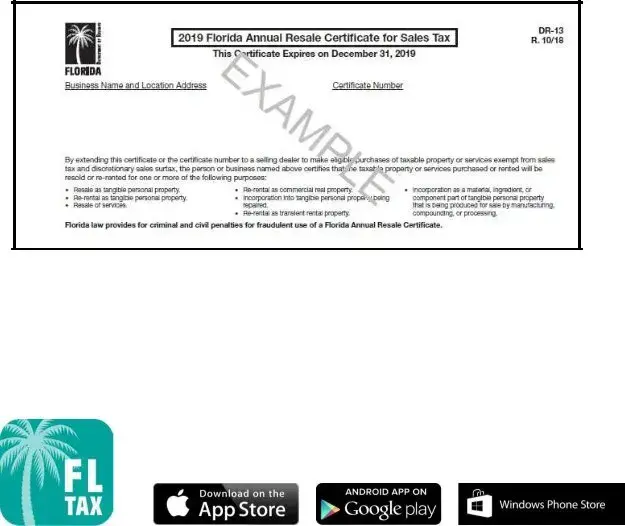

Official Florida Annual Resale Certificate Template

In the state of Florida, businesses engaging in the sale of goods and services must navigate a variety of tax obligations, one of which includes the understanding and proper use of the Florida Annual Resale Certificate for Sales Tax. This pivotal document, delineated in the form GT-800060 R. 04/19, serves multiple functions vital for both the purchaser and seller within the sales tax framework. Principally, it allows businesses to purchase or rent property and services tax-exempt when these items are intended for resale. The certificate, which must be renewed yearly, negates the necessity for signatures, streamlining the process whereby businesses declare their intent to resell items. Registration with the Florida Department of Revenue is a prerequisite for obtaining this certificate, ensuring that all transactions are properly monitored and that businesses comply with state tax laws. Additionally, the certificate distinguishes between items for resale and personal or business use, elucidating scenarios where tax-exempt purchases are not permissible. Civil and criminal penalties are in place for misuse of the certificate, emphasizing its importance in the regulation of taxable transactions. For sellers, accepting a customer's Annual Resale Certificate transfers certain responsibilities and liabilities, underscoring the dual roles each party plays in maintaining the integrity of the state's sales tax system. The versatility of the certificate is matched by the variety of methods available for verifying the tax-exempt status of purchases for resale, including the use of a modern, free mobile app designed for smooth verification processes. This comprehensive approach to handling sales tax through the Florida Annual Resale Certificate underscores Florida's commitment to facilitating a clear, efficient pathway for businesses to meet their tax obligations while nurturing a robust commercial environment.

Example - Florida Annual Resale Certificate Form

Flor id a An n u a l Re sa le Ce r t ifica t e

for

Sa le s Ta x

R. 04/19

FLO R ID A AN N U A L RE SA LE CE R T IF ICA T E S F OR SA LE S TA X

•Florida Annual Resale Certificates for Sales Tax are available for downloading and printing. You can download or print your certificate as often as needed.

•Signature requirements have been discontinued. The certificate user declares that the items or services being purchased will be resold when the certificate or the certificate number is issued to a seller to make

Re gist r a t ion

If your business will have taxable transactions, you must register as a sales and use tax dealer before you conduct business in Florida. You can register to collect and report tax through the Department's website. The site will guide you through an application interview that will help you determine your tax obligations. If you do not have Internet access, you can complete a paper Florida Business Tax Application (Form

Note: The information in this brochure applies only to the Florida Annual Resale Certificate for Sales Tax (“Annual Resale Certificate”). It does not apply to the Florida Annual Resale Certificate for Communications Services Tax (see Florida’s Communications Services Tax brochure

An Annual Resale Certificate will allow you to make

•Resale or

•

•

•

•

•

Resale of services.

Incorporation into and sale as part of the repair of tangible personal property by a repair dealer.

Incorporation as a material, ingredient, or component part of tangible personal property that is being produced for sale by manufacturing, compounding, or processing.

W h e n N ot t o U se y ou r AN N U A L RE SA LE CE R T IF ICA T E

An Annual Resale Certificate may not be used to make

•But not resold or

•

•

Before selling or renting the goods.

By your business or for personal purposes.

See the chart provided in this publication listing types of businesses and examples of items that you may purchase or rent

AN N U A L RE SA LE CE R T IF ICA T E S e x p ir e e a ch y e a r on D e ce m be r 3 1

As long as you are a registered sales and use tax dealer and you are conducting business, an Annual Resale Certificate will be issued to you each year. Certificates issued to new business locations beginning in

Florida Department of Revenue, Florida Annual Resale Certificate for Sales Tax, Page 1

Department's website for electronic or paper filers. If you file paper sales and use tax returns, your certificate will also be mailed to you with your annual coupon book or your paper return.

Using your tax account information, you may download and print your certificate. Go to floridarevenue.com/taxes/printcertificate.

I n a ct iv e Re gist e r e d D e a le r s a n d U se Ta x D e a le r s

Annual Resale Certificates are issued only to dealers who have a valid sales tax account and whose registration status is active, which means the business is open for business and collecting and remitting sales tax to the Department of Revenue. A registered dealer who is on inactive status or has only a use tax account will not be issued an Annual Resale Certificate.

Con solida t e d Re gist r a t ion s

Purchasers who file returns on a consolidated basis

Pu r ch a se r ’s Re spon sib ilit y

As a purchaser it is your responsibility to ensure that goods purchased using your Annual Resale Certificate are purchased for resale. If the goods purchased for resale are later used (not resold), you are responsible for reporting and paying use tax and surtax on the items.

Pe n a lt y

There are civil and criminal penalties for intentional misuse of an Annual Resale Certificate. Resale fraud is a

Se lle r ’s Re spon sib ilit y

Other businesses may buy goods from you tax exempt. Business owners who purchase goods for resale must provide you a copy of their current Annual Resale Certificate. You should not accept an Annual Resale Certificate if you know or have reason to believe that the goods are purchased for reasons other than those stated on the certificate. For example, a resale certificate from a car dealership should not be accepted for the purchase of office supplies or similar items not normally sold by car dealerships.

Se llin g D e a le r Lia bilit y

A selling dealer who accepts a copy of an Annual Resale Certificate will not be held liable for tax on the transaction if it is later determined the purchaser was not an active, registered dealer at the time of the transaction.

Sig n a t u r e N ot Re qu ir e d

A signature is not required on the annual resale certificate. The user certifies that the items or services purchased will be resold when the certificate or the certificate number is issued to a seller to purchase items and services

Florida Department of Revenue, Florida Annual Resale Certificate for Sales Tax, Page 2

Type of |

Purchases that may |

|

|

|

|||

qualify for resale |

Purchases that are generally taxable |

||

business |

|||

exemption |

|

||

|

|

||

|

Disposable |

Dishes, flatware, kitchen utensils, cleaning supplies, office |

|

|

|||

Restaurants |

containers, paper napkins, |

||

Bars |

plastic eating utensils, and |

equipment, office supplies, delivery vehicles, kitchen equipment, |

|

credit card machines, and menus |

|||

|

beverages |

|

|

|

Items for resale to |

Items used in serving customers |

|

Barber shops |

customers for off- premises |

||

|

use, including shampoos, |

brushes, cosmetics, cleaning supplies, hair dryers, curling irons, |

|

Beauty salons |

beautician chairs, scissors, combs, shears, office supplies, and |

||

hair tonics, brushes, and |

|||

|

office equipment |

||

|

cosmetics |

||

|

|

||

|

|

|

|

Car dealers |

Tires, batteries, auto parts, |

|

|

seat covers, auto paint, |

Hand and power tools, machinery, tape, sandpaper, |

||

|

|||

Auto repair shops |

antifreeze, nuts, bolts, and |

lubricants, solvents, rags, cleaning supplies, office supplies |

|

oil available for resale to |

and equipment, free loaner vehicles, delivery vehicles, |

||

Service stations |

|||

customers or incorporated |

wreckers, lifts, and diagnostic equipment |

||

|

into repairs |

|

|

|

|

|

|

Florists |

Fertilizers, flowers, shrubs, |

|

|

|

|

||

Plant nurseries |

potting soil, and garden |

Hoses, garden tools, lawn mowers, rakes, office equipment, |

|

tools for resale to |

|||

|

supplies used in |

||

Landscape |

customers on an itemized |

||

|

|||

gardeners |

invoice |

|

|

|

|

|

|

|

Soft drinks, candy, beer, |

|

|

|

|

||

Convenience |

supplies, office supplies, |

Cash registers, business equipment, cleaning supplies, office |

|

household supplies, |

|||

stores |

supplies, gas pumps, credit card machines, and ATMs |

||

cleaning supplies, and |

|||

|

|

||

|

motor oil available for |

|

|

|

resale to customers |

|

|

|

Items intended for resale |

|

|

|

rather than use in business |

Items for use in |

|

Pet shops |

operations, including pet |

pet litter, pet dishes, cleaning supplies, office supplies, and office |

|

|

food, pet litter, brushes, |

equipment |

|

|

and pet dishes |

|

|

|

|

|

|

Service providers, |

None. These types of |

|

|

businesses are generally |

|

||

for example: |

|

||

considered to be the end |

|

||

attorneys, |

Electronics, service vehicles, appliances, office equipment and |

||

users of products they use |

|||

accountants, |

supplies, books, stationery, computer hardware or software, |

||

architects, doctors, |

in providing service to |

bandages, mouthwash, toothbrushes, toys, and bedding |

|

customers and generally |

|||

dentists, daycare |

do not qualify for resale |

|

|

centers |

|

||

exemption. |

|

||

|

|

||

|

|

|

Florida Department of Revenue, Florida Annual Resale Certificate for Sales Tax, Page 3

D o cu m e n t in g Sa le s f or Re sa le

AS A SELLER you must document each

Method 1 – Obtain a copy of your customer’s current Annual Resale Certificate. You can accept paper or electronic copies. Maintain copies of the certificates (paper or electronic) for three years.

Method 2 – For each sale, obtain a transaction authorization number using your customer’s Annual Resale Certificate number. You do not need to maintain a copy of your customer’s Annual Resale Certificate number when you maintain a transaction authorization number for a

Phone: Dial

Online: Go to floridarevenue.com/taxes/certificates. Enter sales tax certificate numbers for verification.

FL TAX mobile app available for iPhone, iPad, Android phones and tablets, and Windows phones.

Find our free app in your device’s app store.

•

•

•

•

•

Download the free FL TAX mobile app from the app store on your mobile device. Enter your

Enter your customer’s Annual Resale Certificate number in the Buyer field.

A Valid or Not Valid response will be provided immediately. If the buyer’s certificate number is valid, you will receive a transaction authorization number. This number is for a single purchase only, and is not valid for any other purchases made by the same customer.

A verification response report will be stored in the app if your device’s memory space permits. This report can be emailed for easy record storage. The report displays the following information:

Date and time of transaction

Buyer’s name (when their certificate is valid)

Buyer’s sales tax or tax exemption certificate number

Verification response

Response details including transaction authorization number (when valid)

Florida Department of Revenue, Florida Annual Resale Certificate for Sales Tax, Page 4

Keep a record of all verification response reports to document your

The telephone system, the online system, and the mobile app will each issue a transaction authorization number or alert the seller that the purchaser does not have a valid resale certificate. The transaction authorization number is valid for that purchase only, and is not valid for other resale purchases made by the same purchaser. As a seller, you must get a new transaction authorization number for each resale transaction.

Method 3 – Each calendar year, obtain annual vendor authorization numbers for your regular customers.

Online: Go to floridarevenue.com/taxes/certificates. You can upload a batch file for customer certificate verification and retrieve that file 24 hours after submission.

You do not need to maintain a copy of your customer’s Annual Resale Certificate when you maintain a vendor transaction authorization number each calendar year for that customer.

Information, forms, and tutorials are available on the Department’s website at floridarevenue.com.

To speak with a Department representative, call Taxpayer Services at

To find a taxpayer service center near you, go to floridarevenue.com/taxes/servicecenters.

For written replies to tax questions, write to:

Taxpayer Services MS

Florida Department of Revenue

5050 W Tennessee St

Tallahassee FL

Subscribe to Receive Updates by Email from the Department

Subscribe to receive emails for due date reminders, Tax Information Publications (TIPs), or proposed rules at floridarevenue.com/dor/subscribe.

Florida Department of Revenue, Florida Annual Resale Certificate for Sales Tax, Page 5

File Specifications

| Fact Name | Description |

|---|---|

| Purpose of the Form | The Florida Annual Resale Certificate for Sales Tax allows businesses to make tax-exempt purchases or rentals of property or services intended for resale. |

| Availability | Businesses can download or print the certificate as often as needed directly from the Florida Department of Revenue's website. |

| Registration Requirement | Before conducting business in Florida, a business must register as a sales and use tax dealer to receive a Certificate of Registration (Form DR-11) and a Florida Annual Resale Certificate for Sales Tax (Form DR-13). |

| Expiration and Renewal | Annual Resale Certificates expire each year on December 31. Registered businesses conducting business will automatically receive a new certificate each year. |

| Penalties for Misuse | Misuse of the Annual Resale Certificate, such as purchasing items for use rather than for resale, can result in civil and criminal penalties, including a third-degree felony charge for resale fraud. |

Instructions on Filling in Florida Annual Resale Certificate

Filling out the Florida Annual Resale Certificate for Sales Tax is an essential process for business owners who intend to make tax-exempt purchases or rentals of property and services for resale in the state. This certificate enables businesses to buy goods without paying sales tax if the goods are to be resold in the normal course of operations. Given the significance of this certificate in ensuring compliance with Florida's tax laws, it's important to understand the correct way to complete and utilize the document.

- Before anything else, ensure your business is registered as a sales and use tax dealer through the Florida Department of Revenue's website. If you're not yet registered, complete the registration process to get your Certificate of Registration (Form DR-11) and your Florida Annual Resale Certificate for Sales Tax (Form DR-13).

- Once registered, you can download or print your Florida Annual Resale Certificate for Sales Tax directly from the Department's website. Navigate to floridarevenue.com/taxes/printcertificate and follow the instructions provided for either electronic or paper filers.

- Note that a signature is no longer required on the Annual Resale Certificate. By issuing the certificate or the certificate number to a seller, you're certifying that the purchases made will be for resale purposes.

- Keep in mind the specific uses allowed for your Annual Resale Certificate. It should only be used for purchasing goods or services that will be resold. Using the certificate for items that will not be resold or for personal use is prohibited and can lead to penalties.

- Be aware of the expiry date of your Annual Resale Certificate. It expires on December 31 each year. However, if you remain a registered dealer and continue conducting business, a new certificate will be automatically issued each year.

- Always verify the status of your business registration. Annual Resale Certificates are only issued to businesses with active status, meaning they are open for business and actively collecting and remitting sales tax to the Department of Revenue.

- If your business operates under a consolidated registration, you may use a copy of the current Annual Resale Certificate for either the consolidated registration number or an active location reported under the consolidated registration number. Sellers can accept either copy from the purchaser.

- Lastly, remember that misuse of an Annual Resale Certificate carries severe penalties, including civil and criminal sanctions. Ensure that all purchases made with the certificate are strictly for resale, as part of your business operations.

Following this guided procedure will not only keep your business in good standing with the Florida Department of Revenue but will also streamline your resale operations by allowing tax-exempt purchases. Always stay updated on the guidelines and make sure to renew your certificate annually to continue enjoying the benefits of resale privileges in Florida.

Understanding Florida Annual Resale Certificate

What is a Florida Annual Resale Certificate for Sales Tax?

A Florida Annual Resale Certificate for Sales Tax allows businesses to make tax-exempt purchases or rentals of property or services that will be resold. It is issued by the Florida Department of Revenue to registered sales and use tax dealers conducting business in Florida.

How can I obtain a Florida Annual Resale Certificate?

To obtain a Florida Annual Resale Certificate, you must first register as a sales and use tax dealer on the Florida Department of Revenue’s website or complete a paper Florida Business Tax Application (Form DR-1) if you do not have Internet access. Once approved, you will receive a Certificate of Registration (Form DR-11) and a Florida Annual Resale Certificate (Form DR-13).

Can I use the Florida Annual Resale Certificate for all my purchases?

No, the Florida Annual Resale Certificate can only be used for purchasing or renting property or services that will be resold or re-rented. It cannot be used for items that will be used personally by the business or before selling or renting the goods.

Does the Florida Annual Resale Certificate expire?

Yes, the Florida Annual Resale Certificate expires each year on December 31. Active registered sales and use tax dealers will receive a new certificate each year for as long as they are conducting business.

How can I download or print my Florida Annual Resale Certificate?

You can download and print your certificate as often as needed from the Florida Department of Revenue’s website by using your tax account information. Detailed instructions can be found by going to floridarevenue.com/taxes/printcertificate.

What if my business is on inactive status?

If your business is on inactive status or if you only have a use tax account, you will not be issued an Annual Resale Certificate. Active registration status indicates the business is open and actively collecting and remitting sales tax.

Can consolidated registrations use the Florida Annual Resale Certificate?

Yes, purchasers who file returns on a consolidated basis (80-code account numbers) can use a copy of the current Annual Resale Certificate for either the consolidated registration number or the active location reported under the consolidated registration number.

What are my responsibilities as a purchaser using the Florida Annual Resale Certificate?

As a purchaser, it's your responsibility to ensure that goods purchased with the Florida Annual Resale Certificate are for resale. If the goods are later used rather than resold, you must report and pay use tax and surtax on those items.

What penalties exist for misuse of the Florida Annual Resale Certificate?

Misusing the Florida Annual Resale Certificate, including using it to evade tax, is subject to civil and criminal penalties. Resale fraud is considered a third-degree felony subject to a 200 percent penalty.

How should sales for resale be documented?

Sales for resale must be documented by obtaining a copy of your customer’s current Annual Resale Certificate, obtaining a transaction authorization number using your customer’s certificate number for each sale, or obtaining annual vendor authorization numbers for your regular customers. These methods help ensure that sales are properly documented for tax-exempt purposes.

Common mistakes

Filling out forms can sometimes feel like navigating a maze. When it comes to the Florida Annual Resale Certificate form, even the smallest misstep can lead to big headaches. Here are six common mistakes people make when filling out this form:

- Forgetting to register as a sales and use tax dealer before conducting business in Florida. If you’re heading into the world of selling, make sure you’ve signed up through the appropriate channels first.

- Using the certificate for personal purchases or for items that won’t be resold or rented. It’s tempting to think of this certificate as a get-out-of-tax-free card, but its use is strictly for business-to-business transactions where the end product will be sold on.

- Not keeping updated certificates for each calendar year. Certificates expire on December 31st annually, so don’t get caught with an outdated document.

- Printing multiple copies for multiple locations when only one certificate is needed per consolidated registration. Streamline your paperwork and save a few trees in the process.

- Overlooking the responsibility to pay use tax if items purchased for resale are later used instead. Changing your mind can cost you, so plan carefully when making purchases.

- Misunderstanding seller and purchaser responsibilities regarding the acceptance of resale certificates. Just because a transaction is tax-exempt to you doesn’t mean it’s exempt for everyone involved.

Avoiding these pitfalls doesn’t just keep you on the right side of regulations; it makes the whole process smoother for everyone involved. Whether you’re a seasoned business owner or just starting out, keep these mistakes in mind for a hassle-free experience with your Florida Annual Resale Certificate.

Documents used along the form

When working with the Florida Annual Resale Certificate for Sales Tax, businesses often require additional forms and documents to ensure compliance with state tax laws and to streamline the process of tax-exempt purchasing for resale purposes. Understanding these documents and their uses simplifies the process for both sellers and purchasers.

- Florida Business Tax Application (Form DR-1): This is the initial registration form needed to apply for a sales and use tax dealer permit in Florida. It's the first step for businesses to become tax compliant, allowing them to legally conduct sales within the state.

- Certificate of Registration (Form DR-11): Issued after the approval of Form DR-1, this certificate signifies that a business is officially registered as a dealer of sales and use tax with the Florida Department of Revenue.

- Communication Services Tax Certificate (Form DR-700012): Similar to the Annual Resale Certificate for sales tax, this specific certificate is necessary for businesses that are purchasing communication services for resale. It ensures the tax-exempt status of these purchases.

- Florida Sales and Use Tax Return (Form DR-15): Filed periodically, this return reports taxable sales, purchases, and the collected sales tax that is due to the Florida Department of Revenue from operational business activities.

- Consumer’s Certificate of Exemption (Form DR-14): Nonprofit organizations and governmental entities use this certificate to make tax-exempt purchases or leases in Florida, including items for resale.

- Use Tax Return (Form DR-15MO): Required for out-of-state purchases brought into Florida for use, distribution, or consumption within the state. It ensures that use tax is paid on items that did not have Florida sales tax collected at the time of purchase.

Each document plays a crucial role in the tax compliance and operational processes of businesses dealing with resalable goods and services in Florida. From registering as a tax dealer to reporting sales and use tax, understanding and properly utilizing these forms enables businesses to efficiently manage their tax obligations and benefits within Florida’s regulatory framework.

Similar forms

The Florida Business Tax Application (Form DR-1) shares similarities with the Florida Annual Resale Certificate for Sales Tax in that both are integral steps in the process of registering and legitimizing a business for tax purposes within the state of Florida. While the Annual Resale Certificate specifically permits businesses to make tax-exempt purchases for resale, the DR-1 form is the primary document used to apply for a business tax account, which is a prerequisite for obtaining the resale certificate.

The Certificate of Registration (Form DR-11) is closely related to the Florida Annual Resale Certificate as well. After completing the DR-1 form, businesses receive the DR-11 certificate, which is their proof of registration as a dealer with the Florida Department of Revenue. This registration is required before a business can be issued an Annual Resale Certificate, linking the two documents in the business setup and tax compliance process.

The Florida Annual Resale Certificate for Communications Services Tax parallels the Annual Resale Certificate for Sales Tax in its purpose and use, albeit for a different tax category. Both certificates allow businesses to purchase goods or services tax-exempt for the purpose of resale; however, they apply to different types of taxes—sales and use tax versus communications services tax—highlighting the specialized tax laws within the state.

Exemption Certificates for Sales Tax in other states have functional similarities to the Florida Annual Resale Certificate. These certificates universally serve to exempt businesses from paying sales tax on items purchased for resale. Although the specifics and requirements may vary from state to state, the underlying principle of promoting tax-free purchases for resale purposes remains constant, illustrating a common tax practice across jurisdictions.

Lastly, the Use Tax Account Registration documents for businesses may also be compared to the Florida Annual Resale Certificate, especially in contexts where businesses must document the exemption from sales tax for items not sold but used within the business. While a resale certificate facilitates tax-free purchases intended for resale, registering for a use tax account ensures compliance when items are purchased tax-exempt for use rather than sale, covering the opposite end of the tax compliance spectrum.

Dos and Don'ts

When dealing with the Florida Annual Resale Certificate for Sales Tax, there are specific do's and don'ts to ensure compliance and avoid potential penalties. Here's a guide on what you should and shouldn't do when filling out this form:

- Do ensure your business is registered as a sales and use tax dealer if you're conducting taxable transactions in Florida.

- Do not use the Annual Resale Certificate for personal purchases or for items that your business will use rather than resell or re-rent.

- Do download or print your certificate from the Florida Department of Revenue's website as often as needed.

- Do not forget that Annual Resale Certificates expire each year on December 31. Make sure your certificate is current before making any tax-exempt purchases.

- Do check the list provided in the Florida Department of Revenue's publication for examples of what can be purchased tax-free with an Annual Resale Certificate.

- Do not misuse the Annual Resale Certificate to evade paying taxes. Misuse can lead to civil and criminal penalties, including a third-degree felony for resale fraud.

- Do keep a record of all tax-exempt purchases made with the Annual Resale Certificate. If goods initially purchased for resale are later used by your business, you're responsible for paying the applicable use tax and surtax.

- Do not accept an Annual Resale Certificate from a buyer if you have reason to believe the items are not being purchased for resale, such as office supplies from a car dealership.

Compliance with these guidelines helps ensure that your business uses the Florida Annual Resale Certificate for Sales Tax correctly, avoiding penalties and maintaining good standing with the Florida Department of Revenue.

Misconceptions

Understanding the Florida Annual Resale Certificate is crucial for business owners. However, there are several misconceptions that can lead to confusion or improper use of the certificate. Here are nine common misunderstandings and clarifications to help guide you:

- Anyone can use the Florida Annual Resale Certificate. Actually, only registered sales and use tax dealers in active status, who plan to resell the purchased goods or services, are eligible to use this certificate.

- It applies to purchases of all goods and services. This is not the case. The certificate is only for goods and services that will be resold or re-rented. Items used for personal use or consumed by the business cannot be purchased tax-free with this certificate.

- It’s okay to use the certificate for tax-exempt purchases of personal items. Misusing the certificate for personal purchases or items not intended for resale can lead to severe penalties, including civil and criminal charges.

- The certificate is valid indefinitely. Each Annual Resale Certificate expires on December 31st of the year it was issued. A new certificate is provided annually as long as the business remains eligible.

- There's no need to provide the certificate to the seller at the time of purchase. Sellers must be provided with a copy of the current Annual Resale Certificate or otherwise validated electronically through an authorization number to document the tax-exempt sale.

- A signature is required on the certificate. As of the last update, signatures are no longer required on the certificate. The user simply needs to provide the certificate or the certificate number to make tax-exempt purchases for resale.

- Only a paper version of the certificate is valid. Electronic copies of the certificate are equally valid. Dealers are allowed to download and print their certificate from the Florida Department of Revenue’s website as needed.

- Using an expired certificate is not a big deal. Utilizing an expired or invalid certificate for tax-exempt purchases can result in penalties and fines. Businesses must ensure their certificates are current and valid for each tax year.

- Only goods can be purchased tax-exempt with the certificate. The certificate also applies to services that are intended for resale, not just tangible personal property. This can include various professional and non-tangible services, as long as they are resold to the end consumer.

It is essential for businesses operating in Florida to fully understand the proper use of the Florida Annual Resale Certificate. This ensures compliance with tax laws and avoids potential legal and financial repercussions. Always consult with the Florida Department of Revenue or a tax professional if you have questions regarding your specific situation.

Key takeaways

Florida Annual Resale Certificates for Sales Tax facilitate tax-exempt purchases or rentals of property and services intended for resale, which support businesses in managing their taxable transactions more efficiently. These certificates, critical for maintaining compliance and optimizing business operations, provide several key benefits and responsibilities for users:

- Access to tax-exempt purchases or rentals of property and services, specified for resale activities, includes a broad range of items from tangible personal property to services incorporated into repairs.

- Annual Resale Certificates must not be utilized to make tax-exempt transactions on goods or services intended for business use or personal consumption instead of resale.

- The renewal of the Annual Resale Certificate occurs automatically each year, provided the business maintains an active sales and use tax registration with the Florida Department of Revenue.

- Purchasers bear the responsibility for ensuring that all items acquired under the certificate are indeed for resale; misuse can lead to severe penalties, including both civil and criminal charges.

Businesses seeking to leverage the benefits of the Florida Annual Resale Certificate must first ensure their eligibility by registering as a sales and use tax dealer. By adhering to the guidelines set forth by the Florida Department of Revenue, businesses can download or print their certificates as necessary for operational use. It's critically important that both purchasers and sellers maintain accurate records to support the tax-exempt nature of transactions facilitated by these certificates. Effective use of the Annual Resale Certificate supports businesses in maintaining compliance with state tax laws while minimizing unnecessary tax expenditures.

Popular PDF Templates

Florida S Corp Filing Requirements - The form serves as a declaration of income and expenses, affecting the corporation's tax liability in Florida.

Dr 504 Florida - Submission of the DR-504 form requires a comprehensive understanding of the property's use and organization's activities.

Notice to Owner Form Pdf - Conveys the critical nature of adhering to Florida's Construction Lien Law for all parties involved in property development.