Official Florida Lottery Dol 129 Template

Engaging with the complexities of business operations in Florida presents an opportunity for entrepreneurs and enterprise owners to tap into additional revenue streams, one of which includes becoming a lottery retailer. The Florida Lottery DOL-129 form encapsulates the foundational step for businesses to align with the state's lottery retail requirements, serving as an application roadmap. This comprehensive form outlines the necessary prerequisites such as the non-refundable application fee with variable costs depending on the nature of the application—ranging from new applications to changes in business details like relocation or ownership amendments. A crucial aspect highlighted within the form is the meticulous background investigation process each applicant undergoes, underscored by requirements for fingerprinting, and possibly necessitating a bond or equivalent financial security. Furthermore, the DOL-129 demands detailed business information, including corporate identity, tax, and sales licensure, whilst also catering to details pertaining to minority business status and the type of business operation. Intricacies extend into personal details and backgrounds of relevant officers or shareholders, demonstrating the Florida Lottery's commitment to integrity and legal compliance among its retailers. The form, continuously seeking precision, transitions into a marketing evaluation segment, striving to understand the retailer's environment and thereby optimize lottery sales performance. Paired with a strict privacy notice regarding the use of Social Security numbers for background checks, the DOL-129 represents a thorough vetting tool, ensuring that only eligible and compliant businesses can venture into the sale of lottery tickets, thereby safeguarding the interest of both the state and its citizens.

Example - Florida Lottery Dol 129 Form

RETAILER APPLICATION

FOR LOTTERY USE ONLY

Florida Lottery |

ID#___ CHAIN#___ |

|

250 Marriott Drive |

||

PROSPECT#______ |

||

Tallahassee, FL |

||

(850) |

DO___________ |

|

|

Initial Application $100, Additional Location $25, Change of Location $10,

New Officer, Director or Shareholder $25 each.

Each applicant shall be subject to a background investigation which can include fingerprinting.

A retailer applicant shall be required to post a bond, certificate of deposit or other security if it is determined during the background

investigation that such requirement is necessary to secure payment of lottery proceeds.

Check application type and complete the information below - PLEASE PRINT OR TYPE:

0 INITIAL APPLICATION O100% SALE OF STOCK O NEW OFFICER(S), DIRECTOR(S), SHAREHOLDER(S) 0 ADDITIONAL STORE LOCATION

0 CHANGE OF LOCATION: Date of Relocation ____________

0 CHANGE OF OWNERSHIP: Previous Location ID#___________ Date of Sale _______

For information concerning sale of business: Contact Name ________ Phone Number ( ___

SECTION 1 - BUSINESS INFORMATION

1.CORPORATE OR OTHER LEGAL NAME: ________________________

2.STORE NAME (dba): _______________ 3. STORE PHONE: { __ } __ - ___

4.STORE ADDRESS: _______________________________

StreetCityState Zip Code County

|

|

|

_ |

5. MAILING ADDRESS: _____________________________ |

|||

SameasStoreAddressO Street or P.O. Box |

City |

State |

Zip Code |

6. CONTACT NAME AND TITLE: ___________________________ |

|||

First |

Middle Initial |

Last |

Title |

7. CONTACT NUMBERS AND |

|

{ __} |

|

{ __} |

{ __} __- ____ |

||

Phone |

Alternate Phone |

|

Fax Number |

8.TAXPAYER IDENTIFICATION NUMBER: Provide number used to file business income tax return.

Sole Proprietors, list Social Security Number. All other entities, list Federal Employer Identification Number.

9.FLORIDA SALES TAX NUMBER: _ _ - _ _ _ _ _ _ _ _ _ _ - _ 0 Applied For O Tax Exempt

10. ALCOHOLIC BEVERAGE LICENSE NUMBER: |

0 Applied For O Not Applicable |

|||

11. |

MINORITY BUSINESS: 0 YES |

ONO (If yes, check appropriate minority category) |

||

|

African American |

Native American |

_ Hispanic American |

|

|

American Woman |

Asian American |

|

|

12. |

BUSINESS TYPE: (Check One) |

_ Partnership |

Non Profit |

_ Sole Proprietorship |

|

_ Corporation |

|||

|

_ Limited Partnership |

_ Limited Liability Company |

_ Limited Liability Partnership |

|

13. |

FLORIDA DEPT. OF STATE, DIVISION OF CORPORATIONS DOCUMENT NUMBER: ____________ |

|||

1 |

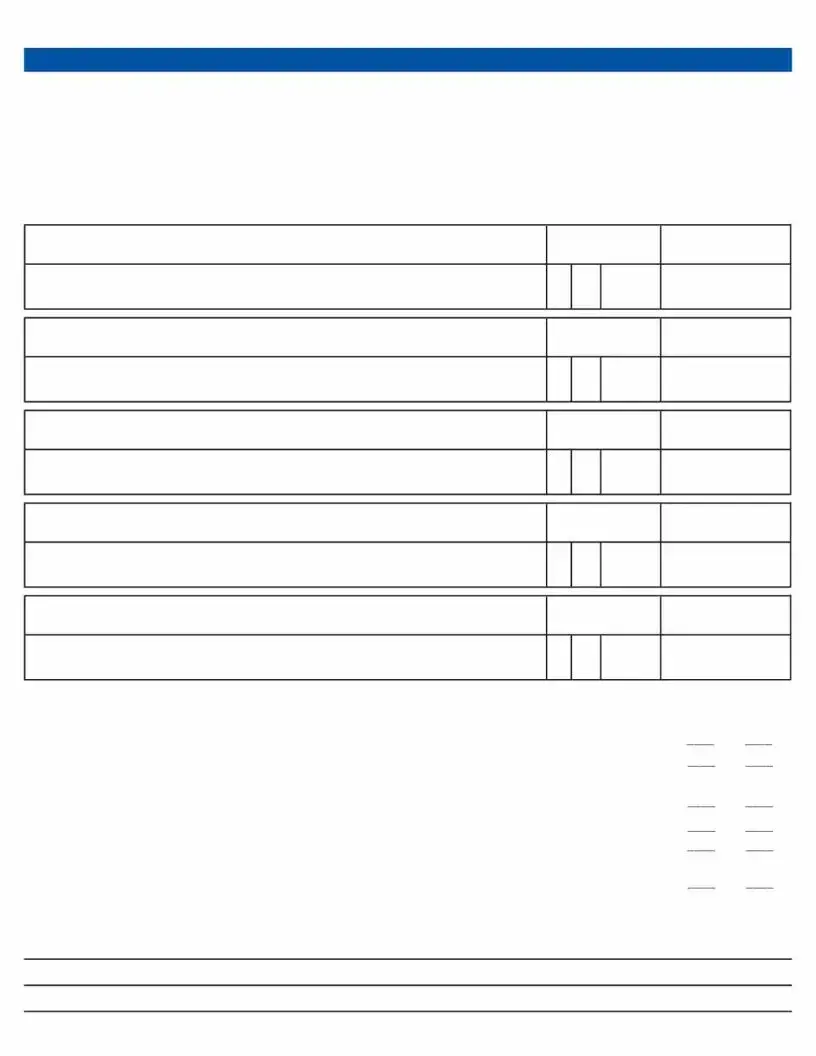

SECTION 2 - OFFICER/OWNER INFORMATION

THE LOTTERY SHALL NOT CONTRACT WITH ANY PERSON WHO IS RELATED TO AND RESIDING WITH ANY EMPLOYEE OF THE LOTTERY.

1.Are any of the individuals listed below related to an employee of the Florida Lottery in one of the following ways: husband, wife, parent, grandparent, spouse's parent, child, brother, sister, spouse of a child, aunt, uncle, grandchild, niece, nephew, first cousin, and living in the same household as the employee? ____ Yes ___No

2.LIST ALL OWNERS, INDIVIDUAL PARTNERS, MANAGING MEMBERS, CORPORATE OFFICERS, DIRECTORS. LIST

Name (first, middle initial, last) |

|

Phone |

|

Title |

|

|

Birthdate |

Home Address |

City |

State |

Zip |

Sex |

Race |

% Ownership |

Social Security Number |

Name (first, middle initial, last) |

|

Phone |

|

Title |

|

|

Birthdate |

Home Address |

City |

State |

Zip |

Sex |

Race |

% Ownership |

Social Security Number |

Name {first, middle initial, last) |

|

Phone |

|

Title |

|

|

Birthdate |

Home Address |

City |

State |

Zip |

Sex |

Race |

% Ownership |

Social Security Number |

Name {first, middle initial, last) |

|

Phone |

|

Title |

|

|

Birthdate |

Home Address |

City |

State |

Zip |

Sex |

Race |

% Ownership |

Social Security Number |

Name (first, middle initial, last) |

|

Phone |

|

Title |

|

|

Birthdate |

Home Address |

City |

State |

Zip |

Sex |

Race |

% Ownership |

Social Security Number |

3.Have any of the individuals listed above:

a.Been convicted of, or pleaded guilty or nolo contendere to a felony within the last 10 years, regardless of adjudication?

b.Been convicted of, or pleaded guilty or nolo contendere to any gambling offense within the last 10 years, regardless of adjudication?

Yes No

Yes No

c. Been arrested and have any pending criminal charges that have not been resolved? |

Yes |

No |

d. Been a Florida Lottery Retailer? |

Yes |

No |

e. Been suspended or terminated as a Florida Lottery Retailer? |

Yes |

No |

f. Been subject to any adverse actions or findings as a lottery retailer with any other state lottery within |

|

|

the continental United States? |

Yes |

No |

If yes to questions a, b, c, d, e, or f, please explain response and include dates below (use additional sheet if necessary).

2 |

4.For any individuals listed in the Officer/Owner Information, Section 2, who are not U.S. citizens, please list the individual's name, mother's maiden name, father's name; passport number, permanent resident or

How did you learn about becoming a Florida Lottery Retailer? Check one: |

D Sales Rep Visit |

||||

D Florida Lottery Website |

D Word of Mouth |

D Direct Mail |

D Print Ad |

||

D Florida Business Information Portal |

D Other: Please Specify |

|

|

||

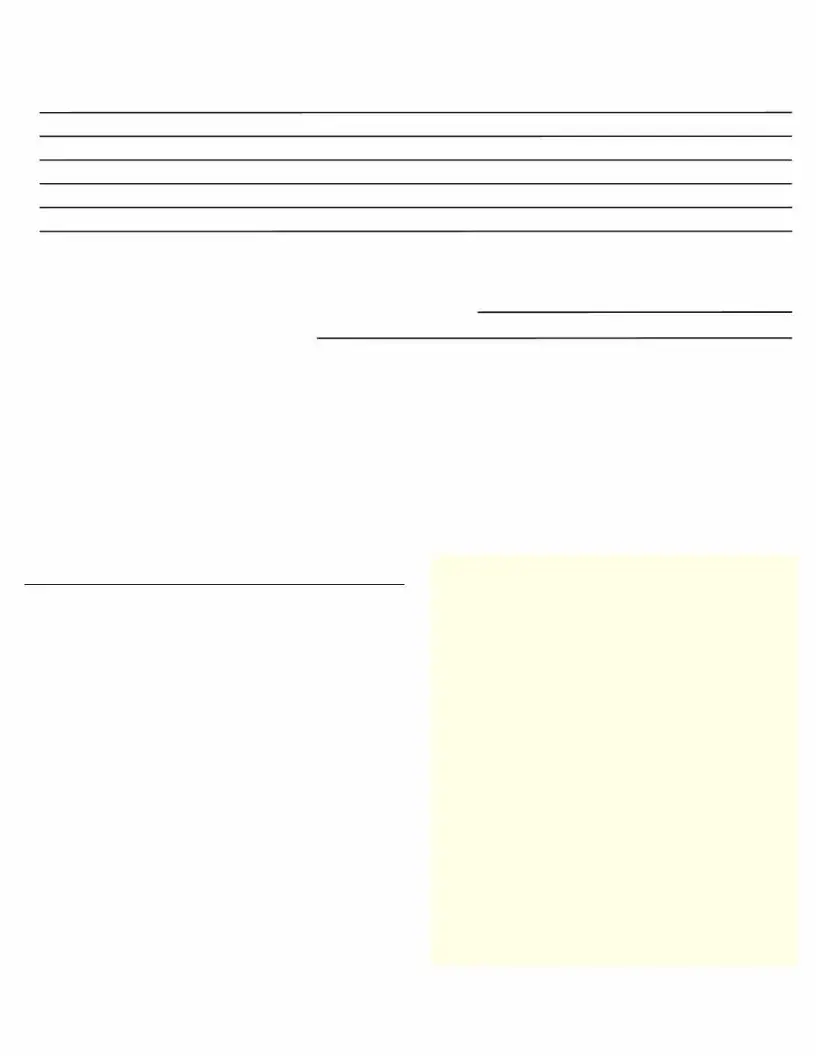

Certification:

An attorney in fact may not make any affidavit as to the personal knowledge of the principal.

I HEREBY CERTIFY that the information contained on this form or otherwise submitted to the Florida Lottery in connection with my application to become a retailer is true and correct in every material respect. I understand that providing inaccurate or misleading information is grounds for rejection of this application or cancellation of the Retailer Contract. The Florida Lottery is authorized to obtain criminal background, Florida tax, credit, and general information about me, my business, and any persons listed on this application, which may assist in making a decision on this application. The business location where lottery tickets will be sold is in compliance with the accessibility requirements set forth in sections 553.501 - 553.513, Fla. Stat., the Florida Americans with Disabilities Accessibility Implementation Act.

I HEREBY CERTIFY I have read and understand the content contained in the Retailer Awareness and Integrity Training document found on the Florida Lottery's website at flalottery.com/HowToApply.

State of _______________

Signature of Authorized Corporate Officer, Partner, or Owner

|

County of _______________ |

|||

|

Sworn to or affirmed and subscribed before me this |

|||

Print or type name |

________ day of ______, ___, |

|||

|

||||

|

|

(Day) |

(Month) |

(Year) |

|

|

|||

Title |

by _______________ |

|||

|

|

(Name of Authorized Corporate Officer, Partner, or Owner) |

||

|

|

|

|

|

|

Signature of Notary Public |

|

|

|

|

|

(Print, Type or Stamp Commissioned Name of Notary Public) |

||

|

__ Personally Known or __ Produced Identification |

|||

|

Type of |

|

|

|

Affix Notary stamp above. |

Identification ______________ |

|||

Certificates of Authority and retailer contracts are not assignable or transferable between persons or locations. STATEMENT OF PUBLIC DISCLOSURE: Information contained in this application shall be open to the public for inspection.

3 |

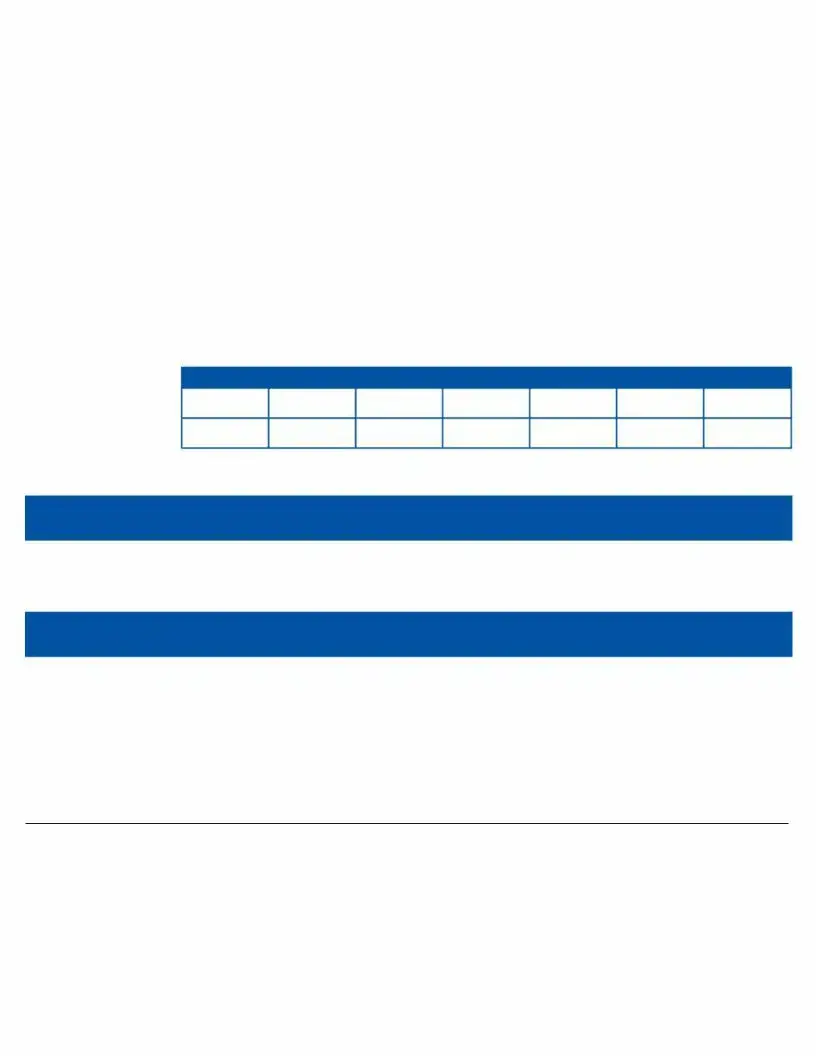

MARKETING EVALUATION/SITE SURVEY

Store Name:

1.TRADE STYLE (Circle One)

Airport Location |

Convenience Store |

Hardware/Building Supplies |

|

Restaurant - No Liquor |

|||

Appliances |

no gas pumps |

Hotel/Motel |

|

|

Shopping Mall Location |

||

Auto Parts/Repair |

Convenience Store- |

Ice Cream Shop |

|

Small Grocery/Meat/Fish Market |

|||

Bakery |

with gas pumps |

Jewelry Store |

|

Sports Arena/Amusement Park |

|||

Bar/Tavern/Lounge |

Department Store |

Laundry/Dry Cleaner |

|

Supermarket |

|

||

Barber Shop/Hairdresser |

Dollar Store/Discount Store |

Mail Services/Copy Center |

|

Telecommunications Center |

|||

Beauty Shop |

Drug Store/Pharmacy |

Municipality/Political Subdivision |

Travel Agency |

|

|||

Bingo Hall |

Financial Services |

Newsstand/Tobacconist/Sundries |

Travel Plaza/Truck Stop |

||||

Bowling Alley |

Flea Market |

|

Wholesale Club |

|

|||

Car Wash |

Florist |

|

Package Liquor Store |

|

Other ________ |

||

Clothing/Shoes |

Gas Station/Auto Repair |

|

|

|

|

||

Coffee/Deli/Sub Shop |

Gift/Card Shop |

Restaurant - Liquor |

|

|

|

||

2. BUSINESS OPERATION: |

0 SEASONAL BUSINESS |

0 |

|

||||

Business Hours |

MONDAY |

TUESDAY |

WEDNESDAY |

THURSDAY |

FRIDAY |

SATURDAY |

SUNDAY |

FROM |

|

|

|

|

|

|

|

TO |

|

|

|

|

|

|

|

3. RETAILER INSTALLATION INFORMATION: |

■ Yes |

■ No |

New Construction or Store Not Yet Open? Please Check. |

||

If yes, complete a, b, & c below. |

|

|

a. Store opening date:___________

b. Approximate date for terminal and communications equipment installation:__________

c. Building contact name and phone number: _____________________ |

||

Retailer Owns Location? Please Check. |

■ Yes |

■ No |

If no, complete a & b below.

Retailers with a lease agreement must have their landlord's approval for the installation of communications equipment on the roof and the installation of cables inside the location.

a.Landlord contact

b.Landlord phone number:_________________________________

4.COMMENTS:

Sales Representative:

|

|

|

|

|

|

|

|

|

|

Lottery Sales Representative Signature |

SR# |

Stop# |

Date |

||||||

Lottery District Manager: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Lottery District Manager Signature |

Date |

4

PRIVACY ACT NOTICE

RETAILER APPLICANTS

Under the Federal Privacy Act, disclosure of a person's Social Security number is voluntary unless a Federal statute specifically requires such disclosure or allows states to collect the number. In connection with filing an application to become a Florida Lottery retailer, disclosure of the applicant's Social Securtiy number is required by 26 U.S.C.A. s. 6109 for tax reporting purposes. The applicant's Social Security number will also be used in performing the background investigation necessary to implement Section 24.112, Florida Statutes, because the Social Security number is used as an identifier in the databases searched.

The Lottery may also provide this information to law enforcement agencies to enforce criminal laws.

Under Section 119.071(5), Florida Statutes, an agency may collect Social Security numbers if it is imperative for the performance of the agency's duties and responsibilities. Notice is hereby provided that for retailer applicants that are legal entities, it is imperative that the Lottery use the Social Security numbers of members, partners, officers, directors, etc., to conduct the background investigations necessary to implement Section 24.112, Florida Statutes, because the Social Security number is used as an identifier in the databases searched.

5

File Specifications

| Fact | Description |

|---|---|

| Form Designation | DOL-129 (Revised 4/19) |

| Primary Use | Retailer Application for Lottery Use |

| Application Fees | Initial Application $100, Additional Location $25, Change of Location $10, New Officer/Director/Shareholder $25 each |

| Background Investigation | Includes fingerprinting and may require posting a bond or other security |

| Governing Law | Section 24.112, Florida Statutes |

| Privacy Act Notice | Provides information on the use of Social Security numbers for tax reporting and background checks |

| Application Submission | Form and fees payable to the Florida Lottery |

| Non-Refundable Fee | All application fees are non-refundable |

Instructions on Filling in Florida Lottery Dol 129

Filling out the Florida Lottery DOL-129 form is a straightforward process that applicants must complete carefully to ensure their application is considered. This form is used for various purposes, including applying for an initial lottery retailer license, adding new officers, directors, or shareholders, opening additional store locations, and changing the location or ownership of a current lottery-retailing business. After completing this form, the applicant will undergo a background check, and depending on the outcomes, may be required to post a bond or other security. Here are the steps to fill out the form correctly:

- Enter the Florida Lottery ID#, Chain#, and Prospect# if known, or leave blank if this is an initial application.

- Select the application type by marking the appropriate box: Initial Application, 100% Sale of Stock, New Officer(s), Director(s), Shareholder(s), Additional Store Location, Change of Location, or Change of Ownership.

- In Section 1 - Business Information, fill in the corporate or legal name, store name (dba), store phone number, store address, mailing address if different, contact name and title, contact numbers and email address, taxpayer identification number, Florida sales tax number, alcoholic beverage license number if applicable, and whether the business is a minority business along with the type and business type.

- Provide the Florida Department of State, Division of Corporations Document Number if available.

- In Section 2 - Officer/Owner Information:

- Answer whether any individuals listed are related to and residing with an employee of the Florida Lottery.

- List all owners, individual partners, managing members, corporate officers, directors, and shareholders of 10% or more interest. Include their name, phone, title, birthdate, home address, sex, race, % ownership, and Social Security Number. Attach additional sheets if more space is needed.

- Answer questions regarding convictions, pending criminal charges, previous lottery retailer status, or any adverse actions or findings as a lottery retailer in other states. If any answers are "yes," provide explanations.

- For non-U.S. citizens listed, provide the required personal information.

- Certification: Read and certify that all the information provided is true and correct, and acknowledge the conditions stated. This section must be signed by an authorized corporate officer, partner, or owner in front of a notary public, who will also sign and provide their details.

- Complete the Marketing Evaluation/Site Survey in collaboration with a Lottery Sales Representative, covering details such as trade style, business operation (seasonal or year-round), retailer installation information, and any comments.

- Acknowledge the Privacy Act Notice regarding the use of Social Security numbers for retailer applicants.

After carefully filling out and reviewing the form to ensure accuracy, submit it along with the non-refundable application fee to the Florida Lottery. The fee amount varies depending on the type of application. Following submission, the Florida Lottery will process your application, perform the necessary background checks, and contact you with further instructions or to request additional information if needed.

Understanding Florida Lottery Dol 129

What is the purpose of the Florida Lottery DOL-129 form?

The Florida Lottery DOL-129 form is used by individuals or entities applying to become authorized Florida Lottery retailers. It gathers detailed information about the business and its owners or officers, including their legal and store names, contact information, business type, and more. The form is also intended for use in changes such as additional store locations, change of location, change of ownership, or updating officer, director, or shareholder information.

Who needs to fill out the DOL-129 form?

Any business entity that wishes to sell Florida Lottery products at their retail location is required to complete the DOL-129 form. Additionally, current lottery retailers looking to make changes to their business details, locations, or ownership structure must also use this form to process those changes.

What is the application fee for the Florida Lottery Retailer application?

The initial application for becoming a Florida Lottery retailer comes with a non-refundable fee of $100. If you are adding an additional location, the fee is $25 for each additional site. A fee of $10 is associated with changing locations, and if there are new officers, directors, or shareholders, each person incurs a fee of $25.

Is a background check necessary for Florida Lottery Retailer applicants?

Yes, each applicant undergoes a background investigation, which may include fingerprinting. This process is essential to ensure the integrity and security of the Florida Lottery and its operations.

Are there any requirements for posting a bond?

A retailer applicant might be required to post a bond, certificate of deposit, or other security types. This requirement typically arises if it is determined during the background investigation that such security is necessary to guarantee payment of lottery proceeds.

What should be done if an applicant has been previously convicted of a felony or a gambling offense?

Applicants must disclose if any of the listed individuals have been convicted of or pleaded guilty to a felony or any gambling offense within the last ten years, regardless of adjudication, as well as any pending criminal charges. Detailed explanations, including dates, must be provided if any of these circumstances apply.

Can the Florida Lottery refuse to contract with certain individuals?

The Florida Lottery will not contract with any person who is related to and residing with any employee of the Florida Lottery. The relationships include immediate family members and extended relatives if living in the same household as the employee.

How can an individual learn about becoming a Florida Lottery Retailer?

Prospective retailers can learn about becoming a Florida Lottery Retailer through various channels, including direct visits by sales representatives, the official Florida Lottery website, word of mouth, direct mail, print advertisements, and the Florida Business Information Portal.

What happens after submitting the DOL-129 form?

Once submitted, the form will be reviewed by Florida Lottery officials. The applicant may be contacted for additional information or clarification. Upon approval, further instructions will be provided regarding the next steps, training, and terminal installation.

Is information provided in the DOL-129 form open to public inspection?

Yes, details contained in the Florida Lottery DOL-129 application are open to public inspection, ensuring transparency and adherence to public records law.

Common mistakes

Filling out the Florida Lottery DOL-129 form can be a complex process that requires attention to detail. Mistakes made during this process can lead to delays or even rejection of the retailer application. Here are ten common mistakes people make when completing this form:

- Not paying the correct application fee: The form requires different fees for initial applications, additional locations, change of location, and adding new officers, directors, or shareholders. Applicants sometimes overlook the necessary fee amount and method of payment, which is payable to the Florida Lottery by check or money order.

- Leaving sections incomplete: Certain sections of the form ask for detailed business information, officer/owner information, and more. Skipping any required section can result in the application being incomplete.

- Not checking the appropriate boxes: The form includes multiple-choice questions, such as the type of application (initial, change of location, etc.), that need to be accurately marked to reflect the applicant's intentions.

- Error in business information: Providing incorrect corporate or other legal names, store names, or contact numbers leads to miscommunications and potential processing delays.

- Incorrect or missing Taxpayer Identification Number (TIN) and Florida Sales Tax Number: These numbers are critical for tax reporting purposes, and any mistake here can have serious implications.

- Listing the wrong type of business entity: The form requires applicants to check whether their business is a sole proprietorship, corporation, LLC, etc. Misidentifying the business type can lead to incorrect processing of the application.

- Failing to disclose relevant criminal history: Questions related to past convictions, pending charges, or adverse actions from other state lotteries must be answered truthfully, as failing to do so could result in a rejection of the application.

- Forgetting to sign and date the application: An unsigned or undated application is considered incomplete and will not be processed.

- Not providing landlord’s contact if applicable: Retailers with lease agreements must have their landlord’s approval for the installation of communications equipment. Failure to provide the landlord's contact information can halt the installation process.

- Overlooking the certification and notary public sections: The application requires certification that the information provided is correct and must be notarized, a step sometimes missed by applicants.

These mistakes can significantly affect the processing time and outcome of a Florida Lottery retailer application. Applicants should carefully review all sections of the DOL-129 form, ensure all information is accurate, and that all necessary documentation is included before submission.

Documents used along the form

Processing an application with the Florida Lottery using the DOL-129 form requires careful and accurate provision of information. To complement this application and ensure comprehensive compliance and understanding, various other documents and forms are often utilized. Those engaging in this process should be aware of these additional materials to prepare adequately.

- Fingerprint Card: Applicants may need to submit their fingerprints for the background check process. This card captures the necessary prints in a format acceptable to law enforcement and the Florida Lottery's background investigation requirements.

- Personal History Form: This document is detailed, requiring information about past residences, employment history, criminal records, if any, and other personal data relevant to the background investigation.

- Proof of Tax Compliance: This can include recent tax returns or certificates of good standing from the Florida Department of Revenue, confirming that the applicant has no outstanding tax liabilities.

- Business License/Permit Copies: Since a lottery retailer operates within a commercial framework, the application must be accompanied by copies of relevant business licenses or permits that authorize the operation of the business at its location.

- Lease Agreement or Proof of Ownership: This document evidences the legal right of occupancy or ownership of the premises from which lottery sales will be conducted, ensuring the retailer has a stable operation base.

- Banking Information Form: In order to facilitate financial transactions between the retailer and the Florida Lottery, applicants must provide detailed banking information where lottery proceeds will be deposited or from which fees will be withdrawn.

Understanding each document's role and ensuring their accuracy and completeness can significantly contribute to a smooth application process with the Florida Lottery using the DOL-129 form. Proper documentation not only expedites approval but also establishes a solid foundation for a compliant and successful retail operation. It is important for applicants to diligently gather and review all necessary forms and documents, adhering to the Florida Lottery's guidelines to foster a successful partnership.

Similar forms

- Business License Application: Like the Florida Lottery DOL-129 form, a business license application requires detailed business information, owner or director details, and often addresses regulatory compliance and background checks to verify the legality and credibility of the business.

- Alcohol Beverage License Application: This document also gathers comprehensive details about the business and its owners, similar to the Florida Lottery DOL-129 form, including checks for criminal history and adherence to specific legal requirements related to the sale of alcohol.

- Federal Employer Identification Number (EIN) Application: Although focused on tax identification, this application shares similarities with the Florida Lottery DOL-129 form by requiring taxpayer identification numbers and business details for the purpose of identification and verification.

- Vendor Application Forms: Often used by entities seeking to provide goods or services, these forms collect detailed business information, contact details, and sometimes personal information of owners or key managers, resembling the structure of the DOL-129 form.

- Gaming or Casino License Application: This type of application parallels the Florida Lottery DOL-129 form by requiring detailed ownership information, background checks, and adherence to regulatory standards due to the nature of the gambling industry.

- State Sales Tax Registration Forms: Similar to the DOL-129, these require business details, contact information, and taxpayer identification numbers to ensure compliance with state tax regulations.

- Background Check Authorization Forms: The DOL-129 form requires a background investigation. In a similar vein, many forms for employment, volunteering, or licensing might demand authorization to perform a background check, focusing on criminal history and personal credibility.

- Minority-Owned Business Certification Application: This form collects detailed business information and owner demographics to assess eligibility for minority status, resembling the section in the Florida Lottery DOL-129 form that asks for minority business designation.

- Franchise Disclosure Documents: While serving a different purpose, franchise disclosure documents require in-depth business information, owner information, and financial statements, akin to the comprehensive nature of the DOL-129 form’s requirements.

Dos and Don'ts

When you're filling out the Florida Lottery DOL-129 form, there are some key dos and don'ts that can help streamline the process and avoid unnecessary mistakes. Here's a list to guide you through:

- Do ensure all information is accurate and truthful. The form clearly states that providing misleading information can result in the rejection of the application or cancellation of the Retailer Contract.

- Do print or type the information clearly. This ensures that your application is easily readable and can be processed efficiently.

- Do provide a clear and complete description of your business operation. The form requires specifics about your trade style, business hours, and installation information if applicable.

- Do double-check the form for any sections that require detailed explanation, especially if you've answered 'Yes' to questions about convictions, pending charges, or adverse actions related to lottery retailing in other states.

- Don't forget to include the non-refundable application fee. The form specifies the fees for different application types, and it's crucial to ensure that your payment is correct and included with your submission.

- Don't overlook the need for a background investigation, including fingerprinting, if indicated. This is a mandatory part of the application process for validating your eligibility as a lottery retailer.

- Don't ignore the requirement to comply with the Florida Americans with Disabilities Accessibility Implementation Act. Your business location must meet these accessibility standards for you to qualify as a Florida Lottery retailer.

- Don't submit the application if any of the owners or officers listed are related to and residing with an employee of the Florida Lottery, as this could invalidate your application.

Following these guidelines can provide a smoother application process, ensuring you meet all the requirements to potentially become a Florida Lottery retailer.

Misconceptions

There are several misconceptions about the Florida Lottery DOL-129 form that people often have. Understanding these can help clarify the application process for becoming a Florida Lottery retailer.

- Misconception #1: The non-refundable application fee is overly expensive and not necessary.

In reality, the fees—$100 for an initial application, $25 for each additional location or new officer, director, or shareholder, and $10 for a change of location—are used to cover the administrative costs associated with processing the application, including background investigations.

- Misconception #2: The background investigation is an invasion of privacy.

This process is essential to ensure the integrity of the Florida Lottery operations. It helps in assessing the business and personal history of applicants to secure the Lottery's interests.

- Misconception #3: Once you apply, you automatically become a retailer.

Approval is not guaranteed. The application undergoes a thorough review process, including background checks, financial assessments, and other criteria, to determine eligibility.

- Misconception #4: Retailer contracts are assignable or transferable.

As explicitly stated, certificates of authority and retailer contracts cannot be transferred or assigned between persons or locations, ensuring that all retailers meet the Florida Lottery's requirements.

- Misconception #5: Any business type can apply.

While many business types can apply, the FL Lottery has specific criteria and restrictions, including the prohibition of contracting with any person residing with a Lottery employee.

- Misconception #6: The disclosure of Social Security numbers is optional.

For tax reporting purposes and to perform the necessary background checks, disclosing Social Security numbers is mandatory under federal and state laws.

- Misconception #7: Only U.S. citizens can apply.

The form allows for detailed information submission about non-U.S. citizens, including passport and permanent resident details, indicating that non-U.S. citizens can apply, providing they meet other requirements.

- Misconception #8: You need to personally know a Florida Lottery employee to apply successfully.

The application process is open to all eligible business owners, and knowing someone within the Lottery does not influence the outcome. However, an applicant related to and residing with a Lottery employee is ineligible to contract with the FL Lottery.

Understanding these aspects of the DOL-129 form can help applicants navigate the process more effectively and set realistic expectations regarding their application to become a Florida Lottery retailer.

Key takeaways

When preparing to fill out and use the Florida Lottery DOL-129 form, it's important to keep these key takeaways in mind to ensure accurate and compliant submissions:

- The application fee is non-refundable and varies depending on the action you are taking. Ensure you understand the exact amount you need to pay for your specific application type.

- All applicants will undergo a background investigation, which may include fingerprinting. This is a critical step in the application process to secure the integrity of lottery operations.

- If it's determined necessary from the background check, a retailer applicant may need to post a bond, certificate of deposit, or other security to ensure payment of lottery proceeds.

- Accurately check the application type that applies to you and fill in all requested information clearly, whether it’s an initial application, change of ownership, or another modification.

- Be sure to include all required personal and business information. Missing or incorrect information can lead to delays or rejection of the application.

- Disclosure of Social Security numbers or Federal Employer Identification Numbers is mandatory for tax reporting purposes and thorough completion of the background investigation.

- Your business location must comply with accessibility requirements as outlined in the Florida Americans with Disabilities Accessibility Implementation Act to be eligible for selling lottery tickets.

- Certification by an authorized corporate officer, partner, or owner is required at the end of the application, confirming that all provided information is accurate and true.

- The application, including Social Security numbers and other personal information, will be open for public inspection as stated in the Statement of Public Disclosure.

Adhering to these guidelines will help ensure a smooth application process, maintain compliance with Florida Lottery regulations, and facilitate a quicker path to becoming an authorized lottery retailer.

Popular PDF Templates

How Long Does It Take to Become a Cna in Florida - Detailed instructions guide you through disclosing any possible criminal history to avoid application denial.

Florida Tax Id Number Example - Includes a section for reporting any changes in business address or information, keeping business records up-to-date.