously.

- Do follow e-filing and e-service procedures if you choose to file and serve documents electronically, ensuring you comply with Florida Rule of General Practice and Judicial Administration.

- Do provide your e-mail address on each form where your signature appears if you elect to serve and receive documents by e-mail.

- Don’t overlook the requirement to file this document if your gross income is $50,000 or more per year, unless certain exceptions apply.

- Don’t forget to sign the form after completing it. An unsigned form may result in processing delays or be considered invalid.

- Don’t send the form to the other party without first ensuring it’s been filed with the court, unless it's served with your initial papers.

- Don’t neglect the specifics of how to serve the form to the other party, including the method of delivery and the certificate of service date requirements.

- Don’t attempt to e-file or e-serve without first making sure you understand the electronic processes and requirements of your judicial circuit.

- Don’t neglect to use the Designation of Current Mailing and E-mail Address form if you decide to serve and receive documents by e-mail.

- Don’t include your address, telephone, and fax information at the bottom of this form if you're keeping your address confidential for safety reasons related to domestic violence or other specified crimes.

Misconceptions

Understanding legal documents can sometimes feel like navigating a labyrinth, especially when dealing with the intricacies of family law in Florida. Among these documents, the Family Law Financial Affidavit (Long Form) is particularly notorious for being misunderstood. Let’s clarify some of these common misconceptions to ensure individuals handling family law cases have clear insights.

One Size Fits All: It's a common belief that one financial affidavit can serve all purposes in family law cases across the board. However, the truth is that the Long Form of the Family Law Financial Affidavit is specifically designed for individuals with an annual gross income of $50,000 or more. Different cases might require different forms, emphasizing the tailored approach needed in legal proceedings.

No Need to Update: The notion that once filed, the affidavit doesn't need updating is another area of confusion. Circumstances change, and the court requires current financial information to make informed decisions. Updates to the affidavit might be necessary to reflect the most accurate financial situation.

E-Service Exemption: Some people mistakenly think that if they are self-represented, they can't or shouldn't use electronic service (e-service) for documents. Yet, e-service is an option that simplifies and speeds up the process of serving documents to the other party, even for those without legal representation.

General Instructions are Just Casual Guidelines: There's a misconception that the instructions for filling out the affidavit are simply guidelines that can be loosely followed. In reality, these instructions are critical to ensuring the affidavit is completed accurately and thoroughly, vital for presenting one’s financial situation to the court.

Financial Affidavits are Only for Divorce Proceedings: While divorce proceedings are a common scenario where financial affidavits are used, they’re also vital in other family law cases. Issues such as child support, alimony, and marital asset distribution in cases that aren't related to divorce might also require a detailed financial affidavit.

Electronic Filing (e-Filing) is Optional: There's a widespread belief that electronically filing the affidavit with the court is a matter of preference. While self-represented litigants may have the choice, the Florida Rules of General Practice and Judicial Administration have moved towards requiring all legal documents, including petitions and pleadings, to be filed electronically, aiming to streamline the legal process and make it more efficient.

Dispelling these misconceptions is crucial for those navigating the complexities of family law in Florida. Understanding the specific requirements and expectations of legal proceedings helps ensure individuals are better prepared and can advocate more effectively for their interests.

Key takeaways

Understanding and accurately completing the family law financial affidavit in Florida, specifically Form 12.902(c) for individuals with a gross income of $50,000 or more annually, is crucial for parties involved in family law cases. Here are some key takeaways to assist in the process:

- Use this form if your gross annual income exceeds $50,000, except in cases of simplified dissolution of marriage without financial affidavits, no minor children or support issues with a settlement agreement in place, or when the court can't decide on financial issues.

- The form must be filled out in black ink or typed, signed by you, and filed with the clerk of the circuit court in the county of the petition, with a copy retained for your records.

- It is mandatory to serve a copy to the other party within 45 days of receiving the petition if not served with the initial paperwork, adhering to Florida Rule of General Practice and Judicial Administration 2.516.

- For more in-depth understanding and definitions, consult the "General Information for Self-Represented Litigants" and Florida Family Law Rule of Procedure 12.285, available at the start of the forms booklet.

- Electronic filing (e-filing) and service (e-service) are now required under Florida Rules of General Practice and Judicial Administration, with specifics under rule 2.525 for filing and rule 2.516 for service, unless excused under certain criteria.

- When calculating monthly income or expenses, proper conversion based on payment frequency (hourly, daily, weekly, bi-weekly, semi-monthly) is key, using the hints provided in the instructions to ensure accuracy.

Remember, if assistance from a nonlawyer is utilized in filling out these forms, they must provide you with a copy of a Disclosure from Nonlawyer, Florida Family Law Rules of Procedure Form 12.900(a), and include their contact information on the form. Additionally, for those requiring address confidentiality due to being a victim of certain crimes, a Request for Confidential Filing of Address, Florida Supreme Court Approved Family Law Form 12.980(h), should be filed instead of providing address details on the form.

Popular PDF Templates

Fr-44 Insurance - It covers both owner’s policy for specific vehicles and operator’s policy for any vehicle driven.

Florida Hvac Efficiency Card - By submitting this form, HVAC technicians affirm that the replacement systems adhere to the City of Lake Worth's energy efficiency standards.

Florida Lawyers Support - Ensure your legal documents in probate cases are up-to-date with 2022 forms that reflect current law.