Official Florida F 1065 Template

In the diverse landscape of business taxation in Florida, partnerships navigating their fiscal responsibilities must acquaint themselves with the Florida Partnership Information Return, known as Form F-1065. Effective from January 16th under the rule 12C-1.051 of the Florida Administrative Code, this form serves as a crucial tool for partnerships operating with the state, providing a structured method for reporting income adjustments and distribution among partners. It meticulously details various additions and subtractions to federal income, thereby guiding partnerships in accurately adjusting their income to reflect obligations under state tax laws. Furthermore, it delineates the distribution of income adjustments to partners, ensuring transparency and compliance in the allocation of partnership earnings. The form encompasses apportionment information crucial for businesses operating both within and outside Florida, offering a formulaic approach to determine the share of business income attributable to the state. By addressing the valuation of property, payroll data, and sales figures, it aids in calculating the apportionment factors essential for tax reporting purposes. As a gateway to compliance, the Florida F-1065 form embodies the intricacies of state tax requirements, steering partnerships through the complexities of financial reporting with an emphasis on precision and integrity.

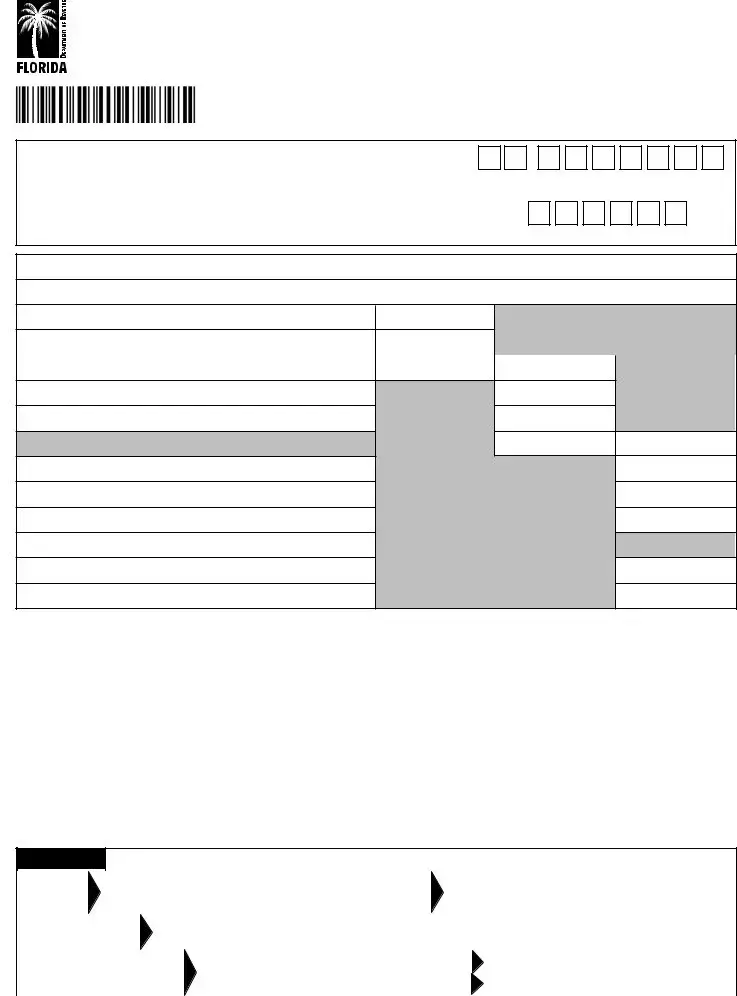

Example - Florida F 1065 Form

Florida Partnership Information Return

|

|

|

|

|

|

|

|

Rule |

|

|

|

|

|

|

|

Florida Administrative Code |

|

|

|

|

|

|

|

|

|

Effective 01/16 |

|

|

|

For the taxable year |

|

|

|

||

beginning |

|

, |

|

and ending |

|

, |

|

. |

_________________________________________________________________________________________________________________ |

||

Name of Partnership |

|

|

_________________________________________________________________________________________________________________ |

||

Street Address |

|

|

_________________________________________________________________________________________________________________ |

||

City |

State |

ZIP |

-

Federal Employer Identification Number (FEIN)

Principal Business Activity Code

Part I. Florida Adjustment to Partnership Income

A.Additions to federal income:

1.Federal

Total interest excluded from federal ordinary income

Less associated expenses not deductible in |

|

|

computing federal ordinary income |

( |

) |

|

|

|

|

|

Net Interest |

|

|

|

2.State income taxes deducted in computing federal ordinary income

3.Other additions

Total

A.

B. Subtractions from federal income

B.

C. Subtotal (Line A less Line B)

C.

D. Net adjustment from other partnerships or joint ventures

D.

E. Partnership income adjustment

1. Increase (total of Lines C and D)

E. 1.

2. Decrease (total of Lines C and D)

2.()

Part II. |

Distribution of Partnership Income Adjustment |

|

|

||

|

|

|

|

|

|

Partner’s name and address (Include FEIN) |

(a) |

(b) |

(c) |

||

Column (a) times Column (b) = partner's |

|||||

|

|

Amount shown |

Partner's percentage |

||

|

|

share of Line E. |

|||

Note: If there is no adjustment on Line E, show partner’s percentage |

on Line E, Part I, |

of profits |

Enter here and on Florida Form |

||

of profits in |

Column (b) and leave Columns (a) and (c) blank. |

above |

|

Schedule I, Line 19 (if decrease, Schedule |

|

|

II, Line 11) |

||||

|

|

|

|

||

|

|

|

|

|

|

A. |

|

|

|

|

|

|

|

|

|

|

|

B. |

|

|

|

|

|

|

|

|

|

|

|

C. |

|

|

|

|

|

|

|

|

|

|

|

Under penalties of perjury, I declare that I have examined this return, including accompanying schedules and statements, and to the best of my knowledge and belief, it is true, correct, and complete. Declaration of preparer (other than taxpayer) is based on all information of which preparer has any knowledge.

Sign Here |

|

Signature of partner or member |

(Must be an original signature.) |

Date |

||||||||||||||||

|

|

|||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Preparer’s Tax Identification Number (PTIN) |

||||||||||

Paid |

Preparer’s |

|

Check if self- |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||

Signature |

Date |

employed |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

Preparer |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Firm’s name (or yours |

|

FEIN |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

Only |

|

|

|

|

|

|

|

|

|

|

|

|||||||||

if |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

and address |

|

ZIP |

|||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Mail To: Florida Department of Revenue, 5050 W. Tennessee St., Tallahassee FL

R. 01/16

Page 2

NOTE: Please read instructions (Florida Form

Part III. |

Apportionment Information |

|

|

|

|

|

|||

|

|

|

|

|

|

|

|||

For use by partnerships doing business both within |

(a) Within Florida |

(b) Total Everywhere |

|||||||

|

|

and without Florida |

|||||||

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|||

1. |

Average value of property per Schedule |

|

|

|

|

|

|||

|

|

|

|

|

|

|

|||

2. |

Salaries, wages, commissions, and other compensation paid or accrued |

|

|

|

|

|

|||

|

in connection with trade or business for the period covered by this return |

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

3. |

Sales |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

For use by partnerships providing transportation |

(a) Within Florida |

(b) Total Everywhere |

|||||||

|

|

services within and without Florida |

|||||||

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|||

1. |

Transportation services revenue miles (see instructions) |

|

|

|

|

|

|||

|

|

|

|

|

|||||

|

|

|

|

|

|

|

|

|

|

For use in computing average value of property |

Within Florida |

Total Everywhere |

|

||||||

|

|||||||||

|

|

|

|

|

|||||

a. Beginning of Year |

b. End of Year |

c. Beginning of Year |

d. End of Year |

||||||

|

|

|

|

||||||

|

|

|

|

|

|

|

|||

1. |

Inventories of raw material, work in process, finished goods |

|

|

|

|

|

|||

|

|

|

|

|

|

|

|||

2. |

Buildings and other depreciable assets (at original cost) |

|

|

|

|

|

|||

|

|

|

|

|

|

|

|||

3. |

Land owned (at original cost) |

|

|

|

|

|

|||

|

|

|

|

|

|

|

|||

4. |

Other tangible assets (at original cost) and intangible assets |

|

|

|

|

|

|||

|

(financial |

organizations only). Attach schedule. |

|

|

|

|

|

||

|

|

|

|

|

|

|

|||

5. |

Total (Lines 1 through 4). |

|

|

|

|

|

|||

|

|

|

|

|

|

|

|||

6. |

Average value of property in Florida (Within Florida), add |

|

|

|

|

|

|||

|

Line 5, Columns (a) and (b) and divide by 2. For average |

|

|

|

|

|

|||

|

value of property everywhere (Total Everywhere), add Line 5, |

|

|

|

|

|

|||

|

Columns (c) and (d) and divide by 2. |

|

|

|

|

|

|||

|

|

|

|

|

|

|

|||

7. |

Rented property - (8 times net annual rent) |

|

|

|

|

|

|||

|

|

|

|

|

|

|

|||

8. |

Total (Lines 6 and 7). Enter on Part |

_____________________________ |

_____________________________ |

|

|||||

|

and (b) |

|

|

||||||

|

|

Average Florida |

Average Everywhere |

||||||

|

|

|

|

||||||

Part IV. |

Apportionment of Partners' Share |

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

Partner (Name and Address) |

Percent of |

Property Data |

Payroll Data |

Sales Data |

||||

Interest In |

|

|

|

|

|

|

||

|

|

Partnership |

Within Florida |

Everywhere |

Within Florida |

Everywhere |

Within Florida |

Everywhere |

|

|

|

|

|

|

|

|

|

A. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

B. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

C. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

NOTE: Transfer data to Schedule III - A, Florida Form

Instructions for Preparing Form

R. 01/19

Rule

Effective 01/19

Page 1 of 4

General Instructions

Who Must File Florida Form

Every Florida partnership having any partner subject to

the Florida Corporate Income Tax Code must file Florida

Form

partnership is a partnership doing business, earning income, or existing in Florida.

Note: A foreign

Florida joint venture is subject to the Florida Income Tax Code and must file a Florida Corporate Income/

Franchise Tax Return (Florida Form

A corporate taxpayer filing Florida Form

Where to File

Florida Department of Revenue

5050 W Tennessee St

Tallahassee FL

When to File

You must file Florida Form

day of the fourth month following the close of your taxable year.

If the due date falls on a Saturday, Sunday, or federal or state holiday, the return is considered to be filed on time if

postmarked on the next business day.

Extension of Time to File

To apply for an extension of time for filing Florida Form

You must file Florida Form

information on the requirements that must be met for your request for an extension of time to be valid.

Extensions are valid for six months. You are only

allowed one extension.

Attachments and Statements

You may use attachments if the lines on Florida Form

contain all the required information and follow the format of the schedules of the return. Do not attach a copy of the federal return.

Signature and Verification

An officer or person authorized to sign for the entity must

sign all returns. An original signature is required. We will not accept a photocopy, facsimile, or stamp. A receiver,

trustee, or assignee must sign any return required to be filed for any organization.

Any person, firm, or corporation who prepares a return for

compensation must also sign the return and provide:

•Federal employer identification number (FEIN).

•Preparer tax identification number (PTIN).

Rounding Off to

accompanying schedules. To round off dollar amounts,

drop amounts less than 50 cents to the next lowest dollar

and increase amounts from 50 cents to 99 cents to the

next highest dollar. If you use this method on the federal return, you must use it on the Florida return.

Taxable Year and Accounting Methods

The taxable year and method of accounting must be the same for Florida income tax as it is for federal income tax. If you change your taxable year or your method of accounting for federal income tax, you must also change the taxable year or method of accounting for Florida income tax.

Final Returns

If the partnership ceases to exist, write “FINAL RETURN”

at the top of the form.

General Information Questions

Enter the FEIN. If you do not have an FEIN, obtain one from the Internal Revenue Service (IRS). You can:

•Apply online at irs.gov

•Apply by mail with IRS Form

form, download or order it from irs.gov or call

Enter the Principal Business Activity Code that applies to Florida business activities. If the Principal Business Activity Code is unknown, see the IRS “Codes for

Principal Business Activity” section of federal Form 1065.

General Information

Both the income and the apportionment factors are

considered to “flow through” to the members of a

partnership or joint venture.

Use parts I and II of the Florida Partnership Information Return to determine each partner’s share of the Florida partnership income adjustment.

Parts III and IV are used to determine the adjustment that must be made to each partner’s apportionment factors. For example, a corporate partner’s share of the partnership’s sales within Florida will be added to the

corporation’s sales within Florida. The partner’s share of the partnership’s “everywhere sales” will be added to the corporation’s “everywhere sales.” The corporation’s sales apportionment factor, as reflected on Schedule III of Florida Form

(corporation’s Florida sales +

share of partnership’s Florida sales) (corporation’s everywhere sales + share of partnership’s everywhere sales)

Part I. Florida Adjustment to

Partnership Income

Line A. Additions to federal income

1.Federal

Enter the amount of interest which is excluded from ordinary income under section (s.) 103(a), Internal Revenue Code (IRC), or any other federal law, less

the associated expenses disallowed in computing ordinary income under s. 265, IRC, or any other law.

2.State income taxes deducted in computing federal ordinary income

Enter the sum of any tax on or measured by income,

which is paid or accrued as a liability to the District of Columbia or any state of the United States and is deductible from gross income in computing federal ordinary income for the taxable year. You should exclude taxes based on gross receipts or revenues.

3.Other additions

Enter any other items you are required to add as an adjustment to calculate adjusted federal income.

Line B. Subtractions from federal income

Enter any items required to be subtracted as an adjustment to calculate adjusted federal income.

For example, s. 220.13(1)(e), F. S., provides for a

subtraction taken equally over a seven year period corresponding to the add back to adjusted federal income for the special bonus depreciation.

Line C. Subtotal

Subtract Line B from Line A.

R. 01/19

Page 2 of 4

Line D. Net adjustment from other partnerships or joint ventures

If, because of Florida changes, the partnership’s share

of income from other partnerships or joint ventures is different from the amount included in federal taxable

income, you must make an appropriate adjustment on Line D. Attach a schedule explaining any adjustment.

Line E. Partnership income adjustment

Calculate the total partnership income adjustment (sum of Lines C and D). Enter net increases to income on Line 1. Enter net decreases to income on Line 2.

Part II. Distribution of Partnership

Income Adjustment

Distributing each partner’s share of the total partnership

income adjustment (Part I, Line E) is accomplished in

Part II.

Each corporate partner must enter its share of the adjustment in Column (c) on its Florida Corporate Income/ Franchise Tax Return (Florida Form

Part III. Apportionment Information

You must complete this part if either the partnership or any of the partners subject to the Florida Income Tax Code does business outside Florida.

Florida taxpayers doing business outside the state must apportion their business income to Florida based on a

taxpayers granted permission to use a single sales factor under s. 220.153, F.S., and taxpayers who were given

prior permission by the Department to apportion income using a different method under s. 220.152, F.S.

The

For more information about apportioning income see s. 220.15, F.S., and Rule

this fraction is the average value of real and tangible personal property owned or rented and used during the taxable year in Florida. The denominator is the average value of such property owned or rented and used

everywhere during the taxable year. The property factor for corporations included within the definition of financial organizations must also include intangible personal

property, except goodwill.

Property owned is valued at original cost, without regard to accumulated depreciation. Property rented is valued at eight times the net annual rental rate. You must reduce the net annual rental rate by the annual rental rate received from

In Part

Line 1, Column (a). Enter the average everywhere in Part

The payroll factor is a fraction. The numerator of this fraction is the total amount paid to employees in Florida during the taxable year for compensation. The denominator is the total compensation paid to employees

everywhere during the taxable year. Enter the numerator in Part

For purposes of this factor, compensation is paid within Florida if:

(a)The employee’s service is performed entirely within

Florida, or

(b)The employee’s service is performed both within and without Florida, but the service performed outside Florida is incidental to the employee’s service, or

(c)Some of the employee’s service is performed in

Florida and either the base of operations or the place from which the service is directed or controlled is in Florida, or the base of operations or place from which the service is controlled is not in any state in which some part of the service is performed and the employee’s residence is in Florida.

The partnership must attach a statement listing all

compensation paid or accrued for the taxable year other than that as shown on federal Form

the federal Form 1065.

R. 01/19

Page 3 of 4

The sales factor is a fraction. The numerator of this fraction is the total sales of the taxpayer in Florida during the taxable year. The denominator is the total sales of

the taxpayer everywhere during the taxable year. Enter the numerator in Part

Florida defines the term “sales” as gross receipts without regard to returns or allowances. The term “sales” is not

limited to tangible personal property, and includes:

(a)Rental or royalty income if such income is significant in the taxpayer’s business.

(b)Interest received on deferred payments of sales of real or tangible personal property.

(c)Sales of services.

(d)Income from the sale, licensing, or other use of intangible personal property such as patents and copyrights.

(e)For financial organizations, income from intangible personal property.

Sales will be attributable to Florida using these criteria:

(a)Sales of tangible personal property will be “Florida sales” if the property is delivered or shipped to a purchaser within Florida.

(b)Rentals will be “Florida sales” if the real or tangible personal property is in Florida.

(c)Interest received on deferred payments of sales of

real or tangible personal property will be included in

“Florida sales” if the sale of the property is in Florida.

(d)Sales of service organizations are within Florida if the services are performed in Florida.

For a financial organization, “Florida sales” will also

include:

(a)Fees, commissions, or other compensation for financial services rendered within Florida.

(b)Gross profits from trading in stocks, bonds, or other securities managed within Florida.

(c)Interest, other than interest from loans secured by mortgages, deeds of trust, or other liens on real or tangible personal property found outside Florida.

(d)Dividends received within Florida.

(e)Interest charged to customers at places of business maintained within Florida for carrying debit balances of margin accounts, without deduction of any costs incurred in carrying such accounts.

(f)Interest, fees, commissions, and other charges or gains from loans secured by mortgages, deeds of trust, or other liens on real or tangible personal property found in Florida or from installment sale agreements originally completed by a taxpayer or his agent to sell real or tangible personal property located in Florida.

(g)Any other gross income, including other interest resulting from the operation as a financial organization within Florida.

Special methods of apportioning income by taxpayers providing insurance or transportation services are provided. For example, the income attributable to transportation services is apportioned to Florida by

multiplying the adjusted federal income by a fraction.

The numerator is the “revenue miles” within Florida and the denominator is the “revenue miles” everywhere. For

transportation other than by pipeline, a revenue mile is the

R. 01/19

Page 4 of 4

transportation of one passenger or one net ton of freight the distance of one mile for a consideration.

Part IV. Apportionment of Partners’ Share

Each partner’s share of the apportionment factors is determined by multiplying the amount in Part

Lines 1, 2, and 3 by the percentage interest of each

partner. Amounts determined should be added to each partner’s apportionment factors included on its Florida

Form

Partnerships subject to a special industry apportionment fraction (for example, those engaged mainly in transportation services) should adjust this schedule to

report each partner’s share of the special apportionment fraction (for example, revenue miles for transportation companies).

Contact Us

Information, forms, and tutorials are available on the Department's website at floridarevenue.com

To speak with a Department representative, call Taxpayer Services at

Friday (excluding holidays).

To find a taxpayer service center near you, visit floridarevenue.com/taxes/servicecenters

For written replies to tax questions, write to:

Taxpayer Services - MS

Florida Department of Revenue

5050 W Tennessee St

Tallahassee FL

Subscribe to our tax publications to receive due date reminders or an email when we post:

•Tax Information Publications (TIPs).

•Proposed rules, notices of rule development workshops, and more. Visit floridarevenue.com/dor/subscribe

References

The following documents were mentioned in this form and are incorporated by reference in the rules indicated below.

The forms are available online at floridarevenue.com/forms.

Form |

Florida Partnership Information Return |

Rule |

Form |

Florida Corporate Income/Franchise Tax Return |

Rule |

Form |

Florida Tentative Income/Franchise Tax Return |

Rule |

|

and Application for Extension of Time to File Return |

|

File Specifications

| Fact Name | Description |

|---|---|

| Governing Law | Rule 12C-1.051 Florida Administrative Code |

| Form Version | Florida Partnership Information Return F-1065 R. 01/16 |

| Effective Date | Effective from January 2016 |

| Who Must File | Every Florida partnership with a partner subject to Florida Corporate Income Tax |

| Due Date | On or before the first day of the fifth month following the close of the taxable year |

| Extension Information | To apply for an extension, complete Florida Form F-7004, valid for five months |

| Attachments and Statements | Use attachments if more space is needed, following the format of the return schedules |

| Signature Requirement | An original signature of an authorized officer is required for filing |

| Apportionment Information | Needed if the business or any partner does business outside Florida |

| Final Returns | If the partnership ceases, mark the form as a "FINAL RETURN" |

| Where to File | Florida Department of Revenue, 5050 W. Tennessee St., Tallahassee, FL 32399-0135 |

Instructions on Filling in Florida F 1065

Filling out the Florida F-1065 form is essential for partnerships operating within the state to ensure compliance with tax regulations. Follow these steps carefully to accurately complete the form:

- Start by entering the taxable year at the top of the form, specifying the beginning and ending dates for the period you are reporting.

- Under the section titled "Name of Partnership," provide the full legal name of the partnership.

- Fill in the partnership's complete street address, including city, state, and ZIP code, in the designated fields.

- Input the Federal Employer Identification Number (FEIN) in the specified space.

- Enter the Principal Business Activity Code that best describes the main business activity of the partnership.

- In Part I, list down all federal tax-exempt interest and associated expenses under the "Additions to federal income" section. Then, calculate and enter the net interest.

- Add any state income taxes deducted in computing federal ordinary income and other additions required. Summarize these amounts to get the total for Part I, Section A.

- For subtractions from federal income, detail any relevant amounts and subtract these from the subtotal calculated in Section A to fill out Part I, Section C.

- If applicable, include the net adjustment from other partnerships or joint ventures in Part I, Section D.

- Calculate the partnership income adjustment (increase or decrease) and enter this in Part I, Section E.

- In Part II, distribute the Partnership Income Adjustment to each partner, mentioning the partner's name and address, percentage share of profits, and the amount derived from the calculation in Part I, Section E.

- For partnerships doing business both within and outside Florida, complete Part III by providing apportionment information related to property, payroll, and sales.

- In Part III-A, calculate and enter the average value of property, salaries, wages, and sales within Florida and everywhere else.

- Part III-B and III-C are specialized sections for partnerships providing transportation services and for calculating the average value of property, respectively. Fill these out as per the specific circumstances of your partnership.

- Finish the form by completing Part IV, apportioning each partner's share based on property, payroll, and sales data.

- Ensure an authorized partner signs the form and include the date, preparer’s tax identification number (PTIN), and any other required preparer information.

- Mail the completed form to the Florida Department of Revenue at the address provided: 5050 W. Tennessee St., Tallahassee, FL 32399-0135.

After submitting the form, you'll have successfully reported your partnership's income and distribution adjustments to the Florida Department of Revenue. Timely and accurate completion helps maintain compliance with state tax obligations, paving the way for a smoother operational flow for your partnership throughout the fiscal year.

Understanding Florida F 1065

What is the Florida F-1065 form?

The Florida F-1065 form is the Partnership Information Return required by the state of Florida. It is designed for partnerships that do business, earn income, or exist within Florida. This form allows partnerships to report their income, adjustments, and apportion income between partners for tax purposes.

Who needs to file the Florida F-1065 form?

Every partnership with a presence in Florida or having any partner subject to Florida corporate income tax must file the Florida F-1065. This includes limited liability companies classified as partnerships for federal tax purposes that have a corporate partner.

When is the Florida F-1065 form due?

This form must be filed by the first day of the fifth month following the close of the taxable year. If this date falls on a weekend or holiday, the next business day becomes the due date. Timeliness is determined by the postmark date.

How can one apply for an extension to file the Florida F-1065 form?

To apply for an extension, a partnership must complete and file Florida Form F-7004, which is the Florida Tentative Income/Franchise Tax Return and Application for Extension of Time to File Return. Note that having a federal extension does not automatically extend the state filing deadline.

Are partnerships required to attach their federal return to the Florida F-1065?

No, do not attach a copy of the federal return to the Florida F-1065. However, the partnership may need to use attachments to provide additional information if the lines on the form or schedules are insufficient. These attachments should follow the format of the schedules of the return.

What happens if a partnership ceases to exist?

If a partnership dissolves, it should mark the return as "FINAL RETURN". This indicates to the Florida Department of Revenue that the partnership will no longer be filing returns in the future because it has ceased operations or dissolved.

How are adjustments to income made on the Florida F-1065 form?

Adjustments are made to account for the differences between federal taxable income and income as defined by Florida's tax code. Additions to federal income might include tax-exempt interest or state income taxes deducted on the federal return. Subtractions might be specific deductions allowable under Florida law. The form requires detailed listing and calculations to accurately reflect these adjustments.

Common mistakes

Not correctly identifying and breaking down the federal tax-exempt interest on Line A1 including failing to subtract associated expenses not deductible in computing federal ordinary income. This misunderstanding may lead to inaccuracies in the net interest reported.

Failing to add back state income taxes deducted in computing federal ordinary income on Line A2, which is a necessary adjustment for the Florida F-1065 form.

Omitting or incorrectly detailing other additions required to adjust federal income on Line A3. Partnerships often overlook adjustments specific to Florida law that must be considered.

Improper handling of subtractions from federal income on Line B, either by misunderstanding which items are eligible for subtraction or by incorrect calculation of the values.

Not accurately calculating the net adjustment from other partnerships or joint ventures on Line D, including both over-reporting and under-reporting adjustments.

Miscalculating the partnership income adjustment, either increase or decrease, on Line E by not properly summing Lines C and D or misunderstanding the instructions.

Incorrectly distributing the partnership income adjustment among partners in Part II, which can lead to misreported amounts on the Florida Corporate Income/Franchise Tax Return (Form F-1120).

Failing to complete the apportionment information section accurately in Part III, especially not correctly reporting average value of property, payroll data, and sales data for both within Florida and everywhere.

Forgetting to sign the form or not providing the required preparer information in the verification section can delay processing. An original signature is mandatory, and photocopies, facsimiles, or stamps are not accepted.

Documents used along the form

When preparing the Florida Partnership Information Return (F-1065), it's common to need additional forms and documents to complete the filing process accurately. Understanding these documents and their purpose is crucial for any partnership operating in Florida. Below is a list of other forms and documents often used alongside the Florida F 1065 form, each briefly described for clarity.

- Form F-7004 (Florida Tentative Income/Franchise Tax Return and Application for Extension of Time to File Return): Used by partnerships to request an extension of time to file their Florida F-1065, providing additional time to gather and report all necessary information accurately.

- Schedule K-1 (Partner's Share of Income, Deductions, Credits, etc.): Issued to each partner, detailing their share of the partnership's income, deductions, and credits. It's essential for partners' individual tax returns.

- Form F-1120 (Florida Corporate Income/Franchise Tax Return): Required for corporate partners of a partnership to report their share of the partnership income and apportionment factors from the Florida F-1065.

- Form DR-1 (Florida Business Tax Application): Used by new partnerships to register with the Florida Department of Revenue for state tax obligations.

- IRS Form 1065 (U.S. Return of Partnership Income): The federal counterpart to the state-specific Florida F-1065, detailing the partnership's income, gains, losses, deductions, etc., at the federal level.

- Form DR-405 (Tangible Personal Property Tax Return): Required for partnerships owning tangible personal property used in the business to report its value for property tax purposes.

- Form W-9 (Request for Taxpayer Identification Number and Certification): Often collected from each partner to ensure accurate reporting of their tax ID numbers on all related tax documents and filings.

Selecting the appropriate documents and understanding their suggested use enhances the accuracy of your tax filings and ensures compliance with both state and federal tax codes. Properly managing and submitting these forms is crucial for the smooth operation of any partnership within the state of Florida.

Similar forms

The Florida F-1065 form is similar to the Federal Form 1065, "U.S. Return of Partnership Income," in that both are used for reporting the income, deductions, gains, losses, etc., of partnerships. The Federal Form 1065 is for reporting to the IRS, while the Florida F-1065 is specifically for reporting to the Florida Department of Revenue, highlighting both federal and state-level tax compliance for partnerships.

It aligns with the Florida Form F-1120, "Florida Corporate Income/Franchise Tax Return," in the aspect that both require information on income adjustments and apportionment for entities conducting business within and outside Florida. While the F-1120 is for corporations, the F-1065 is for partnerships, yet they share the function of detailing the entity's income subject to Florida state tax.

The form is akin to the Florida Form F-7004, "Florida Tentative Income/Franchise Tax Return and Application for Extension of Time to File Return." Both documents are integral to the tax reporting process, with the F-1065 being the main return form for partnerships and the F-7004 serving as an application for an extension of time to file the primary tax documents, including the F-1065.

Similarly, it has parallels with IRS Form 1065-B, "U.S. Return of Income for Electing Large Partnerships," in the function of reporting the income of partnerships. The primary difference lies in the specific target of the forms; the IRS 1065-B is reserved for electing large partnerships at the federal level, whereas the Florida F-1065 caters to all partnerships operating within Florida, regardless of their size, capturing state-specific tax information.

Dos and Don'ts

When preparing the Florida F-1065 form, it's crucial to approach the task with accuracy and attention to detail. Here are some vital dos and don'ts to help ensure the process goes smoothly and effectively:

-

Do:

- Read the general instructions thoroughly before beginning to fill out the form.

- Use the FEIN (Federal Employer Identification Number) provided, making sure it's correctly entered.

- Ensure the Principal Business Activity Code accurately reflects the business conducted in Florida.

- Round off dollar amounts to whole dollars, consistent with the federal return if the same method was used.

- Complete every section that applies to the partnership's activities and financial situation, especially the Florida Adjustment to Partnership Income and the Distribution of Partnership Income Adjustment sections.

- Attach a schedule explaining any adjustments made in the Net Adjustment from other partnerships or joint ventures section if necessary.

- Consult the specific instructions for the Apportionment Information sections if the partnership or any partners conduct business outside Florida.

- Ensure that an officer or authorized person signs the form, as an original signature is required.

- Mail the completed form to the Florida Department of Revenue by the due date to avoid penalties.

- Keep a copy of the filed form and any documentation provided for the partnership's records.

-

Don't:

- Leave any section blank that applies to the partnership's financial matters without explaining why it's not applicable.

- Forget to attach all required schedules and explanations for adjustments to federal income and apportionment information.

- Overlook rounding off dollar amounts to whole dollars, which could lead to discrepancies with the federal return.

- Miss checking the box for a self-employed preparer if the form is prepared by a partner or member of the LLC who is not compensated separately for this task.

- Submit the form without reviewing it for accuracy and completeness.

- Use a photocopy, facsimile, or stamp in place of the original signature required at the end of the form.

- Forget to file an extension request using Florida Form F-7004 if more time is needed beyond the original deadline.

- Ignore the requirement to change your taxable year or accounting methods on the Florida return if they were changed on the federal return.

- Fail to write "FINAL RETURN" at the top of the form if the partnership ceases to exist.

- Attach a copy of the federal return, as it's not necessary unless specifically requested.

Misconceptions

Many people have misconceptions about the Florida F-1065 form, which can lead to confusion or errors when filling it out. Here are eight common misunderstandings and clarifications to help ensure accurate completion and submission.

- Only Florida-based partnerships need to file: A common misconception is that the Florida F-1065 is only required for partnerships operating exclusively in Florida. In reality, any partnership with a partner subject to Florida Corporate Income Tax must file, regardless of where the partnership is based.

- It's optional for limited liability companies (LLCs): It's wrongly assumed that LLCs, classified as partnerships for federal tax purposes and having a corporate partner, do not need to file the F-1065. However, these entities are indeed required to file.

- Physical submission is the only option: Many believe that the form must be physically mailed. While mailing is one method, filing can also be completed electronically, offering convenience and quicker processing.

- The form is solely for income reporting: The F-1065 is not just for reporting partnership income. It also includes sections for adjustments to income, apportionment information for business done in and out of Florida, and details of the partners' share of income and apportionment factors.

- No need to report federal tax-exempt interest: There's a misconception that federal tax-exempt interest does not need to be reported. However, the form requires the reporting of such interest, along with associated expenses not deductible in computing federal ordinary income.

- Filing only if the partnership owes taxes: Even if a partnership doesn't owe taxes to Florida, it still needs to file the F-1065 to report its income and allocate that income among its partners correctly.

- Partners' information isn’t essential: Every partner's share of the partnership income adjustment must be reported accurately. This information is crucial for correctly calculating taxes due on the income of partners subject to Florida income tax.

- Attachments are unnecessary: If the provided lines on the F-1065 or its schedules are insufficient, attachments must be used to include all required information. These attachments follow the format of the form and provide essential details for accurate processing.

Understanding these misconceptions and the actual requirements of the Florida F-1065 form can help partnerships comply with Florida tax laws accurately and avoid potential issues with the Florida Department of Revenue.

Key takeaways

- Filing Requirements: The Florida F-1065 form is required for any Florida partnership with a partner subject to the Florida Corporate Income Tax Code, including limited liability companies classified as partnerships for federal tax purposes with a corporate partner.

- Due Date: This form must be filed by the first day of the fifth month following the close of the taxable year. If the due date falls on a weekend or holiday, filings are considered on time if postmarked by the next business day.

- Extension Request: Partnerships can apply for a filing extension by completing the Florida Form F-7004, which extends the filing time but does not waive the requirement for a timely filed return. A federal extension does not substitute for a Florida extension.

- Income Adjustments: The form includes sections for adding to or subtracting from federal income to determine the adjusted federal income specific to Florida, taking into account factors such as federal tax-exempt interest and state income taxes deducted in federal returns.

- Apportionment Information: For businesses operating both within and outside Florida, the F-1065 form requires detailed apportionment information, using a three-factor formula based on property, payroll, and sales to calculate Florida's share of adjusted federal income.

- Attachments and Statements: If additional space is needed, attachments may be used provided they contain all required information in the format of the form's schedules. However, a copy of the federal return should not be attached.

- Signature Requirement: The form requires an original signature from an officer or authorized person of the entity. This ensures that the information provided is verified and accurate under penalties of perjury.

- Rounding Off to Whole Dollars: Similar to the federal return, amounts on the Florida F-1065 can be rounded to whole dollars, streamlining the preparation process but requiring consistency in rounding methods between federal and state returns.

Popular PDF Templates

Florida Healthy Kids Income Guidelines - The Florida KidCare Employment Statement underscores a commitment to a thorough eligibility review process, ensuring only qualified applicants receive healthcare benefits.

Motion to Travel While on Probation - Supports the goal of the probation system to rehabilitate individuals and guide them towards lawful behavior.