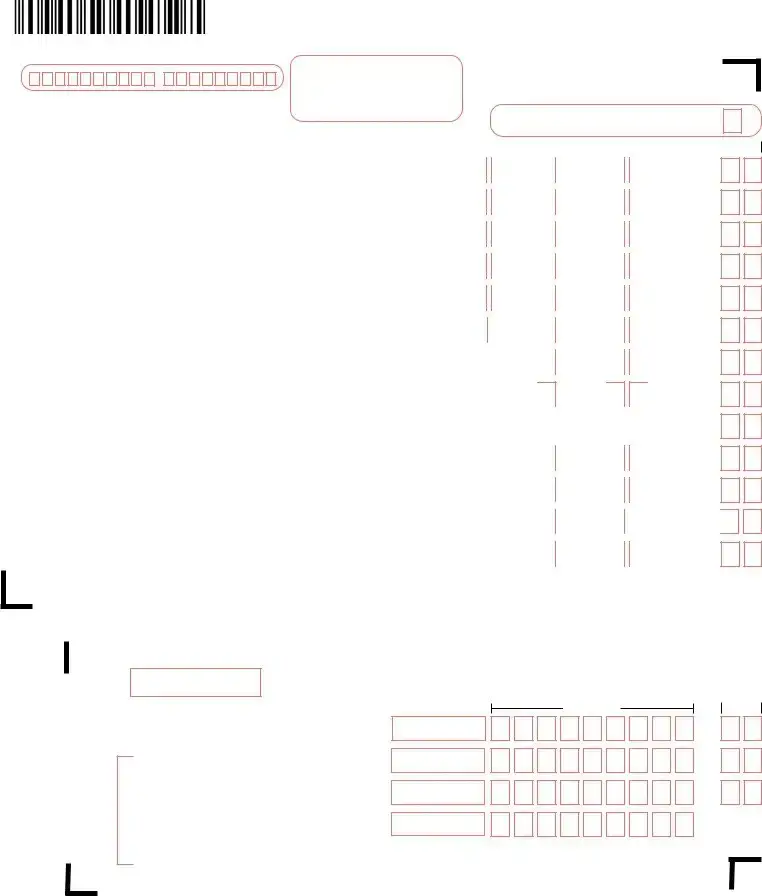

Official Florida F 1120 Template

At the heart of corporate tax obligations in Florida lies the F-1120 form, a comprehensive document designed for corporations to report their income and franchise taxes. Released under Rule 12C-1.051, F.A.C., and carrying an effective date from January 2020, this form spans six detailed pages and is integral for corporations navigating their fiscal responsibilities within the state. Its structure facilitates a meticulous calculation of Florida net income tax, starting from the federal taxable income and incorporating various adjustments, additions, and subtractions as specified within its sections. Corporations are required to report any changes to their name or address, signify their operational status through indicators for initial or final returns, and attach schedule documents that detail specific income sources and deductions emphasizing the form's adaptability to diverse corporate scenarios. Ensuring accuracy is paramount, as this form represents a crucial link between federal income details and state tax liabilities, serving as both a compliance measure and a financial snapshot of the corporation's taxable presence in Florida. The concluding sections underscore the responsibility to attach a federal return copy, the necessity of a signature under penalty of perjury, and the importance of correct preparer information, wrapping up a form that is both challenging and essential for corporate entities operating within Florida's dynamic economic landscape.

Example - Florida F 1120 Form

Florida Corporate Income/Franchise Tax Return |

|

|

R. 01/23 |

|

Rule |

|

Effective 01/23 |

Name |

Page 1 of 6 |

|

|

Address |

|

City/State/ZIP |

|

|

|

Use black ink. Example A - Handwritten Example B - Typed |

For calendar year 2015 or tax year |

|

|

|

|

|

|

|

|

Check here if any changes have been made to |

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

0123456789 |

|

|

|

|

|

|

|

|

name or address |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||||

0 1 2 3 4 5 6 7 8 9 |

|

|

beginning _________________, 2015 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

ending ________________________ |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Year end date _ _________________ |

|

|

|

|

|

DOR use |

|

|

|

|

|

|

|

/ |

|

|

|

|

|

|

|

|

|

|

|

|

/ |

|

|

|

|||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||

|

Federal |

|

Employer Identification Number (FEIN) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

only |

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Computation of Florida Net Income Tax |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

US Dollars |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||

|

1. |

Federal taxable income (see instructions). |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

. |

|

||||||||||||||||||||

|

|

Check here |

|

|

|

|

|

|

|

|

, |

|

|

|

|

|

|

|

, |

|

|

|

|

|

|

|

|

|

|

|

, |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||||

|

|

Attach pages |

|

|

1. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||

|

|

if negative |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||

2. |

State income taxes deducted in computing federal taxable income Check here |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

. |

|

|||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||||||

|

2. |

|

|

|

|

|

|

, |

|

|

|

|

|

|

|

, |

|

|

|

|

|

|

|

|

|

|

|

, |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||||

|

|

(attach schedule) |

|

|

|

|

|

|

|

|

|

if negative |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

3. |

Additions to federal taxable income (from Schedule I) |

Check here |

|

3. |

|

|

|

|

|

|

, |

|

|

|

|

|

|

|

, |

|

|

|

|

|

|

|

|

|

|

|

, |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||||

if negative |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

4. |

Total of Lines 1, 2, and 3 |

|

|

|

|

|

|

|

|

|

Check here |

|

4. |

|

|

|

|

|

|

, |

|

|

|

|

|

|

|

, |

|

|

|

|

|

|

|

|

|

|

|

, |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||

|

|

|

|

|

|

|

|

if negative |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

, |

|

|

|

|

|

|

|

, |

|

|

|

|

|

|

|

|

|

|

|

, |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

, |

|

. |

|

|||||||||||||||||||||||||||||||||||||||||||||||

5. |

Subtractions from federal taxable income (from Schedule II) |

Check here |

5. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||

if negative |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||||

6. |

Adjusted federal income (Line 4 minus Line 5) |

|

Check here |

|

6. |

|

|

|

|

|

|

, |

|

|

|

|

|

|

|

, |

|

|

|

|

|

|

|

|

|

|

|

, |

|

|

|

|

|

|

|

|

|

|

|

|

|

. |

|

||||||||||||||||||||||

if negative |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

7. |

Florida portion of adjusted federal income (see instructions) |

Check here |

|

|

|

|

|

7. |

|

|

|

|

|

|

|

, |

|

|

|

|

|

|

|

|

|

|

|

, |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

8. |

Nonbusiness income allocated to Florida (from Schedule R) |

Check here |

|

|

|

|

|

8. |

|

|

|

|

|

|

|

, |

|

|

|

|

|

|

|

|

|

|

|

, |

|

|

|

|

|

|

|

|

|

|

|

|

|

. |

|

||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||||||||

9. |

|

|

|

exemption |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

9. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

10. |

Florida net income (Line 7 plus Line 8 minus Line 9) |

|

|

|

|

|

|

|

10. |

|

|

|

|

|

, |

|

|

|

|

|

|

|

|

|

|

, |

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

. |

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

11. |

Tax due: 5.5% of Line 10 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

11. |

|

|

|

|

|

|

|

|

, |

|

|

|

|

|

|

|

|

|

|

, |

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

. |

|

||||

12. |

Credits against the tax (from Schedule V) |

|

|

|

|

|

|

|

12. |

|

|

|

|

|

, |

|

|

|

|

|

|

|

|

|

, |

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

. |

|

|||

13. |

Total corporate income/franchise tax due (Line 11 minus Line 12) |

|

|

|

|

|

|

13. |

|

|

|

|

|

, |

|

|

|

|

|

|

|

|

|

, |

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||||||||

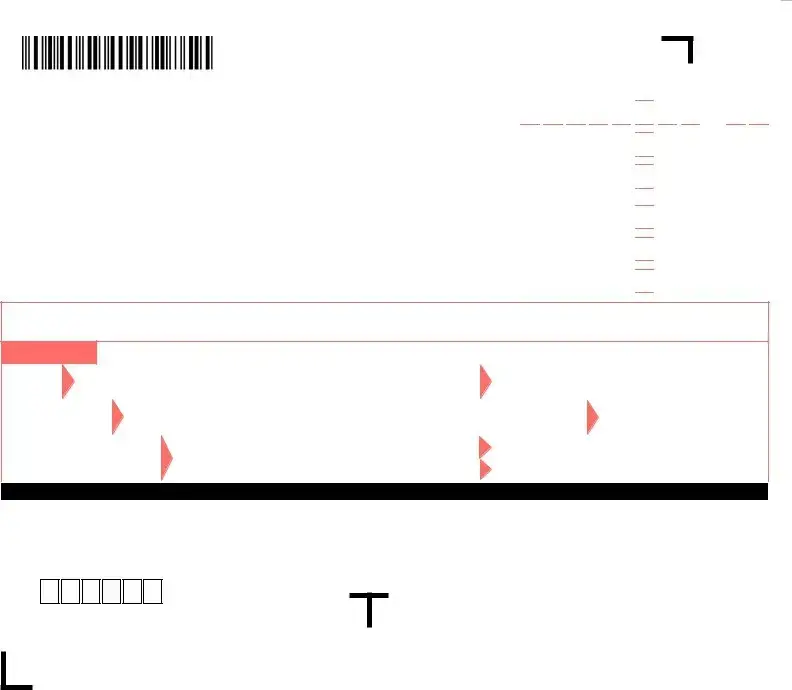

Cents

Payment Coupon for Florida Corporate Income Tax Return |

Do not detach coupon. |

||

|

To ensure proper credit to your account, enclose your check with tax return when mailing. |

R. 01/23 |

|

|

|||

|

|

||

ENDINGYEAR M  M

M  D

D  D

D  Y

Y  Y

Y

Enter name and address, if not

Name

Address

City/St

ZIP

If 6/30 year end, return is due 1st day of the 4th month after the close of the taxable year, otherwise return is due 1st day of the 5th month after the close of the taxable year.

|

US DOLLARS |

, |

CENTS |

|

Total amount due |

, |

. |

||

|

|

|

||

from Line 17 |

, |

, |

. |

|

Total credit |

||||

|

|

|

||

from Line 18 |

, |

, |

. |

|

Total refund |

||||

|

|

|

||

from Line 19 |

|

|

|

|

FEIN |

|

|

|

|

|

|

|||

Enter EIN if not |

|

|

|

|

9100 0 20229999 0002005037 5 3999999999 0000 2

R.01/23 Page 2 of 6

14. |

a) Penalty: |

b) Other____________________ |

|

||

|

c) Interest: |

d) Other____________________ Line 14 Total u 14. |

|||

15. |

Total of Lines 13 and 14 |

|

|

15. |

|

|

|

|

|

|

|

16. |

Payment credits: Estimated tax payments |

16a |

$ |

|

|

|

|

|

|

|

|

|

Tentative tax payment |

16b |

$ |

16 |

|

|

|

|

|

||

17. |

Total amount due: Subtract Line 16 from Line 15. If positive, enter amount |

|

|||

|

due here. If the amount is negative (overpayment), |

|

|

||

|

enter on Line 18 and/or Line 19 |

|

|

17. |

|

18. |

Credit: Enter amount of overpayment credited to next year’s estimated tax |

|

|||

|

here |

|

|

18. |

|

19. |

Refund: Enter amount of overpayment to be refunded here |

19. |

|||

,

,

,

,

,

,

,

,

,

,

,

,

,

,

,

,

,

,

,

,

,

,

,

,

.

.

.

.

.

.

.

.

.

.

.

.

This return is considered incomplete unless a copy of the federal return is attached.

If your return is not signed, or improperly signed and verified, it will be subject to a penalty. The statute of limitations will not start until your return

is properly signed and verified. Your return must be completed in its entirety.

Under penalties of perjury, I declare that I have examined this return, including accompanying schedules and statements, and to the best of my knowledge and belief, it is true, correct, and complete. Declaration of preparer (other than taxpayer) is based on all information of which preparer has any knowledge.

Sign here |

|

|

|

Title |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Signature of officer (must be an original signature) |

Date |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Preparer’s |

|

Preparer |

|

|

Preparer’s |

|||||||||||

Paid |

|

check if self- |

|

|

PTIN |

|

|

|

|

|

|

|

|

|

|

||

signature |

Date |

employed |

|

|

|

|

|

|

|

|

|

|

|

|

|

||

preparers |

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

only |

Firm’s name (or yours |

|

FEIN |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

if |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

and address |

|

ZIP |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

All Taxpayers Must Answer Questions A Through L Below — See Instructions

A.State of incorporation:_______________________________________________________________

B.Florida Secretary of State document number:__________________________________________

C. Florida consolidated return? |

YES q NO q |

D.q Initial return q Final return (final federal return filed)

E.Principal Business Activity Code (as pertains to Florida)

F.A Florida extension of time was timely filed? YES q NO q

Name of corporation: _______________________________________________

H.Location of corporate books:____________________________________________________________

City: __________________________________________ State: ______________ ZIP: ________________

I.Taxpayer is a member of a Florida partnership or joint venture? YES q NO q

J.Enter date of latest IRS audit: ______________

a)List years examined: ____________

K.Contact person concerning this return: _ __________________________________________________

a)Contact person telephone number: (______ )_____________________________________________

b)Contact person email address:_________________________________________________________

L.Type of federal return filed q1120 q1120S or __________________

Where to Send Payments and Returns

Make check payable to and mail with return to: Florida Department of Revenue

5050 W Tennessee Street

Tallahassee FL

If you are requesting a refund (Line 19), send your return to: Florida Department of Revenue

PO Box 6440

Tallahassee FL

Remember:

üMake your check payable to the Florida Department of Revenue.

üWrite your FEIN on your check.

üSign your check and return.

ü

ü

Attach a copy of your federal return.

Attach a copy of your Florida Form

R. 01/23

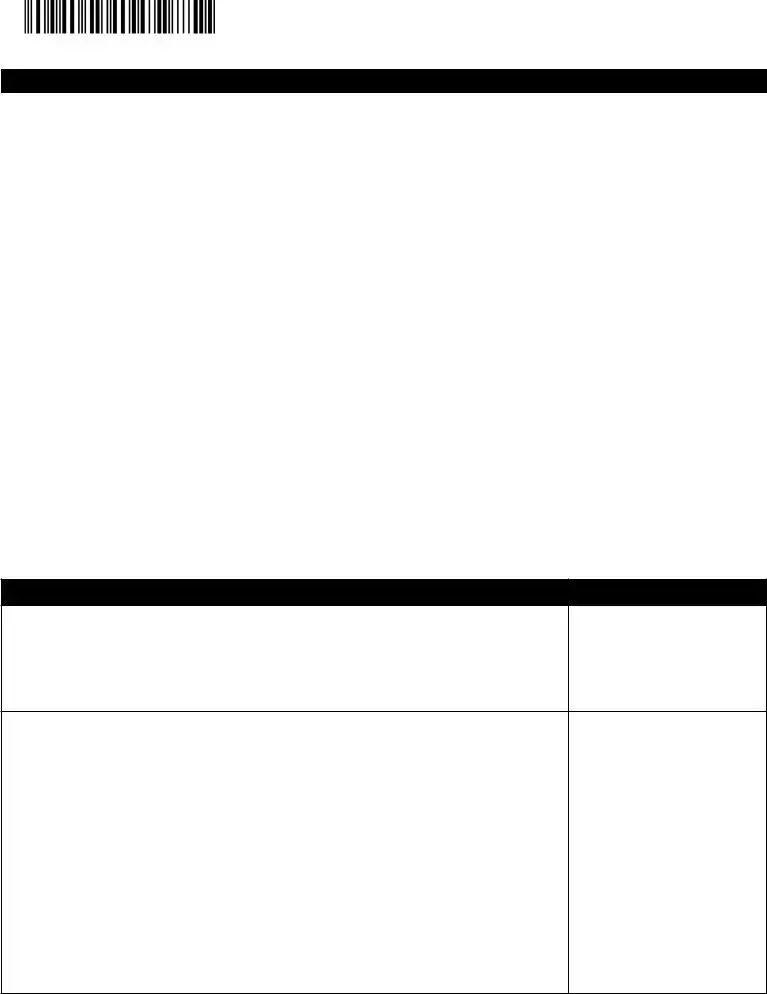

Page 3 of 6

NAME |

FEIN |

TAXABLE YEAR ENDING |

|

|

|

Schedule I — Additions and/or Adjustments to Federal Taxable Income |

|

|

1. |

Interest excluded from federal taxable income (see instructions) |

1. |

|

|

|

2. |

Undistributed net |

2. |

|

|

|

3. |

Net operating loss deduction (attach schedule) |

3. |

|

|

|

4. |

Net capital loss carryover (attach schedule) |

4. |

|

|

|

5. |

Excess charitable contribution carryover (attach schedule) |

5. |

|

|

|

6. |

Employee benefit plan contribution carryover (attach schedule) |

6. |

|

|

|

7. |

Enterprise zone jobs credit (Florida Form |

7. |

|

|

|

8. |

Ad valorem taxes allowable as an enterprise zone property tax credit (Florida Form |

8. |

|

|

|

9. |

Guaranty association assessment(s) credit |

9. |

|

|

|

10. |

Rural and/or urban |

10. |

|

|

|

11. |

State housing tax credit |

11. |

|

|

|

12. |

Florida tax credit scholarship program credit (credit for contributions to nonprofit |

12. |

|

|

|

13. |

New worlds reading initiative credit |

13. |

|

|

|

14. |

Strong families tax credit (credit for contributions to eligible charitable organizations) |

14. |

|

|

|

15. |

New markets tax credit |

15. |

|

|

|

16. |

Entertainment industry tax credit |

16. |

|

|

|

17. |

Research and development tax credit |

17. |

|

|

|

18. |

Energy economic zone tax credit |

18. |

|

|

|

19. |

s.168(k), IRC, special bonus depreciation |

19. |

|

|

|

20. |

Depreciation of qualified improvement property (see instructions) |

20. |

|

|

|

21. |

Expenses for business meals provided by a restaurant (see instructions) |

21. |

|

|

|

22. |

Film, television, and live theatrical production expenses (see instructions) |

22. |

|

|

|

23. |

Internship tax credit |

23. |

|

|

|

24. |

Other additions (attach schedule) |

24. |

|

|

|

25. |

Total Lines 1 through 24. Enter total on this line and on Page 1, Line 3. |

25. |

|

|

|

Schedule II — Subtractions from Federal Taxable Income

1.Gross foreign source income less attributable expenses

(a) Enter s. 78, IRC, income |

$ _________________________ |

|

(b) plus s. 862, IRC, dividends |

$ _________________________ |

|

(c) plus s. 951A, IRC, income |

$ _________________________ |

1. |

(d) less direct and indirect expenses |

|

Total u |

and related amounts deducted |

|

|

under s. 250, IRC |

$ _________________________ |

|

2.Gross subpart F income less attributable expenses

|

(a) Enter s. 951, IRC, subpart F income $ _______________________ |

2. |

|

|

(b) less direct and indirect expenses $ _______________________ |

Total u |

|

|

|

||

Note: Taxpayers doing business outside Florida enter zero on Lines 3 through 6, and complete Schedule IV. |

3. |

||

3. |

Florida net operating loss carryover deduction (see instructions) |

||

|

|||

|

|

|

|

4. |

Florida net capital loss carryover deduction (see instructions) |

4. |

|

|

|

|

|

5. |

Florida excess charitable contribution carryover (see instructions) |

5. |

|

|

|

|

|

6. |

Florida employee benefit plan contribution carryover (see instructions) |

6. |

|

|

|

|

|

7. |

Nonbusiness income (from Schedule R, Line 3) |

7. |

|

|

|

|

|

8. |

Eligible net income of an international banking facility (see instructions) |

8. |

|

|

|

|

|

9. |

s. 168(k), IRC, special bonus depreciation (see instructions) |

9. |

|

|

|

|

|

10. |

Depreciation of qualified improvement property (see instructions) |

10. |

|

|

|

|

|

11. |

Film, television, and live theatrical production expenses (see instructions) |

11. |

|

|

|

|

|

12. |

Other subtractions (attach schedule) |

12. |

|

|

|

|

|

13. |

Total Lines 1 through 12. Enter total on this line and on Page 1, Line 5. |

13. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

R. 01/23 |

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Page 4 of 6 |

||

NAME |

|

|

|

|

|

FEIN |

|

|

|

|

|

|

TAXABLE YEAR ENDING |

|||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

Schedule III — Apportionment of Adjusted Federal Income |

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||

|

|

|

|

|

|

|||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(a) |

|

(b) |

|

|

(c) |

|

|

|

|

(d) |

|

|

|

(e) |

|

|||||

|

|

WITHIN FLORIDA |

|

TOTAL EVERYWHERE |

Col. (a) ÷ Col. (b) |

|

|

|

|

Weight |

|

|

|

Weighted Factors |

|

|||||||

|

|

(Numerator) |

|

(Denominator) |

|

|

Rounded to Six Decimal |

|

If any factor in Column (b) is zero, |

|

Rounded to Six Decimal |

|

||||||||||

|

|

|

|

|

|

|

|

Places |

|

|

see note on Page 9 of the instructions. |

|

Places |

|

||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

1. |

Property (Schedule |

|

|

|

|

|

|

|

|

|

|

|

X 25% or ______ |

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

2. |

Payroll |

|

|

|

|

|

|

|

|

|

|

|

X 25% or ______ |

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

3. |

Sales (Schedule |

|

|

|

|

|

|

|

|

|

|

|

X 50% or ______ |

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

4. |

Apportionment fraction (Sum of Lines 1, 2, and 3, Column [e]). Enter here and on Schedule IV, Line 2. |

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

WITHIN FLORIDA |

|

|

|

|

|

|

TOTAL EVERYWHERE |

|

|||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

|

a. Beginning of year |

|

b. End of year |

|

c. Beginning of year |

|

d. End of year |

|

||||||||||||||

|

|

|

|

|

|

|

|

|

|

|||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

1. |

Inventories of raw material, work in process, finished |

goods |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

2. |

Buildings and other depreciable assets |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

3. |

Land owned |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

4. |

Other tangible and intangible (financial org. only) assets (attach schedule) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

5. |

Total (Lines 1 through 4) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

6. |

Average value of property |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

a. Add Line 5, Columns (a) and (b) and divide by 2 (for within Florida)........... 6a. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

|

b. Add Line 5, Columns (c) and (d) and divide by 2 (for total Everywhere) |

|

|

|

|

|

|

|

|

6b. |

|

|

|

|

|

|

|

|||||

7. |

Rented property (8 times net annual rent) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

a. Rented property in Florida |

|

|

7a. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

b. Rented property Everywhere |

|

|

|

|

|

|

|

|

|

|

7b. |

|

|

|

|

|

|

|

|||

8. |

Total (Lines 6 and 7). Enter on Line 1, Schedule |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

a. Enter Lines 6a. plus 7a. and also enter on Schedule |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

Column (a) for total average property in Florida |

|

|

8a. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

b. Enter Lines 6b. plus 7b. and also enter on Schedule |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

Column (b) for total average property Everywhere |

|

|

|

|

|

|

|

|

|

|

8b. |

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(a) |

|

|

|

(b) |

|

||||||

|

|

|

|

|

|

|

|

|

TOTAL WITHIN FLORIDA |

|

|

TOTAL EVERYWHERE |

|

|||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

(Numerator) |

|

|

|

(Denominator) |

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

1. |

Sales (gross receipts) |

|

|

|

|

|

|

|

|

|

|

N/A |

|

|

|

|

|

|

||||

2. |

Sales delivered or shipped to Florida purchasers |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

N/A |

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

3. |

Other gross receipts (rents, royalties, interest, etc. when applicable) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

4. |

TOTAL SALES (Enter on Schedule |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

(a) WITHIN FLORIDA |

|

|

(b) TOTAL EVERYWHERE |

|

(c) FLORIDA Fraction ([a] ÷ [b]) |

|

||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Rounded to Six Decimal Places |

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

1. |

Insurance companies (attach copy of Schedule |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

2. |

Transportation services |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

||||||||||||

Schedule IV — Computation of Florida Portion of Adjusted Federal Income |

|

|

|

|

|

|

|

|

|

|

||||||||||||

1. |

Apportionable adjusted federal income from Page 1, Line 6 |

|

|

|

|

|

|

|

|

1. |

|

|

|

|

|

|

||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||

2. |

Florida apportionment fraction (Schedule |

|

|

|

|

|

|

|

|

2. |

|

|

|

|

|

|

||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||

3. |

Tentative apportioned adjusted federal income (multiply Line 1 by Line 2) |

|

|

|

|

|

|

3. |

|

|

|

|

|

|

||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||

4. |

Net operating loss carryover apportioned to Florida (attach schedule; see instructions) |

|

|

|

|

4. |

|

|

|

|

|

|

||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||

5. |

Net capital loss carryover apportioned to Florida (attach schedule; see instructions) |

|

|

|

|

5. |

|

|

|

|

|

|

||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||

6. |

Excess charitable contribution carryover apportioned to Florida (attach schedule; see instructions) |

|

|

|

|

6. |

|

|

|

|

|

|

||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

7. |

Employee benefit plan contribution carryover apportioned to Florida (attach schedule; see instructions) |

|

|

|

7. |

|

|

|

|

|

|

|||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||

8. |

Total carryovers apportioned to Florida (add Lines 4 through 7) |

|

|

|

|

|

|

|

|

8. |

|

|

|

|

|

|

||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||

9. |

Adjusted federal income apportioned to Florida (Line 3 less Line 8; see instructions) |

|

|

|

|

9. |

|

|

|

|

|

|

||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

R. 01/23

Page 5 of 6

NAME |

|

FEIN |

TAXABLE YEAR ENDING |

|

||||

|

|

|

|

|

|

|||

|

Schedule V — Credits Against the Corporate Income/Franchise Tax |

|

|

|

|

|||

|

1. |

|

Florida health maintenance organization consumer assistance assessment credit (attach assessment notice) |

|

|

1. |

|

|

|

|

|

|

|

|

|

|

|

|

2. |

|

Capital investment tax credit (attach certification letter) |

|

|

2. |

|

|

|

|

|

|

|

|

|

|

|

|

3. |

|

Enterprise zone jobs credit (from Florida Form |

|

|

3. |

|

|

|

|

|

|

|

|

|

|

|

|

4. |

|

Community contribution tax credit (attach certification letter) |

|

|

4. |

|

|

|

|

|

|

|

|

|

|

|

|

5. |

|

Enterprise zone property tax credit (from Florida Form |

|

|

5. |

|

|

|

|

|

|

|

|

|

|

|

|

6. |

|

Rural job tax credit (attach certification letter) |

|

|

|

6. |

|

|

|

|

|

|

|

|

|

|

|

7. |

|

Urban |

|

|

7. |

|

|

|

|

|

|

|

|

|

|

|

|

8. |

|

Hazardous waste facility tax credit |

|

|

|

8. |

|

|

|

|

|

|

|

|

|

|

|

9. |

|

Florida alternative minimum tax (AMT) credit |

|

|

|

9. |

|

|

|

|

|

|

|

|

|

|

|

10. |

|

Contaminated site rehabilitation tax credit (voluntary cleanup tax credit) (attach tax credit certificate) |

|

|

10. |

|

|

|

|

|

|

|

|

|

|

|

|

11. |

|

State housing tax credit (attach certification letter) |

|

|

|

11. |

|

|

|

|

|

|

|

|

||

|

12. |

|

Florida tax credit scholarship program credit (credit for contributions to nonprofit |

|

12. |

|

||

|

|

|

|

|

|

|

|

|

|

13. |

New worlds reading initiative credit (attach certificate) |

|

|

|

13. |

|

|

|

|

|

|

|

|

|

|

|

|

14. |

|

Strong families tax credit (credit for contributions to eligible charitable organizations) (attach certificate) |

|

|

14. |

|

|

|

|

|

|

|

|

|

|

|

|

15. |

|

New markets tax credit |

|

|

|

15. |

|

|

|

|

|

|

|

|

|

|

|

16. |

|

Entertainment industry tax credit |

|

|

|

16. |

|

|

|

|

|

|

|

|

|

|

|

17. |

|

Research and development tax credit |

|

|

|

17. |

|

|

|

|

|

|

|

|

|

|

|

18. |

|

Energy economic zone tax credit |

|

|

|

18. |

|

|

|

|

|

|

|

|

|

|

|

19. |

|

Internship tax credit |

|

|

|

19. |

|

|

|

|

|

|

|

|

|

|

|

20. |

|

Other credits (attach schedule) |

|

|

|

20. |

|

|

|

|

|

|

|

|

|

|

|

21. |

|

Total credits against the tax (sum of Lines 1 through 20 not to exceed the amount on Page 1, Line 11). |

|

|

21. |

|

|

|

|

|

Enter total credits on Page 1, Line 12 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

||

|

Schedule R — Nonbusiness Income |

|

|

|

|

|

||

|

Line 1. Nonbusiness income (loss) allocated to Florida |

|

|

|

|

|||

|

|

|

Type |

|

|

Amount |

|

|

_____________________________________ |

|

_____________________________________ |

|

|||||

_____________________________________ |

|

_____________________________________ |

|

|||||

_____________________________________ |

|

_____________________________________ |

|

|||||

|

|

|

Total allocated to Florida |

1. ___________________________________ |

|

|||

|

|

|

(Enter here and on Page 1, Line 8) |

|

|

|

|

|

|

Line 2. Nonbusiness income (loss) allocated elsewhere |

|

|

|

|

|||

|

|

|

Type |

State/country allocated to |

|

Amount |

|

|

_____________________________________ |

____________________________________ |

_____________________________________ |

|

|||||

_____________________________________ |

____________________________________ |

_____________________________________ |

|

|||||

_____________________________________ |

____________________________________ |

_____________________________________ |

|

|||||

|

|

|

Total allocated elsewhere |

2. ___________________________________ |

|

|||

|

Line 3. Total nonbusiness income |

|

|

|

|

|

||

|

|

|

Grand total. Total of Lines 1 and 2 |

3. ___________________________________ |

|

|||

(Enter here and on Schedule II, Line 7)

R. 01/23

Page 6 of 6

NAME |

FEIN |

TAXABLE YEAR ENDING |

Estimated Tax Worksheet For Taxable Years Beginning On or After January 1, 2023 |

||

1. Florida income expected in taxable year |

.................................................................................................... |

1. $ ________________ |

2.Florida exemption $50,000 (Members of a controlled group, see instructions on Page 15 of

|

Florida Form |

2. |

$ ________________ |

|

3. |

Estimated Florida net income (Line 1 less Line 2) |

3. |

$ ________________ |

|

4. |

Total Estimated Florida tax (5.5% of Line 3) |

$ _____________________________ |

|

|

|

Less: Credits against the tax |

$ _____________________________ |

4. |

$ ________________ |

5.Computation of installments:

Payment due dates and |

If 6/30 year end, last day of 4th month, |

|

payment amounts: |

otherwise last day of 5th month - Enter 0.25 of Line 4 |

5a.______________________ |

|

Last day of 6th month - Enter 0.25 of Line 4 |

5b.______________________ |

|

Last day of 9th month - Enter 0.25 of Line 4 |

5c.______________________ |

|

Last day of taxable year - Enter 0.25 of Line 4 |

5d.______________________ |

NOTE: If your estimated tax should change during the year, you may use the amended computation below to determine the amended amounts to be entered on the declaration (Florida Form

1. Amended estimated tax |

1. $ _______________ |

2.Less:

(a)Amount of overpayment from last year elected for credit

|

to estimated tax and applied to date |

2a. - $______________ |

|

|

(b) Payments made on estimated tax declaration (Florida Form |

2b. - $_____________ |

|

|

(c) Total of Lines 2(a) and 2(b) |

2c. |

$ _______________ |

3. |

Unpaid balance (Line 1 less Line 2(c)) |

3. |

$ _______________ |

4. |

Amount to be paid (Line 3 divided by number of remaining installments) |

4. |

$ _______________ |

References

The following documents were mentioned in this form and are incorporated by reference in the rules indicated below.

The forms are available online at floridarevenue.com/forms.

Form |

Underpayment of Estimated Tax on Florida |

Rule |

|

Corporate Income/Franchise Tax |

|

Form |

Florida Tentative Income/Franchise Tax Return |

Rule |

|

and Application for Extension of Time to File |

|

|

Return |

|

Form |

Florida Enterprise Zone Jobs Credit Certificate of |

Rule |

|

Eligibility for Corporate Income Tax |

|

Form |

Enterprise Zone Property Tax Credit |

Rule |

Form |

Instructions for Corporate Income/Franchise Tax Return |

Rule |

Form |

Declaration/Installment of Florida Estimated |

Rule |

|

Income/Franchise Tax |

|

File Specifications

| Fact Name | Description |

|---|---|

| Form Identification | The document is identified as Florida Corporate Income/Franchise Tax Return, Form F-1120 R. 01/20. |

| Governing Rule | It is governed by Rule 12C-1.051, Florida Administrative Code (F.A.C.), with an effective date of January 2020. |

| Attachment Requirements | A copy of the federal return (pages 1–5) must be attached, ensuring completeness and compliance with validation standards. |

| Penalty for Noncompliance | Failure to properly sign, verify, or complete the return in its entirety can result in penalties. The statute of limitations for any action regarding the return does not start until these conditions are met. |

Instructions on Filling in Florida F 1120

Filing the Florida F-1120 form, the Corporate Income/Franchise Tax Return, is an integral process for corporations doing business in Florida. It involves detailing the corporation's income, computing tax liability, and applying any relevant credits. To navigate this process efficiently, follow these enumerated steps:

- Start by entering the corporation's name, address, city, state, and ZIP code at the top of the form. Use black ink and indicate if the form is being filled out by hand or typed.

- Specify if there have been any changes to the name or address since the last filing.

- Enter the tax year or calendar year for which the return is being filed, along with the year-end date.

- Provide the Federal Employer Identification Number (FEIN) in the designated space.

- Under "Computation of Florida Net Income Tax," enter the federal taxable income on line 1, attaching the first five pages of the federal return if necessary.

- Record any state income taxes deducted in computing federal taxable income on line 2, attaching a schedule if there are deductions.

- Add any additions to federal taxable income as per Schedule I on line 3, indicating if the amount is negative.

- Calculate the total of lines 1, 2, and 3 and enter this on line 4.

- List any subtractions from federal taxable income according to Schedule II on line 5.

- Compute the adjusted federal income (line 4 minus line 5) and enter it on line 6.

- If applicable, enter the Florida portion of adjusted federal income on line 7.

- Allocate any nonbusiness income to Florida on line 8, using Schedule R for guidance.

- Deduct the Florida exemption on line 9 to determine the Florida net income.

- Calculate the tax due (4.458% of line 10) and enter this amount on line 11.

- Apply any credits against the tax from Schedule V on line 12.

- Determine the total corporate income/franchise tax due by subtracting line 12 from line 11 and entering the result on line 13.

- Complete the Payment Coupon with the appropriate information including the total amount due, entered from line 17, total credit from line 18, and total refund from line 19.

- Fill out Schedules I, II, III, IV, V, and R as applicable for additional deductions, credits, and apportionments related to the adjusted federal income and ensure the appropriate attachments are included.

- Attach a copy of the federal return, any necessary schedules, and documentation for credits claimed.

- Ensure the corporate officer signs the form and includes their title and date at the bottom. If prepared by someone other than the corporate officer, the preparer must also sign and provide their information.

- Answer the questions from A through L on page 3, providing specifics about the corporation’s status, operations, and contact information.

- Review the form for accuracy and completeness to avoid penalties or delays. The return is not considered complete unless signed and verified.

- Mail the completed form and any payment due to the Florida Department of Revenue at the provided addresses, depending on whether you're requesting a refund or not, and ensure the FEIN is written on the check.

By following these steps carefully, corporations can ensure their Florida Corporate Income/Franchise Tax Return is accurately completed and submitted in compliance with state tax regulations. Keeping a copy of the completed form and all attachments for your records is advisable.

Understanding Florida F 1120

What is the purpose of the Florida F-1120 form?