Official Florida Rts 6 Template

Navigating the complexities of employment and tax laws across different jurisdictions can be challenging for businesses, especially those that deploy workers in multiple states. The Florida RTS-6 form, also known as the Employer’s Reciprocal Coverage Election, serves as a crucial tool for employers in this regard. Crafted under Rule 73B-10.037 of the Florida Administrative Code, this form enables employers to elect, with approval by relevant agencies, coverage under Florida's reemployment tax law for employees who customarily work in more than one jurisdiction. Essentially, this election allows employees who might otherwise be subject to unemployment compensation laws in other states to be covered exclusively under Florida's laws, provided certain conditions are met. The form requires detailed information about the employer, the nature of the business, the employees to be covered by this election, and the reasons for seeking this coverage in Florida. It also outlines the specifics of the reciprocal coverage arrangement, including the percentage of services performed in Florida versus other states, the legal basis for the election, and the effective date of the coverage. With its emphasis on cross-jurisdictional cooperation and the protection of workers' rights to unemployment benefits, the RTS-6 form represents a significant piece of administrative paperwork for employers operating within and beyond Florida's borders. Moreover, it underscores the importance of compliance with state-specific legal requirements while maintaining the flexibility needed to manage a geographically dispersed workforce.

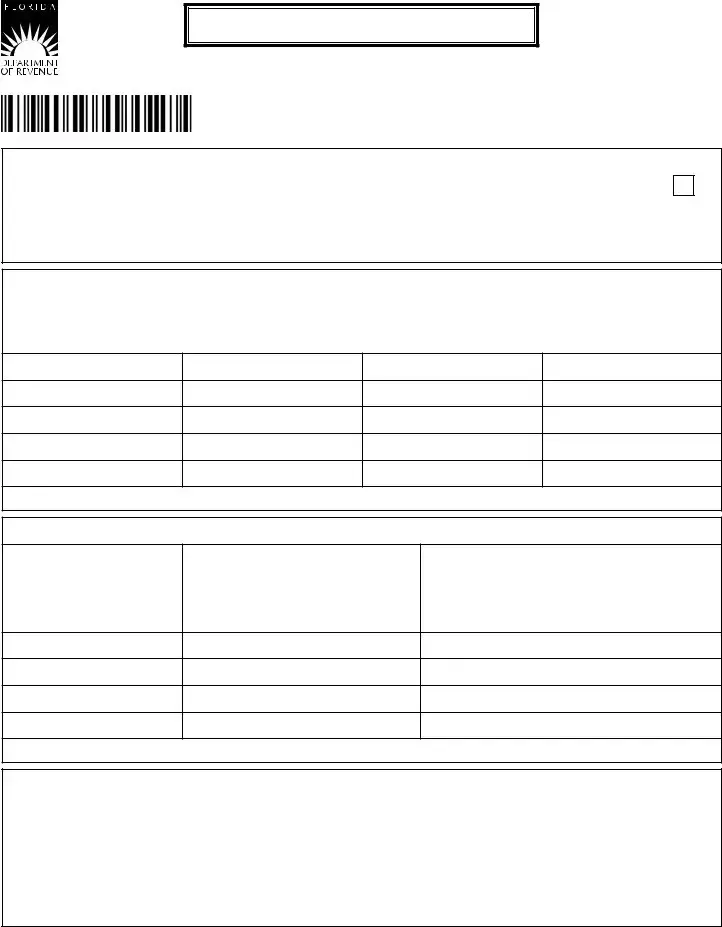

Example - Florida Rts 6 Form

Employer’s Reciprocal Coverage Election

R. 01/13

Rule

|

Reemployment Tax Account Number |

|||||||||||||

Employer’s Name: _______________________________________________________ |

|

|

|

|

|

|

|

|

|

|

|

|

|

— |

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

The above employer hereby elects, subject to approval by the agencies involved, to cover certain individuals (those customarily performing services in more than one jurisdiction) named below and on any attached form, under the reemployment tax (formerly unemployment tax) law of Florida.

1.The employer accordingly requests the state of Florida, Department of Revenue to enter into a reciprocal coverage arrangement to that effect, with each of the following other “interested jurisdictions” (in which the individuals named under Item 2 perform some services for the employer, and under whose unemployment compensation laws they might otherwise be covered):

State

% Of Service

State

% Of Service

(If more space is required, use and attach Form

2. List employees covered by this election:

Employee’s Name

Social Security |

Employee’s Legal |

Number |

Residence |

|

|

Basis for Election in Florida

a)Does some work in Florida

b)Residence in Florida

c)Related to a place of business in Florida

(If more space is required, use and attach Form

3.Nature of employer’s business. _________________________________________________________________________

4.The employer has a place of business in the states listed above. ____________________________________________

5.Nature of work to be performed by the individual(s) listed under Item 2. ______________________________________

6.Employer’s reason for requesting coverage in Florida. _____________________________________________________

7.The employer requests that this election become effective as of the beginning of a calendar quarter, namely as of ______________________________________

www.mylorida.com/dor

R. 01/13

Page 2

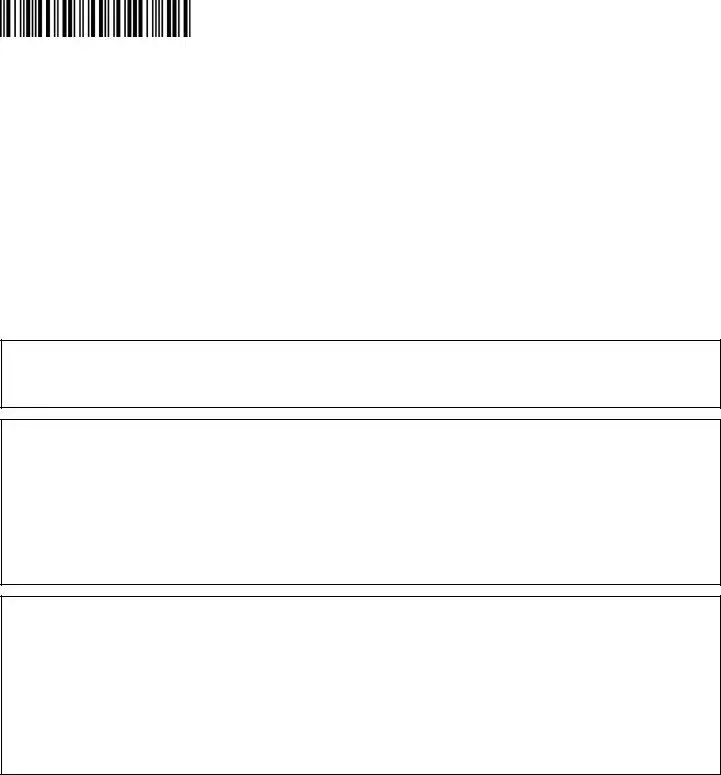

ELECTION (continued)

8.This election, if approved, shall remain operative, as to the individuals listed herewith, until terminated in accordance with the currently applicable regulations of the Florida Department of Revenue.

9.The employer hereby agrees to give each individual covered by this election a notice thereof, promptly after its approval, on a form to be supplied by the Florida Department of Revenue, and to ile copies thereof with said agency.

10.The employer hereby agrees to comply with any requirements applicable to this election under the Florida Department of Revenue.

11.To prevent this election from denying reemployment assistance/unemployment compensation coverage to workers not listed hereon, the employer hereby agrees with each interested jurisdiction approving this election that it may count the workers covered by this election, and their wages, as if this election did not apply, for the purpose

of determining whether the employer is covered by the law of such jurisdiction and whether any other workers employed by him are covered by said law.

SIGNED, for the employer by: ______________________________________________________________________________

Date: ____________________________________________ Title: _________________________________________________

APPROVAL by the state of Florida, Department of Revenue

The foregoing election is hereby approved, in accordance with the applicable regulations, as submitted by the elect- ing employer.

APPROVED for the state of Florida, Department of Revenue.

By: __________________________________________________

Date: ____________________________________________ Title: _________________________________________________

APPROVED by the interested jurisdiction of _________________________________________________________________

The foregoing is similarly approved.

Name of Agency: ______________________________________

By: __________________________________________________

Date: ____________________________________________ Title: _________________________________________________

NOTE: The employer should submit two (2) signed copies for each jurisdiction listed under item 1, plus two (2) additional copies. All copies should be sent to the state of Florida, Department of Revenue, P.O. Box 6510, Tallahassee, FL

Social security numbers (SSNs) are used by the Florida Department of Revenue as unique identiiers for the administration of Florida’s taxes. SSNs obtained for tax administration purposes are conidential under sections 213.053

and 119.071, Florida Statutes, and not subject to disclosure as public records. Collection of your SSN is authorized under state and federal law. Visit our Internet site at www.mylorida.com/dor and select “Privacy Notice” for more

information regarding the state and federal law governing the collection, use, or release of SSNs, including authorized exceptions.

www.mylorida.com/dor

File Specifications

| Fact Name | Description |

|---|---|

| Form Purpose | Allows employers to elect coverage under Florida's reemployment tax law for individuals working in multiple jurisdictions. |

| Form Designation | Employer’s Reciprocal Coverage Election RTS-6 R. 01/13 |

| Governing Regulation | Rule 73B-10.037 Florida Administrative Code |

| Eligibility Criteria | Applies to individuals customarily performing services in more than one jurisdiction. |

| Subject Matter | Concerns reemployment tax (formerly unemployment tax) law of Florida. |

| Additional Form Requirement | If more space is needed, Form RTS-6A (formerly UCS-6A) is to be used and attached. |

| Confidential Information | Social security numbers collected are confidential under sections 213.053 and 119.071, Florida Statutes. |

| Effective Date Request | The employer requests for the election to become effective at the beginning of a calendar quarter. |

Instructions on Filling in Florida Rts 6

When businesses operate across multiple jurisdictions, ensuring compliance with reemployment (unemployment) tax laws can be complex. The Florida RTS-6 form simplifies this for employers by allowing them to elect coverage under Florida's reemployment tax law for employees who work in more than one jurisdiction. Completing this form requires attention to detail and an understanding of your business operations across state lines. Here's how to accurately fill out the RTS-6 form:

- At the top of the form, provide the Employer’s Name as listed on official documents.

- Indicate your Reemployment Tax Account Number in the designated space.

- In the section requesting a reciprocal coverage arrangement, list each state where your employees perform services along with the approximate percentage of their work conducted in those states. Use Form RTS-6A if additional space is needed.

- Under Item 2, list the names of the employees you are electing to cover, their Social Security Numbers, and their legal residence. Specify the basis for their election in Florida, whether it's because they work, reside, or are connected to a place of business in Florida. Attach Form RTS-6A if more space is required.

- Describe the nature of your business as requested under Item 3.

- Confirm that the employer has a place of business in the states listed above by completing Item 4.

- Detail the nature of work to be performed by the individuals listed in Item 2 under Item 5.

- Explain the employer’s reason for requesting coverage in Florida in Item 6.

- Specify when you would like this election to become effective, ideally at the beginning of a calendar quarter, in Item 7.

- Acknowledge that this election will remain operative until terminated according to Florida's regulations in Item 8.

- Agree to notify each covered individual about this election and file the necessary forms with the Florida Department of Revenue as stated in Item 9.

- Commit to complying with any requirements applicable to this election under the Florida Department of Revenue in Item 10.

- Agree that to prevent denying coverage to workers not listed, the employer will allow those workers and their wages to be counted as if this election did not apply, for jurisdictional law coverage purposes, as declared in Item 11.

- Have the form signed and dated by an authorized representative of the employer, indicating their title.

After completion, submit two signed copies to each jurisdiction involved, plus two additional copies to the state of Florida, Department of Revenue. This will ensure that all jurisdictions are aware and can approve or disapprove of the election. The address for the Department of Revenue is provided on the form. Remember, social security numbers collected are used solely for tax administration purposes and are confidential. This form is an important step in managing your employees' reemployment tax obligations efficiently across states.

Understanding Florida Rts 6

What is the Florida RTS-6 form?

The Florida RTS-6 form, known as the Employer’s Reciprocal Coverage Election, is used by employers to request coverage under Florida's reemployment tax (formerly unemployment tax) for their employees who customarily work in more than one jurisdiction. This form helps in ensuring that such employees are covered under Florida law, rather than the unemployment laws of other states where they may perform some services.

Who needs to file the Florida RTS-6 form?

Employers who have employees that perform services in multiple jurisdictions, including Florida, and wish to elect Florida as the state for reemployment tax coverage for these employees, need to file the RTS-6 form. This is particularly used when an employer wishes to consolidate the unemployment tax responsibilities under Florida law for employees working across state lines.

How do employers elect coverage in Florida for their employees?

To elect coverage under Florida's reemployment tax law, employers need to complete the RTS-6 form. They must list the employees to be covered by the election, provide details about the nature of the business, detail the work performed by the mentioned employees, and justify the reason for requesting coverage in Florida. The form requires approval from the Florida Department of Revenue and other involved jurisdictions.

What information is needed to complete the RTS-6 form?

Completing the RTS-6 form requires the employer’s name, reemployment tax account number, a detailed list of employees covered by this election including their social security numbers and legal residence, the nature of the employer’s business, details about the work to be performed by the listed individuals, and the employer’s reason for requesting Florida coverage. It also asks for the election to become operative from a specific date.

Can additional employees be added after the RTS-6 form has been submitted?

Yes, additional employees can be added after the initial submission of the RTS-6 form. Employers who wish to add more employees to their election under Florida law should use and attach the RTS-6A form, which serves as an extension of the original RTS-6 form for listing additional employees.

What are the responsibilities of an employer after the RTS-6 form is approved?

Once the RTS-6 form is approved, the employer is responsible for notifying each individual covered by this election, using a form supplied by the Florida Department of Revenue. Employers must also file copies of this notification with the agency. Furthermore, they must comply with any requirements applicable to the election under the Florida Department of Revenue and ensure all listed employees are covered by the elected arrangement.

How does the reciprocal coverage affect employees not listed on the RTS-6 form?

The reciprocal coverage election made through the RTS-6 form does not deny reemployment assistance or unemployment compensation coverage to workers not listed on the form. The employer agrees that workers covered by the election and their wages may still be counted for determining coverage under the law of any interested jurisdiction, ensuring that other employees remain eligible for coverage under their respective state's unemployment law.

Common mistakes

When filling out the Florida RTS-6 form, which is an Employer’s Reciprocal Coverage Election, many people make errors that can cause delays or issues with the processing of their submission. Identifying and understanding these common mistakes can help ensure the form is filled out accurately and efficiently. Here are four common mistakes:

Not providing complete information about the employer's business. This section requires a detailed description of the nature of the employer's business, yet often, it is filled out with vague or insufficient detail. This can lead to confusion or a need for clarification, slowing down the approval process.

Failing to list all employees covered by the election accurately. This includes not only forgetting to include some employees but also inaccurately filling out their Social Security numbers, legal residence, or the basis for election in Florida. Mistakes in this section can directly affect the employees’ reemployment tax coverage.

Omitting the detailed nature of work to be performed by the individuals listed under Item 2. The form requires specific information about the roles and responsibilities of the impacted employees, yet employers often provide only broad job titles or general descriptions of work, which does not satisfy the requirement.

Incorrectly noting the date for when the election becomes effective. This election is intended to take effect at the beginning of a calendar quarter, and specifying an incorrect start date can invalidate the form or lead to administrative complications.

Avoiding these mistakes not only streamlines the process but also ensures compliance with the Florida Department of Revenue’s requirements. It’s recommended to double-check all details and have all necessary information at hand before filling out the form to avoid these pitfalls.

Documents used along the form

When dealing with the intricacies of employment and taxation law in Florida, particularly in the context of reemployment tax compliance, the Florida RTS-6 form stands out as a pivotal document. This form, crucial for employers seeking a reciprocal coverage election, lays the groundwork for appropriately classifying workers who operate across state lines. However, to navigate this complex procedure efficiently, it's often necessary to understand and potentially utilize various other forms and documents in tandem with the RTS-6. Below is a brief overview of other essential documents frequently used in conjunction with the Florida RTS-6 form, each serving a distinct purpose in the broader scope of employment and tax regulation compliance.

- RTS-6A (formerly UCS-6A): An attachment to the RTS-6, used when additional space is required to list employees covered by the reciprocal coverage election or to specify additional "interested jurisdictions." It ensures comprehensive reporting and compliance with multi-state employment scenarios.

- RTS-3 (Employer’s Quarterly Report): A mandatory quarterly tax report that outlines an employer's payroll information and calculates the reemployment tax due. This report is crucial for maintaining compliance with Florida's reemployment assistance program requirements.

- A Florida Business Tax Application (DR-1): Employers must fill out this form when initially registering for a reemployment tax account with the Florida Department of Revenue. It covers various tax registrations beyond reemployment, including sales and use tax.

- RTS-1 (Employer’s Quarterly Report Payment Coupon): Accompanies the RTS-3 for employers who opt to pay their quarterly reemployment tax in physical form, providing a standardized method for submitting payment.

- UCT-6 (Florida Employer’s Quarterly Report): Another form for reporting an employer’s quarterly wages and calculating the tax due. Filing this accurately is essential for compliance with state unemployment insurance laws.

- RTS-2 (Report to Determine Succession and Application for Transfer of Experience Rating Records): This document is utilized when a business changes ownership, and the new owner wishes to apply for the transfer of the reemployment tax rate based on the business's employment history.

- W-2 (Wage and Tax Statement): While primarily a federal document, the W-2 is also important in Florida for reporting wages, tips, and other compensation to the state along with federal entities.

- RTS-4 (Application for Refund): Employers may use this form to apply for a refund of overpaid reemployment taxes, ensuring that any excess contributions are accurately returned.

- RTS-5 (Employer Election to Become a Reimbursing Employer): Allows employers to elect an alternative method of financing their reemployment tax obligations by reimbursing the state for benefits paid instead of paying taxes quarterly.

- SS-4 (Application for Employer Identification Number): While a federal form, the SS-4 is crucial for any Florida employer as it is used to apply for an Employer Identification Number (EIN), which is needed for tax filings, including the RTS-6.

Understanding and appropriately utilizing these documents in conjunction with the Florida RTS-6 form can significantly streamline the process of compliance with state employment and taxation requirements. Each document serves a specific role in the overarching framework of employment law and tax administration, highlighting the interconnectedness of employment practices and regulatory compliance. Employers are advised to familiarize themselves with these forms to ensure thorough and accurate adherence to Florida's legal standards.

Similar forms

The Florida RTS-6 form is quite specific, focusing on the election of reciprocal coverage for reemployment tax purposes for employees working across state lines. However, there are various documents, primarily used in the realms of employment, taxation, and administrative compliance, that share common features or serve similar purposes. Below is a list of 10 such documents and the attributes that make them alike to the RTS-6 form:

- IRS Form W-9 (Request for Taxpayer Identification Number and Certification): Similar to the RTS-6, the W-9 is used to collect taxpayer identification numbers (TINs) from individuals or entities in a formal documentation process, supporting the administrative aspects of tax compliance.

- UCS-6A (Employee Quarterly Report of Wages Paid): This form, much like the RTS-6A mentioned within the RTS-6 documentation, is used for reporting purposes related to employment and wages, focusing on the administrative requirements for tracking employment data across jurisdictions.

- IRS Form 940 (Employer's Annual Federal Unemployment (FUTA) Tax Return): Similar in its focus on unemployment or reemployment taxes, this document differs by dealing specifically with federal unemployment tax obligations but parallels in administrative compliance for employers.

- SS-4 (Application for Employer Identification Number): Though the SS-4 form is for obtaining an EIN, it shares the commonality of being a critical piece of documentation for employers to fulfill administrative and regulatory requirements, much like the RTS-6 form does for reciprocal coverage elections.

- Form I-9 (Employment Eligibility Verification): The I-9 form, while focused on verifying the eligibility of employees to work in the U.S., requires employers to collect and maintain detailed records on their workforce, akin to the recordkeeping aspects of the RTS-6.

- DOL Form WH-347 (Payroll Form for Federal Contracts): This document, necessary for employers on federal contracts, requires detailed reporting of employee wages and work classification, paralleling the RTS-6's role in oversight and compliance in employment practices.

- State-specific New Hire Reporting Forms: These forms, which vary by state, require employers to report new hires to a state directory for child support enforcement purposes. They share with the RTS-6 the goal of ensuring employers report crucial employee data to governmental agencies.

- IRS Form 1099-MISC (Miscellaneous Income): While focusing on the reporting of payments to individuals and entities, this form intersects with the RTS-6 through its role in the broader landscape of tax and employment documentation, particularly in the context of contractor relationships.

- FL UC-1 (Florida Unemployment Tax Registration Form): Specific to registering an employer for unemployment tax in Florida, this document is part of the same regulatory framework as the RTS-6, both critical to managing an employer's obligations under state law.

- IRS Form 8850 (Pre-Screening Notice and Certification Request for the Work Opportunity Credit): This form is part of the tax filing and compliance process, allowing employers to claim credits for hiring individuals from certain target groups, showcasing another aspect of the intersection between employment practices and tax law compliance similar to the RTS 6 form's objectives.

Each of these documents serves its unique purpose within the administrative and regulatory landscape that employers navigate. Like the RTS-6, they are integral to ensuring compliance, facilitating the smooth operation of taxation, and employment systems across various jurisdictions.

Dos and Don'ts

Filling out the Florida RTS-6 form—Employer’s Reciprocal Coverage Election—is a critical step for employers who wish to cover employees working across state lines under Florida's reemployment tax instead of those states' unemployment tax laws. Here are several dos and don’ts to help ensure the process is smooth and the application is successful.

Things You Should Do

- Double-check employee information: Ensure all employee names, Social Security numbers, and legal residence bases are accurately listed to avoid processing delays.

- Clarify the nature of your business: Provide a clear and comprehensive description of your business and the work performed by the listed employees to facilitate understanding and approval by reviewing authorities.

- Indicate specific states: When listing interested jurisdictions where employees perform some services, be precise about the state and the percentage of services performed there to help the Florida Department of Revenue coordinate effectively.

- Specify the reason for requesting Florida coverage: Your application should include a well-defined reason for choosing Florida for reemployment tax coverage, highlighting the connection between your employees' work and the state.

- Choose the effective date carefully: Select an effective date that aligns with the beginning of a calendar quarter for smoother implementation of the election.

- Sign and date the form: Ensure the form is signed and dated by someone with authorized authority within the company to signify the employer’s commitment to abide by the reciprocal coverage agreement.

- Keep copies for your records: Before sending, make sure to keep a copy of the filled-out form and any attachments for your own records.

Things You Shouldn't Do

- Don’t leave sections incomplete: Failing to fill out any part of the form can result in processing delays or outright rejection, so review the form carefully to ensure all relevant sections are completed.

- Don’t forget to list all involved states: Neglecting to list any states where employees perform services can affect the completeness and accuracy of the reciprocal coverage election.

- Don’t use incorrect employee information: Submitting inaccurate Social Security numbers or legal residence information can lead to issues with employee coverage.

- Don’t overlook the requirement to notify employees: Employers must inform all covered individuals about the election and comply with this by distributing notices after approval.

- Don’t submit without checking for errors: A quick review before submission can catch and correct errors that might otherwise cause unnecessary delays.

- Don’t ignore instructions for additional space: If more space is required for listing employees or states, use and attach Form RTS-6A as instructed, rather than trying to fit extra information in the provided space.

- Don’t forget to send the required copies: Ensure that two signed copies are sent for each listed jurisdiction plus two additional copies to the state of Florida, Department of Revenue, as per the instructions on the form.

By following these guidelines, employers can more effectively navigate the process of submitting a Florida RTS-6 form, laying the groundwork for a successful reciprocal coverage election.

Misconceptions

When dealing with the Florida RTS-6 form, there are several misconceptions that can confuse employers. Understanding these misconceptions is important for correctly guiding the election for reciprocal coverage for certain employees. Here are five common misunderstandings:

Any Employer Can Use This Form: Not all employers are eligible to use the RTS-6 form. It is specifically designed for those who have employees working in Florida as well as in other jurisdictions and want to elect Florida as the state for reemployment tax purposes. It's important that the employer has a place of business within the states listed in their application.

Approval Is Automatic: Simply submitting the RTS-6 form does not guarantee approval. The form is subject to approval by the Florida Department of Revenue and any other interested jurisdiction(s) where the employees perform services. This process ensures that all legal and administrative requirements are met for reciprocal coverage.

Once Approved, It Covers All Employees: Approval of the RTS-6 election only covers the individuals specifically named in the application and any attached Form RTS-6A. It does not automatically apply to all employees of the employer. Each employee must be individually listed to be covered under the election.

It’s a One-Time Requirement: While approval of the RTS-6 may remain operative until terminated, employers must understand that they agree to comply with any applicable requirements under the Florida Department of Revenue. This may include providing notices to each covered employee and filing updated information if there are any changes in the business status or covered employees.

No Need to Inform Covered Employees: Contrary to this belief, the employer is required to notify each employee covered by the RTS-6 election promptly after its approval. This notification must be done on a form supplied by the Florida Department of Revenue, emphasizing the significance of transparent communication between employers and their employees regarding reemployment tax coverage elections.

Understanding these misconceptions is vital for employers to navigate the process correctly and ensure their employees are properly covered under Florida's reemployment tax law. Employers should always seek to comply with the requirements and maintain open lines of communication with their employees about their coverage status.

Key takeaways

Filing out and using the Florida RTS-6 form involves several key steps and considerations for employers. This form is essential for those employers seeking to elect coverage under Florida's reemployment tax law for employees working across multiple jurisdictions. Below are eight crucial takeaways:

- The RTS-6 form allows employers to request coverage under Florida's reemployment tax for employees who work in more than one state, ensuring that these employees are covered under Florida's laws rather than those of another jurisdiction.

- Employers must list each employee for whom they seek Florida reemployment tax coverage, providing details such as the employee's name, social security number, legal residence, and the basis for their election in Florida—whether it’s because they perform some work in Florida, reside in Florida, or are related to a Florida business location.

- The nature of the employer's business, as well as details about the employer's presence in Florida and the specific states where the listed employees perform work, need to be clearly indicated on the form.

- Employers are required to specify the nature of work performed by the individuals listed in the election, providing clarity on the employee's role and the reason for requesting coverage under Florida's jurisdiction.

- Before filing, the employer must select an effective date for the election, coinciding with the beginning of a calendar quarter, which dictates when the coverage will start.

- An agreement to notify each employee covered by the election, using a form provided by the Florida Department of Revenue, and to comply with all applicable requirements is mandatory for the employer.

- The RTS-6 form also includes a provision ensuring that the election does not inadvertently deny reemployment assistance or unemployment compensation coverage to other workers not listed on the form. This is critical for maintaining coverage breadth and avoiding regulatory issues.

- Employers must submit two signed copies of the RTS-6 form for each jurisdiction involved, plus two additional copies to the Florida Department of Revenue. This submission process is essential for the approval and operationalization of the election.

Understanding these key aspects of the RTS-6 form ensures that employers can effectively navigate the process of electing reciprocal coverage for their employees, aligning with Florida's reemployment tax requirements while accommodating the complexities of multi-jurisdictional employment.

Popular PDF Templates

Florida Healthy Kids Income Guidelines - It serves as an alternative means for income verification, providing flexibility in the application process for families unable to provide recent paystubs.

Are Sellers Disclosures Required in Florida - A guide for Florida sellers to report conditions that could materially affect a property’s value, adhering to state disclosure laws.