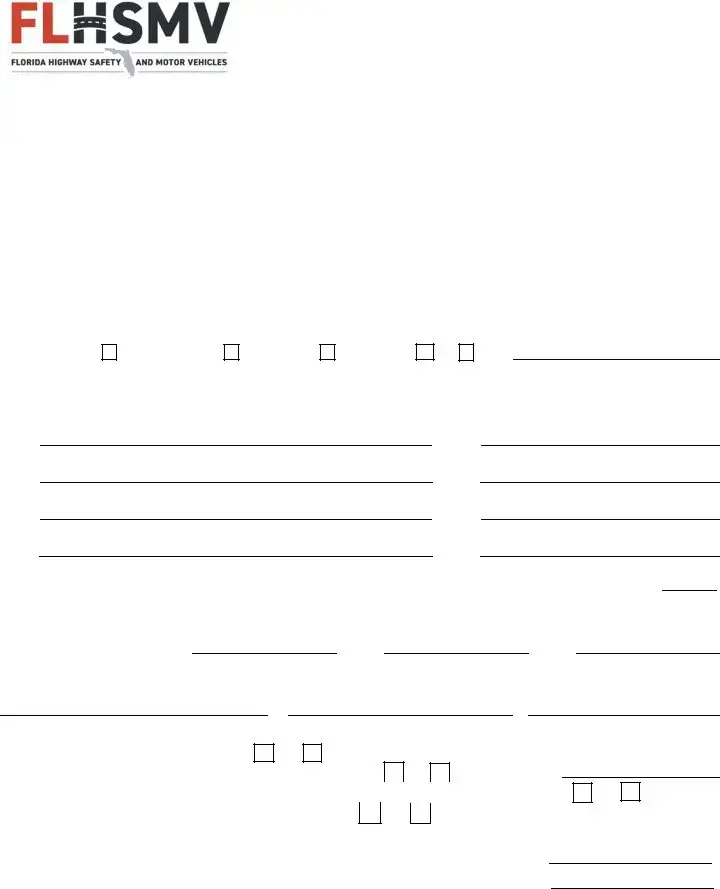

Official Florida Ifta Application Template

In the heart of Florida's administrative procedures for commercial vehicle operations, the Florida IFTA (International Fuel Tax Agreement) Application form plays a critical role. Managed by the FLHSMV Division of Motorist Services, this document is essential for businesses that operate qualified motor vehicles across state lines. The form demands detailed information, such as the business name, federal employer identification number (FEIN), and the physical and mailing addresses, ensuring that all correspondence reaches the right hands. Furthermore, it requires contact details for a designated person within the company, solidifying the communication line between the state and the business. With sections dedicated to specifying the business type—ranging from sole proprietorships to corporations and LLCs— and indicating whether the business has an active International Registration Plan (IRP) account, the form caters to a broad spectrum of commercial vehicle operators. Vehicle information, including whether vehicles are registered in Florida or require setup for consolidated fleets, highlights the comprehensive nature of this application, emphasizing the state's commitment to precise record-keeping. The form also delves into the history of the applicant regarding any prior IFTA licenses and the maintenance of bulk fuel storage, showcasing the depth of scrutiny involved. Additionally, the application concludes with a financial aspect, requiring payment for IFTA decal sets, a clear indicator of the operational costs tied to interstate commercial vehicle operation. Through this meticulous documentation, businesses pledge to adhere to strict tax reporting, payment, and record-keeping obligations under the IFTA, underlining the gravity and importance of compliance within the commercial transport sector.

Example - Florida Ifta Application Form

|

|

FLHSMV |

|

|

Division of Motorist Services |

|

IFTA/CH |

|

|

||||||||||

|

|

2900 Apalachee Parkway, MAIL STOP 62 |

|

Date |

|||||||||||||||

|

|

|

|

Bureau of Commercial Vehicle and Driver Services |

|

|

|

|

|

|

|||||||||

|

|

|

|

Tallahassee, Florida |

|

|

|

|

|

|

|||||||||

|

|

FLORIDA HIGHWAY SAFETY |

INTERNATIONAL FUEL TAX AGREEMENT |

||||||||||||||||

|

|

|

|

||||||||||||||||

|

|

|

|

LICENSE APPLICATION |

|

|

|

|

|

|

|||||||||

1. |

|

|

|

|

|

|

2. |

|

|

|

|

|

|

|

|

|

|

|

|

BUSINESS NAME |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

|

|

|

|

|

|

|

|

FEDERAL EMPLOYER IDENTIFICATION NUMBER [FEIN] |

|

||||||||||

3. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

FL |

||||

|

|

BUSINESS PHYSICAL ADDRESS |

|

|

CITY |

|

|

|

|

|

COUNTY |

|

STATE |

ZIP CODE |

|

||||

4. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

BUSINESS MAILING ADDRESS |

|

|

CITY |

|

|

|

|

|

STATE |

|

|

ZIP CODE |

|

||||

5. |

|

|

|

|

|

|

6. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

BUSINESS TELEPHONE NUMBER |

|

|

|

|

BUSINESS |

|

|

|

|

|

|

||||||

7. |

|

|

|

|

|

|

8. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

BUSINESS CONTACT PERSON |

|

|

|

|

CONTACT PERSON’S |

|

|||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

9.BUSINESS TYPE

SOLE PROPRIETOR

PARTNERSHIP

CORPORATON

LLC

OTHER

[SPECIFY FROM LIST ON REVERSE SIDE]

10. |

|

11. |

|

|

BUSINESS DOT # |

|

IRP ACCOUNT # |

12.LIST ALL OWNERS, PARTNERS OR CORPORATE OFFICERS [ATTACH ADDITIONAL DOCUMENTATION AS NEEDED]

NAME

HOME ADDRESS

NAME

HOME ADDRESS

TITLE

TELEPHONE #

TITLE

TELEPHONE #

13. IF NO ACTIVE IRP ACCOUNT: INDICATE NUMBER OF VEHICLES THAT WILL OPERATE UNDER THIS LICENSE APPLICATION: AND PROVIDE THE VEHICLE INFORMATION LISTED BELOW FOR EACH VEHICLE. [ATTACH ADDITIONAL SHEETS AS NEEDED]

QUALIFIED MOTOR VEHICLE(S) CURRENTLY REGISTERED IN FLORIDA: |

|

|

|

_________________________ |

FLORIDA LICENSE PLATE# |

FLORIDA LICENSE PLATE # |

FLORIDA LICENSE PLATE # |

FLORIDA LICENSE PLATE# |

|||

QUALIFIED MOTOR VEHICLE(S) NOT CURRENTLY REGISTERED IN FLORIDA (copy of registration and lease agreement required):

NAME IN WHICH VEHICLE IS REGISTERED

14.DO YOU INTEND TO CONSOLIDATE FLEETS?

STATE IN WHICH VEHICLE IS REGISTERED VEHICLE IDENTIFICATION # [VIN]

YES |

NO |

15. |

HAVE YOU EVER HELD AN IFTA LICENSE IN ANOTHER JURISDICTION? |

|

YES |

|

NO IF YES, WHERE? |

|||||||

16. HAS YOUR IFTA LICENSE EVER BEEN REVOKED? |

|

YES |

|

NO |

|

|

IS IT CURRENTLY REVOKED? |

|||||

|

|

|

|

|||||||||

17. |

|

|

|

|

|

|

|

|

|

|

||

DO YOU MAINTAIN BULK FUEL STORAGE FOR HIGHWAY USE? |

|

|

|

YES |

NO |

|||||||

If yes, indicate the fuel type and the jurisdiction where the bulk fuel is stored:

YES

NO

Fuel Type: |

|

|

Fuel Type: |

|

|

Fuel Type: |

Jurisdiction: |

|

|

Jurisdiction: |

|

|

Jurisdiction: |

NOTE: THIS APPLICATION IS NOT COMPLETE WITHOUT A DECAL ORDER AND PAYMENT (SEE PAGE 2). Enter the number of IFTA decal sets needed ($4.00 per set, per vehicle). Enter total dollar amount of your order. The address for mailing payment and this application and/or order form is located at the top of this page. Once you have an established IFTA account, an authorized agent (with a Power of Attorney on file) may sign renewal and additional decal orders (with proof and payment) on your behalf.

1 |

|

HSMV 85008 (REV 2/2021) |

|

NUMBER OF VEHICLES REQUIRING IFTA DECALS |

|

|

DECAL FEE PER VEHICLE |

|

|

X |

$4.00 |

|

TOTAL ENCLOSED |

$ |

|

(MAKE CHECK PAYABLE TO FLORIDA DIVISION OF MOTORIST SERVICES) |

|

|

I, THE UNDERSIGNED APPLICANT (BUSINESS OWNER OR COMPANY OFFICER) UNDERSTAND THAT, UNDER PENALTY OF PERJURY, I DECLARE I HAVE EXAMINED THIS APPLICATION AND DECAL ORDER AND TO THE BEST OF MY KNOWLEDGE AND BELIEF IT IS CORRECT AND COMPLETE. I AGREE TO COMPLY WITH ALL TAX REPORTING, PAYMENT,

PRINTED NAME |

|

TITLE |

|

TELEPHONE # (REQUIRED) |

APPLICANT SIGNATURE:

Owner

Company Officer |

DATE |

(SUNBIZ REGISTRATION REQUIRED) |

|

APPLICATION INSTRUCTIONS

1.BUSINESS NAME – Print the name of the motor carrier business making application. If the name is other than an individual's name, attach a copy of the corporation papers or fictitious trade name papers filed with the Florida Secretary of State.

2.FEDERAL EMPLOYER IDENTIFICATION NUMBER (FEIN) – Print your business’s FEIN. Your FEIN should always be referenced when inquiring

on your account.

The following contact information is needed for the business that is making application for an IFTA license. If your business will be using authorized agents to manage your IFTA correspondence and shipment of credentials, you must submit a completed, signed, and notarized Power of Attorney (POA) form (HSMV 96440). Once this POA form is on file, any one of your authorized agents may submit a request to update the shipping address you would like used for your IFTA routine correspondence and credentials.

3.BUSINESS PHYSICAL ADDRESS – Enter the Florida physical location (address, city & zip) of your motor carrier business or office. Post office boxes or rented mail boxes are NOT acceptable.

4.BUSINESS MAILING ADDRESS – Enter the address, city, state & zip used by the business. This address cannot be the address of a service provider or permitting company.

5.BUSINESS TELEPHONE NUMBER – Enter the business telephone number, including area code.

6.BUSINESS

7.CONTACT PERSON – Enter name of internal company person to contact about this account (if not licensee/company officer, attach letter designating this company employee).

8.CONTACT PERSON’S

9.TYPE OF BUSINESS OWNERSHIP – Specify the type of business you own. Other options are Limited Company, LTD Liability LTD Partnership, Limited Liability Partnership, Company Limited, Limited Partnership.

10.U.S. DOT NUMBER – Enter the U.S. DOT number of the business.

11.INTERNATIONAL REGISTRATION PLAN (IRP) ACCOUNT NUMBER – Enter your Florida IRP account number. If you do not have a Florida IRP account, you must provide VEHICLE INFORMATION for each vehicle in your fleet See #13, below.

12.OWNER, PARTNERS OR CORPORATE OFFICER’S NAME(S) – Print the name, home address, city, state & zip, title, and telephone number of every company officer. Attach additional pages to the application, as necessary.

13.VEHICLE INFORMATION – If you do not have a Florida IRP account, indicate the total number of qualified vehicles that will operate under this license application. Provide the license plate number of those vehicles that are registered in Florida and, for those vehicles registered out of state, the name, state of registration, and VIN (with attached proof). Attach additional pages to the application, as necessary.

14.Use a check mark to indicate whether you intend to consolidate ALL of your vehicles in Florida.

15.Use a check mark to indicate whether you have ever held an IFTA license in another jurisdiction and, if YES, indicate jurisdiction(s).

16.Use a check mark to indicate whether your IFTA license has ever been revoked.

17.Use a check mark to indicate whether you maintain bulk fuel tanks, and, if YES, indicate type of fuel stored and the jurisdiction where the bulk fuel tanks are located.

FOR OFFICIAL USE ONLY (WALK IN COUNTER)

DECAL #(S) |

|

PRESENTED TO (PRINT NAME): |

|

SIGNATURE OF RECIPIENT: |

DATE: |

Owner |

Company Officer |

|

(SUNBIZ REGISTRATION REQUIRED) |

HSMV 85008 (REV 2/2021)

Authorized Agent

(POA REQUIRED)

2

File Specifications

| Fact Name | Detail |

|---|---|

| Form Identification | FLORIDA HIGHWAY SAFETY INTERNATIONAL FUEL TAX AGREEMENT LICENSE APPLICATION |

| Relevant Authority | FLHSMV Division of Motorist Services IFTA/CH 2900 Apalachee Parkway, MAIL STOP 62, Bureau of Commercial Vehicle and Driver Services, Tallahassee, Florida 32399-0626 |

| Governing Law | 15C-12.008 |

| Form Number and Revision Date | HSMV 85008 (REV 2/2021) |

| Application Requirements | Includes business information, federal employer identification number (FEIN), physical and mailing addresses, business contact information, type of business ownership, U.S. DOT number, IRP account number, and vehicle information. |

| Additional Requirements for Those Without a Florida IRP Account | Applicants must indicate the total number of qualified vehicles operating under this license application and provide vehicle information, including out-of-state registrations. |

| Decal Order Requirement | This application is incomplete without a decal order and payment, at $4.00 per set, per vehicle. |

| Compliance Agreement | The applicant agrees to comply with tax reporting, payment, record-keeping, and license display requirements specified in the International Fuel Tax Agreement (IFTA). |

Instructions on Filling in Florida Ifta Application

Filling out the Florida IFTA Application form is a critical step for businesses operating commercial vehicles within Florida and beyond its borders. This process allows for the streamlined reporting of fuel taxes, ensuring compliance with tax regulations across member jurisdictions. It's essential to provide accurate and complete information to facilitate a smooth application process. The steps outlined below are designed to guide you through each section of the form, ensuring clarity and compliance.

- Business Name: Enter the legal name of your business as registered. If it's not an individual's name, attach the required corporation or fictitious name registration documents.

- Federal Employer Identification Number (FEIN): Provide your business's FEIN, ensuring it matches the number associated with all your tax accounts.

- Business Physical Address: Write down the physical location of your business in Florida. Remember, P.O. Boxes or rented mailbox addresses are not allowed.

- Business Mailing Address: Enter the mailing address where your business correspondence should be sent. This should not be an address belonging to a service provider.

- Business Telephone Number: Provide your business's primary phone number, including the area code.

- Business E-mail Address: Write down the official business email address for communication purposes.

- Contact Person: Name the person within your business who can be contacted regarding this account. If the person is not a company officer, attach a designation letter.

- Contact Person’s E-mail Address/Telephone Number: Include the e-mail and phone number of the contact person identified in the previous step.

- Business Type: Select the appropriate type of business ownership from the provided options. If your business type is not listed, specify using the options on the reverse side of the form.

- U.S. DOT Number: Enter the business's Department of Transportation number.

- IRP Account Number: If you have a Florida IRP account, include the number here. If not, you must provide detailed vehicle information as instructed later in the form.

- List All Owners/Partners/Corporate Officers: Document the full names, home addresses, titles, and telephone numbers of each applicable person. Attach additional documentation if needed.

- Vehicle Information: If no active IRP account exists, list each qualified vehicle that will operate under this license, including those registered in Florida and those registered elsewhere (providing the necessary registration and lease agreement copies).

- Check whether you intend to consolidate fleets within Florida.

- Indicate if you have previously held an IFTA license in another jurisdiction and provide details if applicable.

- Confirm whether your IFTA license has ever been revoked, and provide details as necessary.

- Specify whether you maintain bulk fuel storage for highway use, including the type of fuel and storage jurisdiction.

- Calculate the number of vehicles that require IFTA decals, the decal fee per vehicle, and the total enclosed payment. Make your check payable to the Florida Division of Motorist Services.

- Signature: The business owner or company officer must sign, declaring the information provided is accurate and complete to the best of their knowledge. The date of signing and telephone number are also required here.

After completing the form and attaching any required documentation and payment, send everything to the address stated at the top of the form. Ensuring accuracy and completeness will facilitate a smoother processing of your IFTA license application.

Understanding Florida Ifta Application

What is the International Fuel Tax Agreement (IFTA) License Application in Florida?

The International Fuel Tax Agreement (IFTA) License Application is a document that motor carriers in Florida must complete to comply with fuel use tax requirements. It allows them to report and pay taxes on the fuel they use within Florida and other IFTA jurisdictions. This centralized system simplifies the process for carriers that operate in multiple jurisdictions, requiring them to file a single quarterly fuel tax report with Florida, their base jurisdiction, which then allocates taxes to other relevant states.

Who needs to complete the Florida IFTA Application Form?

Any motor carrier operating qualified motor vehicles across state lines needs to complete the Florida IFTA Application Form. A qualified motor vehicle is defined as a vehicle used, designed, or maintained for transportation of persons or property having two axles and a gross vehicle weight or registered gross vehicle weight exceeding 26,000 pounds, or three or more axles regardless of weight, or when used in combination, when the weight of such combination exceeds 26,000 pounds gross vehicle or registered gross vehicle weight.

What information is needed to fill out the Florida IFTA Application Form?

To properly fill out the Florida IFTA Application, carriers need to provide specific information including their Business Name, Federal Employer Identification Number (FEIN), business and mailing addresses, contact information, the type of business ownership (e.g., sole proprietor, partnership), U.S. DOT Number, International Registration Plan (IRP) account number if applicable, a list of owners, partners, or corporate officers, vehicle information for all vehicles in their fleet, and their IFTA decal needs. Additionally, applicants are required to disclose whether they have previously held an IFTA license, if their license has ever been revoked, and if they maintain bulk fuel storage for highway use.

How can one apply for an IFTA License in Florida and what are the associated costs?

To apply for an IFTA License in Florida, motor carriers must complete the IFTA Application form (HSMV 85008) and submit it along with the decal order and payment to the Florida Highway Safety International Fuel Tax Agreement License Application office. The cost includes a $4.00 fee per vehicle for the decal sets needed. Payments should be made payable to the Florida Division of Motorist Services. Upon submission, it’s crucial to ensure that all provided information is accurate and complete to comply with tax reporting, payment, record-keeping, and license display requirements as specified in the International Fuel Tax Agreement.

Common mistakes

Filling out the Florida IFTA Application form correctly is crucial for businesses operating commercial vehicles. Here are ten common mistakes that people tend to make during this process:

Failing to provide the correct Business Name as registered with the Florida Secretary of State, which can lead to unnecessary delays.

Incorrectly entering the Federal Employer Identification Number (FEIN), which is essential for identification and verification purposes.

Using a post office box or rented mailbox for the Business Physical Address instead of the actual physical location, which is against the application requirements.

Listing a Business Mailing Address that belongs to a service provider or permitting company, instead of the business's own mailing address.

Omitting or inaccurately providing the Business Telephone Number and Business E-mail Address, which are critical for communication.

Not designating a Contact Person correctly or failing to provide their contact information, which can hinder the communication process.

Selecting an incorrect Business Type or not specifying one if 'Other' is selected, which can affect the categorization of the business.

U.S. DOT Number and IRP Account Number are either not provided or incorrectly entered. These numbers are essential for identification and processing the application.

Not listing all Owners, Partners, or Corporate Officers, along with their complete information, which is required for a complete application.

Failing to properly indicate or provide details for questions on consolidating fleets, holding an IFTA license in another jurisdiction, revocations, and maintaining bulk fuel storage, which are all critical for the application’s approval.

Being meticulous and double-checking the information provided can prevent these mistakes and ensure a smoother application process for the Florida IFTA License.

Documents used along the form

When applying for a Florida IFTA (International Fuel Tax Agreement) License, several additional forms and documents might be necessary to support the application process. These documents are essential for verifying the information provided, ensuring compliance with tax laws, and facilitating the smooth operation of commercial vehicles across state lines. Below is a list of these supplementary items commonly used alongside the Florida IFTA Application form:

- Proof of U.S. DOT Number: Document that shows the applicant's current U.S. Department of Transportation number, which is required for commercial vehicle operation.

- Certificate of Incorporation or similar documents: Used to verify the legal status of a business applying for IFTA, it includes details like the business name, structure, and registration with state authorities.

- Power of Attorney (POA) Form (HSMV 96440): If the business will use authorized agents to manage IFTA correspondence and credentials, this form designates those agents officially.

- IRP (International Registration Plan) Account Number Documentation: For carriers operating across state lines, proof of an existing IRP account or application for one may be required.

- Vehicle Registration Documents: For all fleet vehicles, especially those not currently registered in Florida; includes copies of registration and lease agreements, if applicable.

- Proof of Bulk Fuel Storage: If applicable, documents indicating the presence of bulk fuel storage facilities, including location and fuel type, are necessary.

- SUNBIZ Registration: Documentation proving the business is registered with the Florida Department of State, Division of Corporations. This is vital for proving the legitimacy of the business within the state.

- Additional Vehicle Information Sheets: For applicants with multiple vehicles, extra sheets detailing each vehicle's registration and relevant information as required in the application.

Collecting and preparing these documents in advance can streamline the IFTA application process. Each document plays a crucial role in supporting the application's information, ensuring regulatory compliance, and facilitating cross-border commercial transportation activities.

Similar forms

The Florida Commercial Driver License (CDL) Application shares similarities with the Florida IFTA Application, particularly in the need for personal and business details such as business name, address, telephone number, and the requirement to indicate specific types of operations, similar to the need for declaring vehicle information in the IFTA Application. Both applications serve individuals and enterprises involved in commercial vehicle operations, emphasizing compliance with state regulations.

Business Tax Application forms used in Florida municipalities are comparable to the Florida IFTA Application. These tax applications often require detailed information about the business, including the Federal Employer Identification Number (FEIN), business addresses, and types of business ownership, mirroring the specifics sought in the IFTA form to ensure accurate tax assessment and compliance.

The Florida IRP (International Registration Plan) Account Application is closely related to the IFTA Application, as both are part of the bureaucratic requirements for companies operating commercial vehicles across state lines. Just like the IFTA application demands details about vehicle information, fleet consolidation intentions, and compliance history, the IRP application seeks similar information to allocate vehicle registration fees based on distance traveled in different jurisdictions.

Application for Motor Carrier Services, another document requiring extensive business and operational information including US DOT numbers, type of business ownership, and identification of vehicles for regulatory purposes. This application, similar to the IFTA form, is essential for businesses that utilize heavy vehicles for transport and delivery, ensuring that they meet state guidelines for legal operation.

Dos and Don'ts

When filling out the Florida IFTA Application form, it's essential to follow specific dos and don'ts to ensure the process is smooth and the application is submitted correctly. Here are some key points to consider:

- Do ensure that the business name is written exactly as it is registered with the state or on your corporation papers.

- Don't use a post office box or rented mailbox as the business physical address. The form requires a physical location.

- Do provide a valid Federal Employer Identification Number (FEIN). This number is a critical part of your business identification for tax purposes.

- Don't leave the business contact information section blank. Providing a reliable contact person's name, email address, and telephone number is crucial.

- Do accurately list all owners, partners, or corporate officers, including their home addresses and contact information. Attach additional documentation if the space provided is insufficient.

- Don't forget to specify the type of business ownership. This detail helps in identifying the structure and legal status of your business.

- Do include the correct U.S. DOT number and, if applicable, the Florida IRP account number. These numbers are essential for identification and verification purposes.

- Don't neglect to sign and date the application. An unsigned application is incomplete and will not be processed.

By adhering to these guidelines, applicants can avoid common mistakes and ensure their Florida IFTA Application process is as efficient and error-free as possible.

Misconceptions

When it comes to navigating the complexities of applying for an International Fuel Tax Agreement (IFTA) license in Florida, there are several misconceptions that can lead to confusion. Understanding these can help ensure a smoother application process.

- Misconception 1: Any business address can be used on the application.

- Misconception 2: Business mailing address can be that of a service provider.

- Misconception 3: You can leave the FEIN field blank if you are a sole proprietor.

- Misconception 4: An active Florida IRP account is not necessary.

- Misconception 5: Electronic signatures are acceptable on the application form.

- Misconception 6: You do not need to specify the type of business ownership.

- Misconception 7: Vehicle information is only necessary for vehicles registered in Florida.

- Misconception 8: Only new applicants need to sign and declare the application.

- Misconception 9: If you've had an IFTA license in another jurisdiction, you do not need to disclose it.

- Misconception 10: Decal orders and payment can wait until after the application is approved.

This is incorrect. The Florida IFTA application requires the physical address of the business in Florida. P.O. Boxes or rented mailbox addresses are not accepted. This detail ensures that the business is genuinely operating within the state.

Contrary to this belief, the application specifies that the business mailing address cannot be the address of a service provider or permitting company. It aims at direct communication between the motor carrier business and the authorities.

Actually, the Federal Employer Identification Number (FEIN) is a mandatory field for all business entities, including sole proprietors if they have one. The FEIN facilitates tracking and tax purposes, making it critical for the application.

This is a misunderstanding. While it's true that you can submit an IFTA application without an active Florida International Registration Plan (IRP) account, you must provide detailed vehicle information for each fleet vehicle if you do not have one.

The form requires a physical signature from the business owner or company officer. This requirement underscores the importance of accountability and the verification of information provided in the application.

Incorrect. The application clearly asks for the type of business ownership (e.g., sole proprietor, partnership, corporation, etc.). This information is vital for legal and tax purposes.

This is not the case. The form requires information for all qualified motor vehicles, including those not registered in Florida. For out-of-state vehicles, you must provide the registration state and VIN, along with a copy of the registration and lease agreement if applicable.

Every applicant, regardless of being new or renewing, must sign the declaration under penalty of perjury, affirming the correctness and completeness of the application.

On the contrary, the application form specifically asks whether you have ever held an IFTA license in another jurisdiction. Full disclosure is required for compliance and verification purposes.

This is incorrect. The application is not complete without an accompanying decal order and payment. Applicants must calculate the total based on the number of vehicles and include it with the application package.

Addressing these misconceptions can streamline the process of applying for an IFTA license in Florida, avoiding unnecessary delays and ensuring compliance with state requirements. It underscores the importance of carefully reviewing the application instructions and requirements.

Key takeaways

- To apply for the Florida IFTA license, businesses must provide detailed information including their business name, Federal Employer Identification Number (FEIN), and physical business address within Florida, as PO boxes are not accepted. This ensures traceability and validation of the business’s operational base.

- It's imperative to distinguish between the physical address and the mailing address of the business, underscoring the Florida Department of Highway Safety and Motor Vehicles' requirement for a tangible, verifiable location for the business alongside a possibly different mailing address for communication purposes.

- Identifying a contact person within the company who is responsible for IFTA-related matters is required, which facilitates direct communication and reduces the chance of information mismanagement, ensuring queries or concerns are addressed efficiently.

- The classification of the business type, such as sole proprietorship, partnership, corporation, or LLC, among others, is essential to align with legal and tax obligations under the IFTA provisions in Florida.

- Applicants must list all owners, partners, or corporate officers with their respective details, reinforcing transparency and accountability within the IFTA licensing process. This comprehensive listing helps in distinguishing the responsible parties for the business’s operation and compliance.

- For businesses without a Florida International Registration Plan (IRP) account, specific vehicle information for each vehicle in the fleet is required, including whether these vehicles are currently registered in Florida or out-of-state. This details aid in the accurate assessment of tax liabilities under IFTA.

- A declaration section where the applicant affirms the completeness and accuracy of the application under penalty of perjury, while also agreeing to adhere to all reporting, payment, record-keeping, and license display requirements stipulated by the IFTA. This commitment is crucial for maintaining the integrity and compliance of the IFTA licensing process.

Popular PDF Templates

Florida S Corp Filing Requirements - It provides for computation of tax based on adjusted federal income with specific adjustments relevant to Florida statutes.

Florida Lottery Claim - This form simplifies the lottery prize claiming process in Florida, ensuring winners accurately provide all required details.

Florida School Physical Form 2023 - The detailed medical evaluation section aids in identifying any conditions that may require specific attention or intervention in school settings.