Official Florida Dr 157 Template

In the state of Florida, a variety of forms are essential for the proper administration of services, legal requirements, and citizen requests. Among these, the Florida DR-157 form holds particular importance, serving a distinct purpose within the state's regulatory framework. This document is intricately connected to tax-related procedures, providing a streamlined approach for individuals or entities to report certain types of transactions or status updates to the necessary governmental bodies. While the form itself might appear daunting at first glance, its completion is vital for compliance with Florida's tax laws, potentially affecting a wide range of financial and operational aspects for businesses and individuals alike. It is designed to ensure transparency and maintain the integrity of the state's fiscal structures, making its accurate and timely submission a crucial responsibility. The details required on the form, the specific instances when it must be used, and the implications of its submission or omission underscore its significance in the regulatory landscape of Florida, thus affecting the legal and financial obligations of the form's filer.

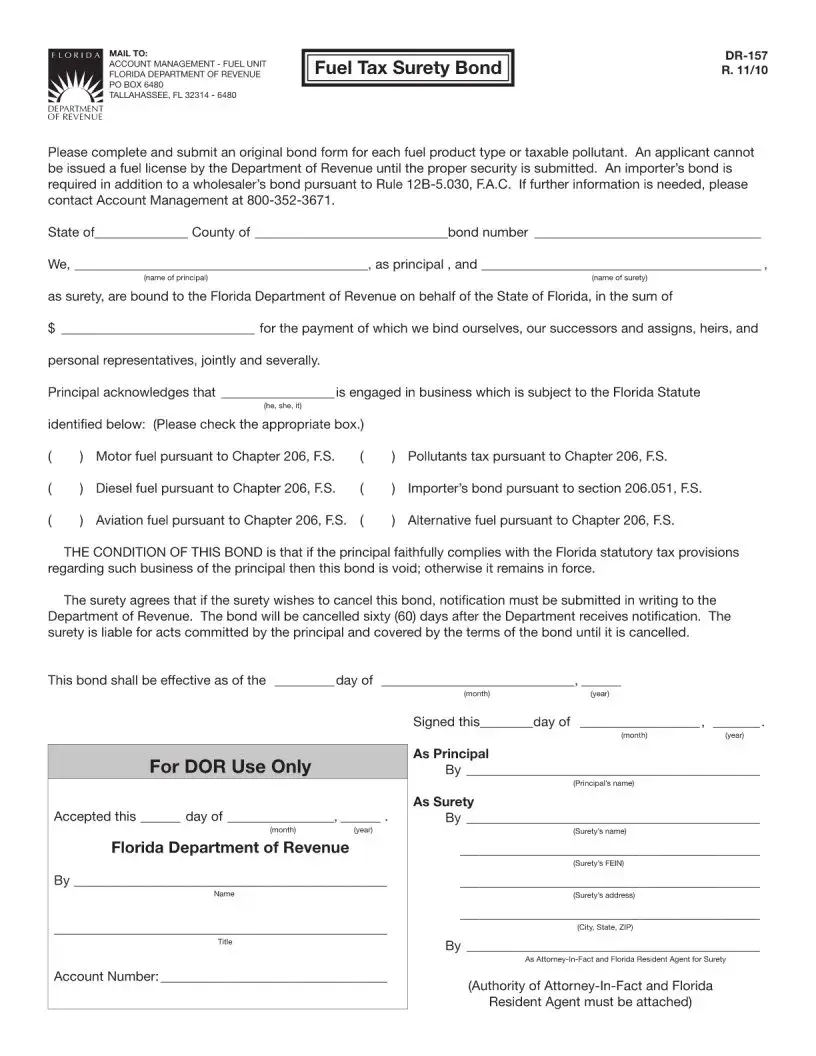

Example - Florida Dr 157 Form

File Specifications

| Fact | Detail |

|---|---|

| 1. Form Name | Florida DR-157 Form |

| 2. Purpose | Used to apply for an exemption from sales and use tax on purchases and rentals |

| 3. Applicable Users | Nonprofit organizations and government entities |

| 4. Governing Law(s) | Florida Statutes, Chapter 212 |

| 5. State Agency | Florida Department of Revenue |

| 6. Filing Frequency | As needed, when applying for the exemption |

| 7. Filing Method | Mail or online submission through the Florida Department of Revenue’s website |

| 8. Supporting Documents Required | Documentation substantiating the nonprofit or governmental status |

| 9. Processing Time | Varies, but applicants should allow several weeks for processing |

| 10. Renewal | Certain exemptions may require renewal, dependent on the specific criteria of the exemption granted |

Instructions on Filling in Florida Dr 157

After deciding to engage in certain business activities within the state of Florida, individuals and entities are required to complete the DR-157 form. This form serves as a pivotal document for establishing one's business identity and ensuring compliance with Florida's regulatory framework. Filling out this form with accuracy and diligence is crucial, as it contains specific information pertinent to the registration and categorization of the business under Florida law. Following completion, the form serves as an official record, facilitating various operational aspects and regulatory compliance within the state. To aid in this essential process, detailed steps are provided below to ensure that the form is filled out correctly and efficiently.

- Start by entering the official name of the business as registered or intended to be registered with the Florida Department of State in the space provided for "Business Name."

- Fill in the Federal Employer Identification Number (EIN) or Social Security Number (SSN), as applicable, in the designated area. This identifier is crucial for tax purposes and for the state to maintain accurate records of your business.

- Complete the "Mailing Address" section with the business's mailing address, ensuring it includes the street address, city, state, and ZIP code. This address will be used by the Florida Department of Revenue for correspondence regarding tax and business matters.

- In the section labeled "Business Location Address," input the physical location of the business if different from the mailing address. Include the street address, city, state, and ZIP code. This information helps the state understand the geographical presence of your business.

- Specify the type of business ownership—such as sole proprietorship, partnership, corporation, etc.—in the field provided. This categorization assists the state in applying the relevant legal and tax frameworks to your business.

- For the "Nature of Business" segment, describe the primary activity or service your business provides. Be as specific as possible to ensure the state accurately understands your business operations and can classify it accordingly.

- Indicate the date when the business started or is expected to start operations in Florida. This date is critical for the state to begin its oversight and taxation processes.

- Provide the name and title of the business's primary contact person along with their phone number. This individual will be the state's primary point of communication for any matters related to the business.

- Review the form thoroughly to ensure all information is accurate and complete. Missing or incorrect information can delay the processing of your form or impact your business's legal standing in Florida.

- Sign and date the form in the designated area to certify the accuracy of the information provided and agree to comply with relevant Florida statutes and regulations.

- Submit the completed form to the Florida Department of Revenue following the submission guidelines provided with the form or on their official website.

Upon submission, the Florida Department of Revenue will process the DR-157 form. This involves reviewing the provided information for accuracy and completeness, classifying the business according to state guidelines, and establishing official records. Businesses should maintain a copy of the submitted form and any correspondence from the state as part of their permanent records. Adhering to these steps not only ensures compliance with state regulations but also lays the foundation for a business's successful operation within Florida.

Understanding Florida Dr 157

What is the Florida DR-157 form?

The Florida DR-157 form is an official document used by estates or trusts to report and pay tax on the income earned. It's specifically designed for fiduciaries to fulfill their tax obligations in the state of Florida, ensuring that any income generated by the estate or trust is duly reported to the Florida Department of Revenue.

Who needs to file the Florida DR-157 form?

Typically, the executor of an estate or the trustee of a trust needs to file the Florida DR-157 form. This responsibility rests on individuals or entities acting as fiduciaries, managing the income-generating assets of an estate or trust in Florida. If you're in this position, it is crucial to determine whether the estate or trust's income level necessitates filing this form.

How can one obtain the Florida DR-157 form?

The form can be easily accessed through the Florida Department of Revenue's official website. Additionally, one can also request a physical copy by contacting the Florida Department of Revenue directly. Make sure to use the most current version of the form to ensure compliance with the latest tax laws and regulations in Florida.

What is the deadline for filing the Florida DR-157 form?

The filing deadline for the Florida DR-157 form usually aligns with the federal tax filing deadlines for estates and trusts, which is generally on the 15th day of the fourth month following the close of the tax year. However, it's important to check for any changes or updates to the deadline each year to avoid late fees and penalties. If you're unable to meet the deadline, you may apply for an extension, but ensure to file this request promptly.

Common mistakes

When filling out the Florida Dr 157 form, individuals often make errors that could be easily avoided. Understanding these common mistakes can help ensure the process is completed accurately, facilitating smoother transactions and preventing unnecessary delays.

-

Not reading instructions carefully: People frequently skim through the instructions rather than reading them thoroughly. This leads to misunderstandings about the required information, resulting in incorrectly completed forms.

-

Incorrect personal information: It's common for individuals to inadvertently provide incorrect personal details, such as misspelled names, wrong addresses, or inaccurate social security numbers.

-

Leaving blank spaces: Some sections are mistakenly left blank because they are overlooked or the applicant assumes they are irrelevant. Every section should be reviewed and filled as applicable.

-

Use of non-blue or non-black ink: The form specifies that entries should be made using blue or black ink. Entries made in other colors can cause processing delays or even render the document invalid.

-

Failure to double-check for errors: Once the form is completed, many fail to review their entries. Double-checking can catch mistakes that can be corrected before submission.

-

Incorrect date format: The form requires dates to be in a specific format (MM/DD/YYYY). Failing to use this format can lead to misunderstandings and processing issues.

-

Not providing required signatures: A common oversight is forgetting to sign the form where necessary. Unsigned forms are considered incomplete and are not processed.

-

Improper attachment of supporting documents: Required attachments are sometimes forgotten, misplaced, or not securely affixed, leading to incomplete applications.

-

Use of correction fluid or tape: Corrections should be made by clearly crossing out incorrect entries and writing the correct information. The use of correction fluid or tape is discouraged as it can question the authenticity of the information.

Avoiding these mistakes can significantly improve the accuracy and processing time of a Florida Dr 157 form submission. Always take the time to carefully review each section and instruction to ensure a complete and correct application.

Documents used along the form

When it comes to navigating the complexities of tax-related documentation in Florida, having a clear understanding of the Florida Dr 157 form is a good starting point, as it serves a specific role in reporting and payment of taxes. However, this form doesn't exist in isolation. Various other documents often accompany the Dr 157 form to ensure comprehensive compliance and accurate reporting. Below is a list of other forms and documents frequently involved in this process, each serving its own unique purpose in the broader context of tax administration and compliance.

- Form DR-1: Also known as the Florida Business Tax Application, this form is essential for new businesses. It serves as the initial registration form that must be filed to obtain a sales tax permit in Florida.

- Form DR-15: This sales and use tax return form is used by businesses to report and remit the sales taxes collected from customers. It’s a regularly filed document that follows the initial registration.

- Form DR-15EZ: A simpler version of the DR-15 form, the DR-15EZ is designed for businesses with straightforward tax reporting needs, typically those that sell from one location or within one county.

- Form DR-15SW: This is a special worksheet intended to help businesses calculate the discretionary sales surtax. It’s valuable for companies operating in or selling to customers in multiple counties.

- Form DR-16: Known as the Application for Self-Accrual Authority/Direct Pay Permit, this form is used by businesses that wish to self-accrue sales and use taxes, rather than paying them at the time of purchase.

- Form DR-26S: This application is for obtaining a refund of sales and use taxes previously paid. It’s often used by businesses that have overpaid taxes due to various reasons like returns or exemptions.

- Form DR-46NT: Issued for obtaining an Annual Resale Certificate for Sales Tax, this form allows businesses to purchase items for resale without paying sales tax at the point of purchase.

- Form DR-97: This Declaration of Tax Representative form authorizes another individual, such as an accountant or attorney, to act on behalf of a business in matters related to Florida's sales and use taxes.

- Employer’s Quarterly Federal Tax Return (Form 941): Though not specific to Florida, this federal form is crucial for businesses with employees. It reports federal withholdings, including income tax, Social Security, and Medicare.

- Annual Resale Certificate for Sales Tax: Each year, businesses engaged in reselling goods must obtain this certificate to make tax-exempt purchases for resale, reinforcing the importance of documentation in maintaining tax compliance.

Completing and maintaining these forms are fundamental responsibilities for businesses operating within Florida. Each document serves as a building block in the foundation of responsible business ownership and tax compliance. By understanding and managing these forms diligently, businesses can ensure they meet legal obligations efficiently and avoid any potential pitfalls that may arise from improper tax practices.

Similar forms

W-9 Form (Request for Taxpayer Identification Number and Certification): This form is used by individuals, companies, and other entities in the United States to provide their taxpayer identification number to entities that will pay them income during the tax year. Like the Florida DR-157 form, it also deals with tax-related identification processes, focusing on verifying the identity and tax status of the receiver to ensure proper tax reporting and compliance.

I-9 Form (Employment Eligibility Verification): Required by U.S. employers to verify the identity and employment authorization of individuals hired for employment in the United States. Similar to the DR-157, it necessitates individuals to provide specific information and documents to confirm their eligibility, in this case, for employment rather than tax purposes.

W-4 Form (Employee’s Withholding Certificate): Employees use this form to determine the amount of taxes that are withheld from their paychecks. Like the DR-157, it gathers individual's financial and personal information to ensure the accurate calculation of tax obligations.

1099 Forms (Various Types): These forms are used for reporting income other than wages, salaries, and tips (for example, independent contractor income). Like the DR-157, 1099 forms are instrumental in tax identification and reporting, ensuring that entities report their income correctly to the IRS.

SS-4 Form (Application for Employer Identification Number): Used by entities to apply for an Employer Identification Number (EIN) from the IRS, this form is similar to the DR-157 in that it involves providing the IRS with necessary tax-related identification information for the entity, facilitating proper tax processing and compliance.

8822 Form (Change of Address): Used to notify the IRS of a change in address, ensuring that the tax-related correspondence is sent to the correct place. Similar to the DR-157, this form deals with the accurate and up-to-date provision of personal information to tax authorities.

4506-T Form (Request for Transcript of Tax Return): Individuals and entities use this form to request a transcript of their tax return or other tax-related documents from the IRS. Like the DR-157, it involves the handling and verification of tax-related information, although it focuses on accessing history rather than providing new data.

Sales and Use Tax Certificate of Exemption Forms: Specific to various states, these forms are used by businesses to purchase goods tax-free that will be resold. They are similar to the DR-157 as they require businesses to provide specific identification information to qualify for tax-related benefits.

Business Tax Application Forms (vary by state): These forms are used by businesses to register for various state-level taxes (sales tax, employer tax, etc.). Similar to the Florida DR-157, they require the provision of detailed business and personal information to ensure compliance with state tax laws.

Dos and Don'ts

When filling out the Florida DR-157 form, it is crucial to pay attention to both the details and the overall requirements. This form is used for various tax-related purposes, and correctly completing it is essential for ensuring accuracy and compliance with Florida's tax laws. Here are seven do's and don'ts to guide you through this process:

Do's:- Read the instructions carefully before you start filling out the form. This will help you understand what information is required and how to enter it correctly.

- Use black ink if you are filling out the form by hand. This ensures that the information is legible and can be scanned or copied clearly.

- Ensure all the information provided is accurate and up-to-date. Double-check your entries against your records to prevent errors.

- Include all necessary attachments or documents that are requested in the form instructions. This could be related to your tax records or other evidence.

- Sign and date the form in the designated area. An unsigned form may be considered invalid.

- Keep a copy of the completed form for your records. This is useful for future reference or if there are any questions about your submission.

- Contact the Florida Department of Revenue if you have any questions or if anything is unclear. It's better to get clarification before submitting the form.

- Do not leave any required fields blank. If a section does not apply to you, write “N/A” (not applicable) instead of leaving it empty.

- Do not use pencil or non-standard ink colors, as these can be hard to read or may not show up well in copies.

- Avoid making corrections or using white-out on the form. If you make a mistake, it's better to start over on a new form to keep the submission neat and legible.

- Do not guess on dates or figures. Verify all information from your records to ensure precision.

- Do not ignore the specific formatting or documentation requests. Follow the form instructions closely to avoid processing delays.

- Do not forget to include your contact information where requested. This may be necessary for any follow-up or clarification.

- Finally, do not submit the form without reviewing it one last time. A quick final check can catch errors you might have missed.

Misconceptions

The Florida DR-157 form, often involved in estate and trust matters, is surrounded by several misconceptions. Understanding these misconceptions can provide clarity and streamline the process for individuals dealing with estate or trust issues. Here are seven common misunderstandings about the Florida DR-157 form:

- It’s Only for Residents of Florida: While the Florida DR-157 form is specific to Florida, it's not strictly for Florida residents. Trustees managing a trust in Florida, regardless of their own residency, may need to complete this form.

- It’s a Tax Return: Some people mistakenly believe the DR-157 form is a type of tax return. In reality, it is a declaration of status used to determine the tax treatment of a trust or estate, rather than a direct tax filing document.

- Completing It Once Is Enough: The belief that submitting a DR-157 form is a one-time requirement is another common misconception. Depending on changes in the trust’s status or applicable tax laws, it may need to be updated or resubmitted.

- It’s Complicated to Fill Out: While any legal form can seem daunting at first glance, the Florida DR-157 form is designed to be straightforward. It does require accurate and detailed information but following the provided instructions can simplify the process.

- It Must Be Filed by an Attorney: It’s a common misconception that only an attorney can file the DR-157 form. In truth, while legal guidance is often beneficial, especially in complex cases, a trustee can complete and file it without an attorney.

- There’s No Deadline for Filing: This is another area of confusion. Like many legal forms, the DR-157 has specific filing deadlines, typically related to the declaration or tax year it pertains to. Missing these deadlines can result in penalties.

- Any Type of Trust Can Use It: Lastly, there’s a misconception that the DR-157 form is universal for all trusts in Florida. The form is actually specific to certain types of trusts, based on their tax classification and the nature of the trust or estate.

Clearing up these misconceptions can help trustees and others involved with trusts and estates in Florida navigate their responsibilities more effectively. Accurate understanding and compliance with the requirements of the DR-157 form are crucial for the proper management and tax treatment of trusts and estates within the state.

Key takeaways

The Florida DR-157 form is crucial for non-profit organizations seeking tax exemption on purchases related to their operations. Understanding how to fill out and utilize this form effectively can assist these organizations in navigating tax laws and ensuring compliance. Here are five key takeaways to guide you through the process:

- The form must be accurately completed, providing detailed information about the non-profit organization, including its legal name, address, and the nature of its tax-exempt operations. This ensures the Florida Department of Revenue can verify the organization's eligibility for tax exemption.

- It is important to submit the DR-157 form promptly. Delayed submission can lead to unnecessary tax payments on purchases that should be exempt. Keeping track of deadlines and requirements can save your organization time and resources.

- Ensure all purchases made using the tax-exempt status are strictly for purposes that align with your organization's non-profit mission. The state of Florida monitors the use of tax exemptions closely, and misuse can result in penalties or revocation of tax-exempt status.

- Keep detailed records of all transactions made under the tax-exempt status. Documentation should include invoices, receipts, and detailed notes about how each purchase serves the organization's exempt purposes. This is crucial for audit purposes and for maintaining the integrity of your organization’s tax-exempt status.

- Regular reviews of the organization's tax-exempt purchases and compliance with the DR-157 form requirements are advisable. Tax laws and exemption criteria can change, and regular audits of your organization's compliance can prevent legal issues and ensure continued eligibility for tax-exempt benefits.

Adhering to these guidelines when dealing with the Florida DR-157 form can significantly aid non-profit organizations in maintaining their tax-exempt status without facing compliance issues. Proper attention to detail and an understanding of the form's requirements are essential for navigating these processes effectively.

Popular PDF Templates

Florida S Corp Filing Requirements - Subtractions from federal income allow partnerships to adjust their taxable income based on specific Florida provisions.

Answer to Counter Petition for Divorce - Mandatory disclosures and other required documents must be filed alongside this form within specified deadlines.