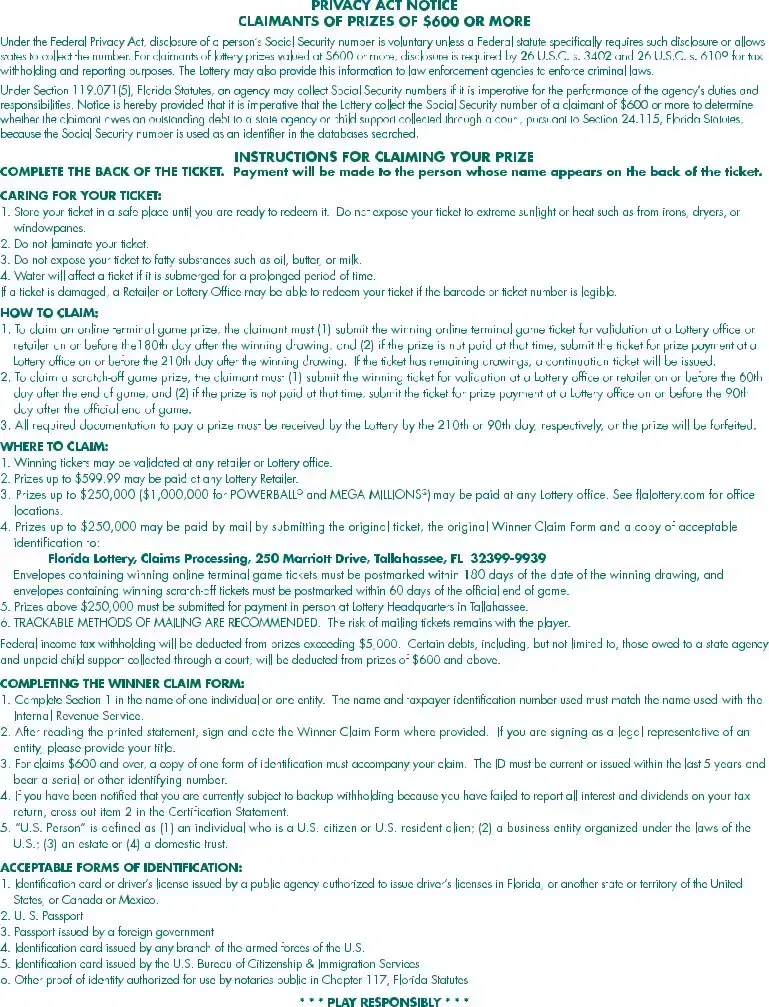

Official Florida Lottery Claim Template

Winning the Florida Lottery brings excitement and a slew of important decisions, one of which is completing the Florida Lottery Claim Form correctly. This vital document is the first step in securing your winnings, whether they are from a scratch-off ticket, a draw game like Powerball or Mega Millions, or any of the other numerous lottery games offered in the state. It serves as your official request to claim your prize and requires careful attention to detail to ensure all provided information is accurate and complete. The form requests personal information, game details, and choice of payment method among others. Understanding each section of the form and knowing what documents to attach is essential for a smooth claiming process, helping winners avoid common pitfalls that could delay or even forfeit their prizes. Navigating through the process, from filling out the form to submitting it properly, is a critical step in transforming a winning ticket into actual monetary gain.

Example - Florida Lottery Claim Form

File Specifications

| Fact | Detail |

|---|---|

| 1. Purpose | The form is used to claim prizes won from the Florida Lottery. |

| 2. Eligibility | Winners must be at least 18 years old or older to claim a prize. |

| 3. Required Information | Claimants must provide personal information, including name, address, and social security number. |

| 4. Prize Claim Deadline | Prizes must be claimed within 180 days of the winning draw date. |

| 5. Payment Options | Claimants can choose between a lump sum or an annuity payment for certain jackpot prizes. |

| 6. Identification | A valid government-issued photo ID is required to claim a prize. |

| 7. Tax Information | Prizes over a certain amount are subject to federal and state taxes. |

| 8. Claim Processing Time | Processing times for claims can vary but typically take a few weeks. |

| 9. Governing Law | The claim process is governed by the Florida Lottery laws and regulations. |

| 10. Claim Locations | Claims can be submitted at any authorized Florida Lottery retailer or at a Florida Lottery District Office. |

Instructions on Filling in Florida Lottery Claim

After winning a prize from the Florida Lottery, the next step is to claim your winnings. To do this, you must complete a Lottery Claim Form accurately. This document is vital for processing your prize and ensuring you receive your winnings without undue delay. By following the outlined steps carefully, you'll provide the necessary information to help expedite your claim. Remember, accuracy and completeness are essential to avoid any potential hiccups in claiming your prize.

- Begin by entering your full legal name as it appears on your government-issued identification.

- Provide your complete mailing address, including the street name and number, city, state, and ZIP code.

- Detail your contact information, specifically your primary phone number and an alternative number if applicable.

- Indicate your date of birth to confirm your eligibility based on age regulations.

- Enter your Social Security Number or Tax Identification Number for tax reporting purposes.

- If you're claiming a prize as part of a group, list the names of all group members. Ensure each member also completes a claim form.

- Sign and date the form to certify that the information provided is accurate and to acknowledge your understanding of the Lottery's rules and regulations.

- Attach the original winning ticket to the claim form. Ensure the ticket is signed on the back.

- If claiming a prize of $600 or more, include a copy of a valid government-issued photo ID (e.g., driver's license, passport) with your claim form.

- Mail the completed form, your signed winning ticket, and any other required documentation to the address provided on the form. For large prizes, consider using certified mail or another secure method to ensure the safe delivery of your claim.

Once your claim form is received, the Florida Lottery will begin processing your winnings. Typically, processing times can vary depending on the prize's size and claim volume at the time. Rest assured, the Lottery's team works diligently to review and process claims as swiftly as possible, ensuring you receive your winnings promptly. Keep a copy of all submitted documents for your records.

Understanding Florida Lottery Claim

What is the Florida Lottery Claim Form?

The Florida Lottery Claim Form is a necessary document for claiming prizes from the Florida Lottery. It must be completed by winners to collect their winnings for draws, scratch-offs, and other lottery games governed by the Florida Lottery.

Where can one find the Florida Lottery Claim Form?

Individuals can obtain the Florida Lottery Claim Form online on the official Florida Lottery website. Alternatively, it is available at any authorized Florida Lottery retailer or by visiting a Florida Lottery District Office in person.

How does one complete the Florida Lottery Claim Form?

Completing the form requires filling out personal information, such as name, address, and Social Security Number, and providing details about the winning ticket, including game name and ticket number. It's important to follow all instructions on the form accurately and attach the original winning ticket.

Is there a deadline for submitting the Florida Lottery Claim Form?

Yes, there is a deadline. Winners must submit the Florida Lottery Claim Form within 180 days after the official end of the game for scratch-off tickets, and within 180 days from the draw date for draw games. Failing to meet this deadline may result in forfeiting the prize.

Can I submit the Florida Lottery Claim Form electronically?

As of the last update, the Florida Lottery does not accept claim forms submitted electronically. Winners must mail their completed form along with the winning ticket and required identification to the Florida Lottery or submit them in person at any Florida Lottery District Office.

What happens after submitting the Florida Lottery Claim Form?

Once submitted, the claim will be processed by the Florida Lottery. If approved, winners will receive their prize either by mail, direct deposit, or in person, depending on the amount and method chosen. Processing times can vary, so winners should allow several weeks for verification and payment.

Are there any fees or taxes applied to lottery winnings in Florida?

Yes, lottery winnings in Florida are subject to federal income taxes and, depending on the amount, other deductions may also apply. However, Florida does not have a state income tax, which applies to lottery winnings. Winners of larger prizes should consult with a financial advisor to understand their tax obligations fully.

Common mistakes

Filling out the Florida Lottery Claim form seems straightforward, but a surprising number of people make mistakes that can delay or even invalidate their claims. To help ensure that your claim process goes smoothly, here's a careful look at common errors to avoid:

Not signing the back of the winning ticket - Your signature acts as proof of ownership, and forgetting this step can lead to complications.

Entering incorrect personal information - Typos or outdated information in your name, address, or contact details can cause delays in processing your claim.

Using unsupported ink colors - Black or blue ink is required for filling out the form to ensure legibility and avoid processing errors.

Skipping sections of the form - Every part of the form is important. Unanswered questions can result in the claim being held up.

Failure to attach identification - A copy of a valid, government-issued ID must accompany your claim to verify your identity.

Not checking the box for the correct game - The Florida Lottery hosts multiple games, and it's crucial to indicate which one you've won.

Choosing the wrong payment option - Some large prizes offer different payout options. Once submitted, changing your choice may not be possible.

Mismatched signature - The signature on the form and ID should match. Inconsistencies can raise questions about the claim's validity.

Missing the deadline - There are specific time limits for claiming prizes, and missing these can mean forfeiting your winnings entirely.

Not keeping a copy of the claim form and ticket - For your records and peace of mind, always keep copies until the claim is fully processed and the prize is received.

Avoiding these mistakes doesn't just ease the claim process; it ensures that winners can enjoy their windfalls without unnecessary stress or delay. The excitement of winning should be cherished, not overshadowed by preventable hiccups. So, take your time, double-check everything, and remember—help is always available if you have questions about completing your Florida Lottery Claim form.

Documents used along the form

When submitting a Florida Lottery Claim form, several other documents are often required to complete the process. These documents help verify identity, ensure compliance with tax laws, and support the claim. Understanding these additional requirements can streamline the submission process, making it more efficient and reducing the chances of delays.

- Government-issued Photo ID: This could be a driver's license, passport, or state identification card. It serves to verify the claimant's identity, ensuring the prize is awarded to the rightful winner.

- Social Security Card: This document is required for tax reporting purposes. The Social Security number must match the name on the claim form and the government-issued photo ID to comply with federal and state tax withholding laws.

- IRS Form W-9 Request for Taxpayer Identification Number and Certification: This form is used to provide the correct taxpayer identification number to the entity that will report the winnings to the IRS, facilitating accurate tax reporting.

- Winner Claim Form Addendum for Prizes Over $600: For larger winnings, this additional form may be required. It includes further details about the winner and any co-claimants, ensuring all necessary information is collected for taxation and prize distribution.

- Direct Deposit Form: If the winner chooses to receive their prize via direct deposit, this form will be necessary. It includes bank routing and account numbers, authorizing the transfer of funds directly to the winner’s bank account.

Collecting and preparing these documents in advance can expedite the claim process. It’s important to review the requirements carefully, as missing or incorrect information can delay prize distribution. The Florida Lottery provides guidelines and assistance for claimants, ensuring that winners receive their prizes with as few hurdles as possible.

Similar forms

Tax Return Forms: Much like the Florida Lottery Claim form, tax return forms require detailed personal information, financial data, and potential deductions. Both documents are essential for the accurate assessment of what one owes or is owed, involve detailed scrutiny to ensure compliance with state and federal regulations, and result in financial transactions with government entities.

Insurance Claim Forms: Submitting an insurance claim form follows a process similar to that of the Florida Lottery Claim form. These forms necessitate comprehensive personal information, descriptions of the claim event, and documentation to substantiate the claim. The primary objective is to evaluate the legitimacy of the claim and determine the amount to be disbursed, aligning closely with the lottery claim procedure's intention to verify winners and award prizes accordingly.

Bank Loan Applications: Bank loan applications share similarities with the Florida Lottery Claim form in terms of requiring detailed personal financial information, the purpose for the application, and various documentation to verify the information provided. Both processes are undertaken with the goal of receiving funds, although through different means and for different reasons, and entail a rigorous verification process to assess eligibility.

Scholarship Application Forms: Scholarship applications, like the Florida Lottery Claim form, require applicants to provide personal information, academic or professional achievements, and often an essay or statement. Both forms serve as requests for financial awards based on certain eligibility criteria, and both require thorough evaluation to determine if the applicant meets the respective awarding criteria.

Dos and Don'ts

When filling out the Florida Lottery Claim form, it's important to navigate the process with a clear understanding of what actions will aid in a successful submission and what pitfalls to avoid. Here are eight key guidelines to ensure your claim is processed smoothly:

- Do review the entire form before starting to ensure you understand all the requirements.

- Do use blue or black ink only; this is critical as other colors may not be accepted or could result in scanning errors.

- Do ensure that all the information you provide is accurate and completely matches your government-issued identification.

- Do double-check your ticket numbers and the claimed prize amount before submission to avoid any discrepancies.

- Don't hurry through the process; taking your time can help prevent mistakes that might delay your claim.

- Don't forget to sign the back of your lottery ticket before submitting. An unsigned ticket can be considered void or result in complications in the claiming process.

- Don't use pencil or erasable pens when filling out your claim form as these can be easily altered.

- Don't neglect to keep a copy of all documents for your records. In the event of any disputes or inquiries, having a copy will be invaluable.

Misconceptions

One common misconception is that winners can claim prizes anonymously. In reality, Florida law mandates the disclosure of the winner's name, city of residence, game won, date won, and the amount of the winnings for transparency and public record purposes.

Many believe the claim form is only necessary for large prizes. However, any winnings over $600 require the completion of a claim form to ensure proper reporting to the Internal Revenue Service.

There's a myth that you must visit the lottery office in person to submit a claim form. While this is an option, winners can also submit their form via mail, although it's advisable to keep a copy for their records.

A common misunderstanding is that the claim process is instant. The processing time can take several weeks, particularly for large prizes which undergo more thorough validation.

Some people think that a lost ticket means a lost prize. If you have signed your ticket, it is possible to claim the prize with the appropriate identification and the completed claim form, though verification under such circumstances is more rigorous.

There is a misconception that taxes are automatically deducted from the winnings before payout. Winners are actually responsible for paying federal and state taxes, and the Florida Lottery provides a W2-G form for tax purposes.

Another misconception is that all prizes are paid in a lump sum. Depending on the game, winners may have the option between an annuity and a lump sum, each with different tax implications.

Some believe the claim form is complicated and requires legal assistance to complete. While it's important to carefully read and accurately complete the form, most individuals can do so without a lawyer's help. Detailed instructions are provided with the form.

Lastly, there's a belief that minors can claim prizes on their own. In Florida, if a minor wins a lottery prize, a parent or guardian must claim the prize on their behalf, ensuring compliance with state laws.

Key takeaways

Winning the Florida Lottery is an exciting event, but it's important to navigate the claim process correctly to ensure you receive your winnings without delay. Here are several key takeaways about filling out and using the Florida Lottery Claim form effectively.

- Complete All Required Information: The Florida Lottery Claim form requires detailed personal information, including full name, address, date of birth, and social security number. Ensure every section is filled out accurately to avoid any processing delays.

- Sign the Ticket: Before submitting the claim form, sign the back of your winning lottery ticket. A signed ticket verifies ownership and protects you in case the ticket is lost or stolen.

- Follow the Instructions: The claim form comes with instructions that guide the claimant through the process. Pay close attention to these instructions to ensure the form is completed correctly.

- Choose Payment Option Wisely: Depending on the amount won, you may have the option to choose between a lump-sum payment or an annuity. Consider consulting with a financial advisor to make the decision that best suits your financial goals.

- Make Copies: Before sending the original ticket and claim form to the Florida Lottery office, make copies of both for your records. This step is crucial in case the originals are lost in transit.

- Understand the Deadline: There is a specific time frame within which you must claim your lottery prize. Check the Florida Lottery's official website or contact their office to know the exact deadline to avoid forfeiting your winnings.

- Consider Anonymity and Tax Implications: Certain large winnings may attract public attention. Understand your rights regarding anonymity. Also, be aware of the tax implications of your winnings, as large sums may be subject to federal and state taxes.

Adhering to these key points will help streamline the claim process, allowing winners to enjoy their newfound fortune with ease and peace of mind. For any uncertainties, the Florida Lottery provides resources and support to guide winners through each step of the claim process.

Popular PDF Templates

Florida Reemployment Tax - With RTS-6, employers aim to streamline tax reporting and compliance across state lines, benefiting from Florida's reemployment tax laws.

Florida Ifta - Navigate your fleet towards successful interstate operations and fuel tax compliance with the strategic use of Florida's IFTA License Application.