Official Florida 3170 Template

The journey through the legal landscape of establishing paternity in Florida involves a critical piece of documentation known as the Florida 3170 form. This form is a cornerstone for parents seeking to acknowledge paternity formally or to contest it, serving as a binding acknowledgment or dispute of a child's parentage. It plays a pivotal role not only in validating a child's identity and familial ties but also in securing legal rights, benefits, and obligations related to child support, custody, and visitation. The completion and submission of this form are governed by specific state laws and guidelines, which ensure that all parties involved are informed and consent to the declarations made within. Moreover, the form is a gateway to a multitude of legal processes and outcomes, impacting the lives of the child, the parents, and their wider familial relationships. Understanding its implications, requirements, and the correct procedure for its submission is essential for anyone navigating the complex terrain of paternity issues in Florida.

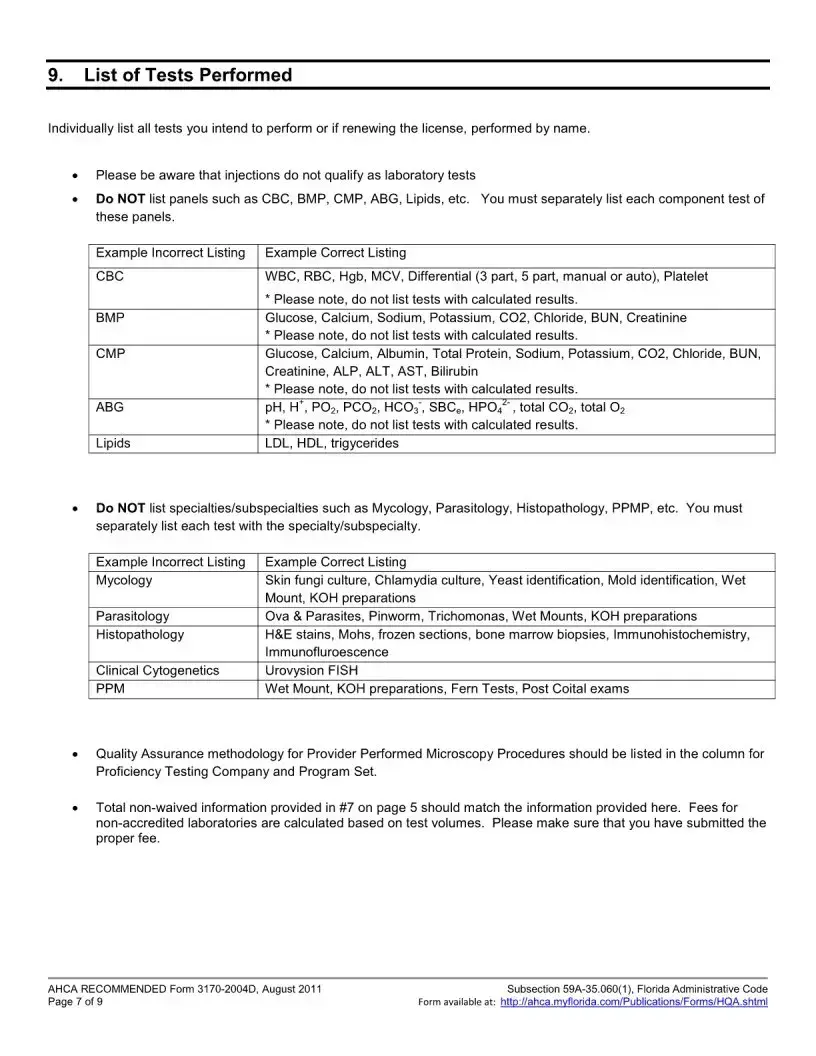

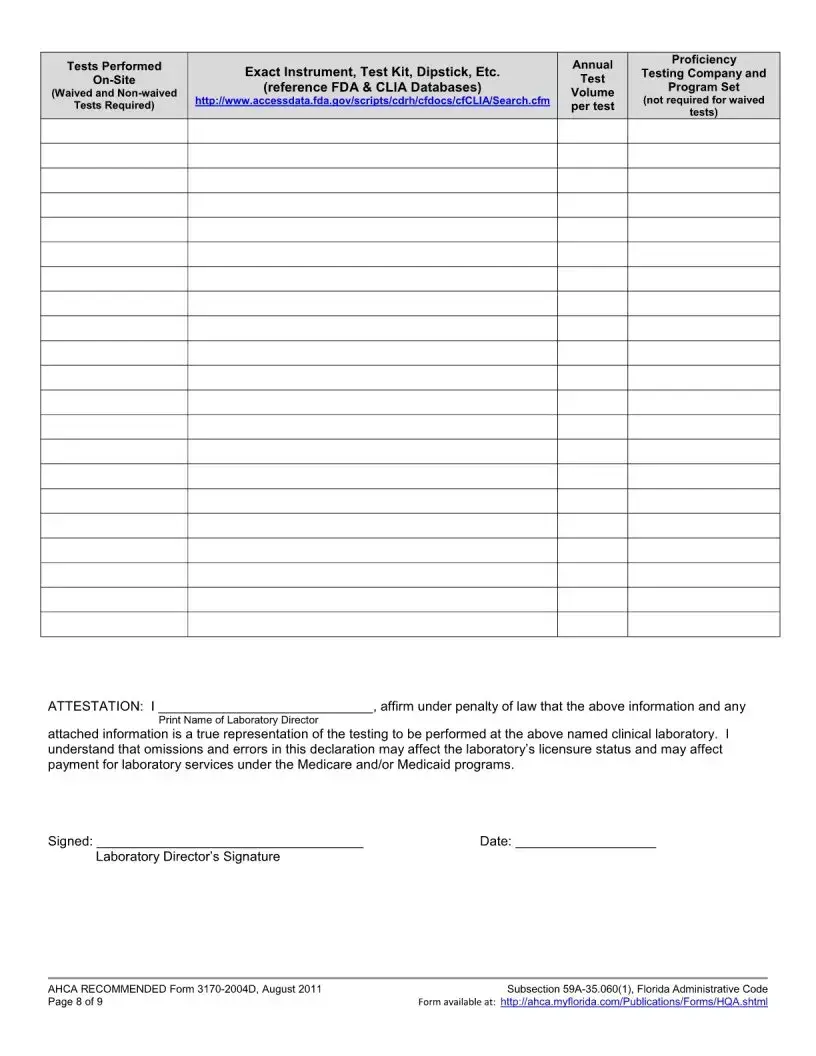

Example - Florida 3170 Form

File Specifications

| Fact Name | Description |

|---|---|

| Purpose of Form | The Florida 3170 form is used for the purpose of applying for a homestead exemption, which can reduce the taxable value of a primary residence. |

| Eligibility Requirements | To qualify, applicants must hold title to the property and it must be their permanent residence as of January 1 of the tax year in question. |

| Submission Deadline | The form must be submitted by March 1st of the tax year to receive the exemption for that year. |

| Renewal Process | While the initial application requires this form, the homestead exemption is automatically renewed in subsequent years unless a change in eligibility occurs. |

| Governing Law | The form and its submission process are governed by Florida Statute 196, which outlines property tax exemptions. |

| Supporting Documentation Required | Applicants must provide proof of residence, such as a Florida driver’s license or ID card, and proof of ownership, like a deed or tax bill. |

Instructions on Filling in Florida 3170

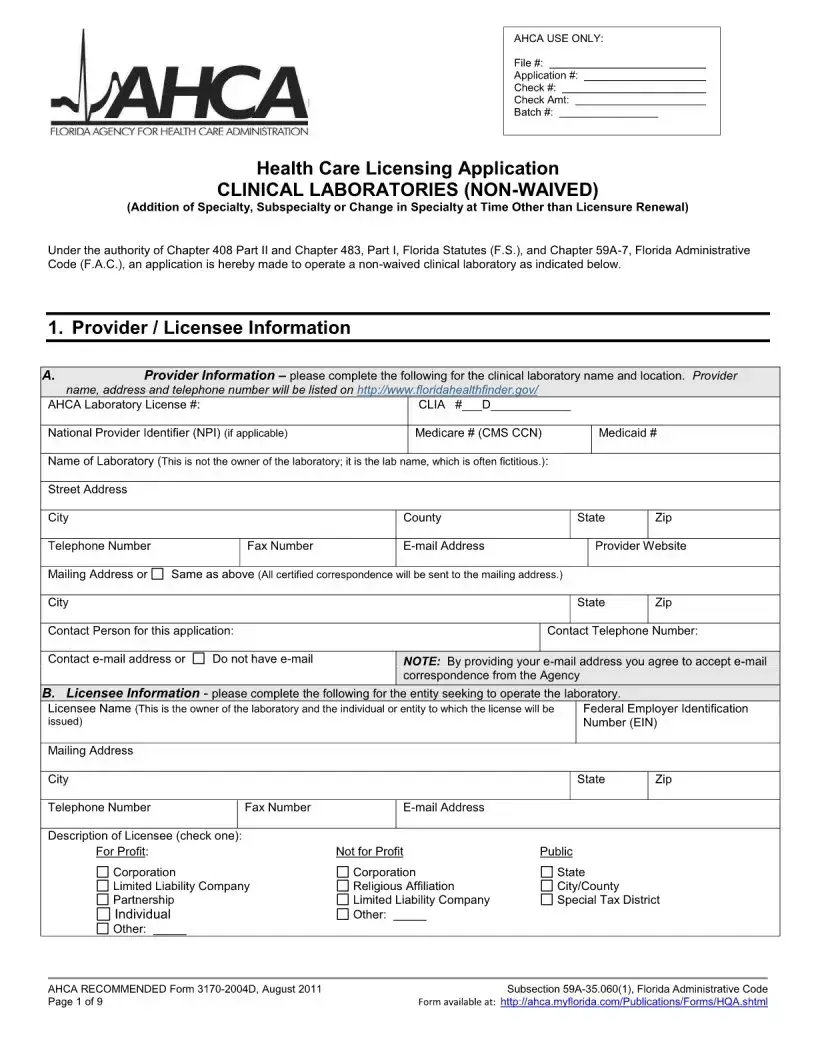

Filling out a form can often feel daunting, especially when it pertains to official matters. The Florida 3170 form is a critical document for residents within the state, marking an important step in the process it's designed for. Completing this form accurately is essential for ensuring the procedure moves forward without unnecessary delays. The steps outlined below are designed to help individuals approach this task with confidence, making sure they provide all the necessary information clearly and concisely.

- Begin by downloading the latest version of the Florida 3170 form from the official website to ensure you have the most current form.

- Read through the entire form first to familiarize yourself with the type of information you will need to provide.

- Fill in your personal details in the section allocated at the top of the form. This usually includes your full name, address, date of birth, and other identification details.

- In the sections that follow, provide the specific information requested by the form. This may include detailed descriptions, dates, and other pertinent data. Ensure the information is accurate and complete.

- For sections that require selections from multiple choices, mark the appropriate box clearly. If the form is online, click the corresponding circle or box.

- Review all the information entered for accuracy. Mistakes or inaccuracies can lead to delays, so it's crucial to double-check every entry.

- Sign and date the form in the designated area. If the form is digital, ensure you follow the instructions for a secure, electronic signature.

- Follow the submission instructions provided with the form. This may include mailing it to a specific address or submitting it through an online portal.

- After submission, make a note of any confirmation numbers or receipts. It's also a good idea to keep a copy of the completed form for your records.

Once the Florida 3170 form has been properly filled out and submitted, the next steps will depend on the specific process the form is part of. Typically, there will be a review period, during which the information provided will be verified. If additional information or documentation is needed, you will be contacted. Patience during this review period is important, as these processes can often take time. Staying informed about the progress and responding promptly to any requests from the reviewing body will help ensure the process moves forward as smoothly as possible.

Understanding Florida 3170

What is the Florida 3170 form?

The Florida 3170 form, also known as the Uniform Incident/Complaint Report form, is used by law enforcement agencies in Florida to report incidents or complaints they encounter during their duties. This form is critical for documenting details of incidents, including information about the individuals involved, the nature of the complaint or incident, and the actions taken by the officers.

Who needs to fill out the Florida 3170 form?

Law enforcement officers in the State of Florida are required to fill out the Florida 3170 form. When officers respond to or discover an incident or receive a complaint, they use this form to record the relevant details. It is an essential part of official documentation and record-keeping for police departments and other law enforcement agencies.

When should the Florida 3170 form be submitted?

This form should be completed and submitted as soon as possible after the incident or complaint is addressed. Timely submission is crucial for ensuring that the details are recorded accurately and for facilitating any necessary follow-up actions or investigations.

What information is required on the Florida 3170 form?

The form asks for comprehensive details about the incident or complaint, including but not limited to: the date, time, and location of the incident; a description of what occurred; the names and contact information of any individuals involved; and the actions taken by responding officers. It may also require supporting documents or evidence to be attached.

Where can I obtain a Florida 3170 form?

Florida 3170 forms are typically available through your local law enforcement agency. They might also be accessible online through the official website of the Florida Department of Law Enforcement or the specific county or city police department's site.

Is training required to fill out the Florida 3170 form correctly?

Yes, law enforcement officers are typically trained on how to properly fill out the Florida 3170 form as part of their standard training curriculum. This ensures that all necessary information is accurately and completely documented.

Can the Florida 3170 form be submitted electronically?

Depending on the law enforcement agency, the Florida 3170 form may be submitted electronically. Many agencies have moved towards digital record-keeping and reporting, allowing for electronic submission to streamline the process. However, it is best to check with the specific agency to confirm their submission requirements.

How long are Florida 3170 forms kept on file?

Florida law dictates the retention period for incident and complaint reports, including the Florida 3170 form. Typically, these records must be kept for a minimum of several years after the reporting date. The exact duration can vary based on the nature of the incident and any applicable statutes or regulations governing public records.

Are there any penalties for not completing the Florida 3170 form correctly?

Failure to properly fill out and submit the Florida 3170 form can result in administrative action against the law enforcement officer or agency. This could include reprimands, additional training requirements, or other disciplinary measures. It's crucial to complete these forms accurately and thoroughly to maintain accountability and uphold the integrity of the legal system.

Common mistakes

When filling out the Florida 3170 form, many people make mistakes that can lead to delays or even rejections of their submissions. To help ensure that the process goes smoothly, it's important to be aware of common errors that occur during the completion of this document.

Not checking the form version – It's essential to use the most current form available, as outdated versions may not be accepted.

Failing to read the instructions carefully before starting – Every form has specific requirements that need to be followed precisely.

Omitting information in required fields – Leaving sections blank when information is requested can lead to an incomplete submission.

Providing incorrect information – Mistakes in key details, like social security numbers or addresses, can cause significant delays.

Ignoring format requirements for dates and numbers – The form may specify particular formats that need to be adhered to.

Forgetting to sign and date the form – An unsigned or undated form is often considered invalid.

Using unacceptable ink colors – For instance, some forms require black ink, and using another color might make the form void.

Not reviewing the form for errors before submission – A quick review can catch mistakes that were initially overlooked.

Misplacing the form after completion – It's crucial to keep track of the form until it is successfully submitted.

Assuming one part of the form doesn't apply without verifying – Skipping sections without proper justification can result in an incomplete application.

To ensure a successful submission of the Florida 3170 form, it's beneficial to be conscious of these common errors. Taking the time to review and verify information can significantly reduce the risk of experiencing delays or additional complications.

Documents used along the form

When handling legal matters, especially regarding the Florida 3170 form, which is commonly used for real estate transactions, it's important to prepare and gather all necessary documentation in advance. The Florida 3170 form serves as a pivotal component in property dealings, laying down the conditions for the sale, including but not limited to, the obligations of both the buyer and seller. Alongside this form, there are several other crucial documents and forms that are often required to ensure a smooth and legally sound process. The completeness of this documentation can significantly streamline the transaction and help avoid any unnecessary delays or legal complications.

- Warranty Deed – This document is used to formally transfer property ownership from the seller to the buyer, guaranteeing that the seller holds a clear title to the property.

- Title Insurance Commitment – Offers a detailed report of the legal status of the property’s title and highlights any outstanding liens, encumbrances, or defects. It serves as a precursor to obtaining title insurance.

- Closing Disclosure – Required for most real estate transactions, this form provides a detailed breakdown of all the financial aspects of the deal, including loan terms, closing costs, and other transaction fees, at least three days before closing.

- Loan Estimate – Reflects an estimate of the loan terms, projected payments, and closing costs. It is typically provided to the borrower within three days after submitting a loan application.

- Proof of Homeowners Insurance – Confirms that the property to be purchased is insured, which is a requirement by lenders before closing on a home loan.

- Survey – Illustrates the property’s boundaries, measurements, and structures, verifying that the property does not infringe on any neighboring properties’ boundaries.

- Home Inspection Report – A comprehensive assessment of the property’s condition, identifying any potential issues or repairs that may need to be addressed.

- Flood Zone Statement – Determines whether the property is situated in a flood hazard area, which could necessitate additional insurance.

Having these documents in conjunction with the Florida 3170 form not only safeguards the interests of all parties involved but also fortifies the legal foundation of the property transaction. Maintaining a checklist of these documents can facilitate a more organized approach, reducing the risk of overlooking any critical piece of paperwork. Ultimately, the success of a real estate transaction hinges on the meticulous preparation and review of all necessary documentation, ensuring a legally compliant and hassle-free transfer of property.

Similar forms

California Declaration of Domicile (Form MC-031) - This document, akin to the Florida 3170 form, is utilized by residents to declare their primary place of residence within the state. Both forms serve a similar purpose in helping individuals assert their residency status, which can affect voting, taxation, and eligibility for state benefits. Despite the difference in state jurisdiction, the core function of declaring a legal domicile connects these documents.

New York Statement of Residence (Form IT-203-B) - Much like the Florida 3170 form, New York's Statement of Residence is designed for individuals to declare their residential status, which is a crucial step in determining state tax obligations. Both forms collect detailed personal information and require the declarant to outline their living arrangements, illustrating their similarities in gathering residency data for state-specific legal and fiscal purposes.

Texas Declaration of Residency (Form P-5) - This form parallels the Florida 3170 in that both are used to certify an individual’s residency within their respective states. The primary purpose of such documents is to aid in various legal processes, including the determination of in-state tuition eligibility and voting rights. Each form is a vital tool in asserting one's legal state of residency, despite differing in their specific state requirements and format.

Georgia Voter Registration Form (Form VR) - Like the Florida 3170, Georgia's Voter Registration Form includes elements that affirm an individual's residency in order to participate in state and federal elections. Although the primary purpose of Georgia’s form is voter registration, the necessity of declaring one’s residence to prove eligibility shares a functional similarity with the declaration intentions of the Florida 3170 form.

Illinois Certificate of Residency (Form CRT-61) - Comparable to the Florida 3170, the Illinois Certificate of Residency is structured to certify an individual’s residency within the state for tax purposes. Both forms play a significant role in determining the tax liabilities of residents versus non-residents and require detailed personal and residency information for processing. The similarity lies in their joint aim of establishing residency to comply with state-specific tax regulations.

Dos and Don'ts

Filling out the Florida 3170 form, which is essential for various transactions within the state, requires careful attention to detail. Below are four things you should do and four things you shouldn't do to ensure the process is completed correctly and efficiently.

What You Should Do

- Ensure all the information entered on the form is accurate and up to date. Incorrect information can lead to delays or rejection of the form.

- Sign and date the form where required. An unsigned or undated form is often considered incomplete and will not be processed.

- Use black or blue ink if filling out the form by hand. These colors are preferred because they are easier to read and photocopy.

- Keep a copy of the completed form for your records. This can be helpful for future reference or if any discrepancies arise.

What You Shouldn't Do

- Do not leave mandatory fields blank. If a section does not apply to your situation, it is better to write 'N/A' (not applicable) than to leave it empty.

- Do not use correction fluid or tape. Mistakes should be neatly crossed out with a single line, and the correct information should be written nearby.

- Do not forget to include necessary attachments or supporting documents. These are often required to process the form correctly.

- Do not ignore the form's instructions. Each section comes with specific directions that should be followed closely to avoid mistakes.

Misconceptions

When dealing with the Florida 3170 form, numerous misunderstandings can lead to costly mistakes. Here, we'll address some of the most common misconceptions to ensure you have the correct information.

The Florida 3170 form is only for businesses: Many believe this form is strictly for business use. However, it's also required for certain individuals, particularly those involved in specific types of transactions or legal situations in Florida.

It can be filed at any time: There's a prevailing thought that the Florida 3170 form can be submitted at any point. Contrary to this belief, there are strict deadlines for filing, which vary depending on the specific circumstances or requirements set forth by Florida law.

Filing the form is optional: Some people mistakenly consider filing the Florida 3170 form as optional. In reality, for those to whom it applies, submitting this form is mandatory and failing to do so can result in penalties or legal issues.

The form is complicated and requires a legal professional to fill out: While it's true that legal documents can be complex, the Florida 3170 form is designed to be straightforward. Most individuals can complete it without legal help, although consulting a professional is beneficial if there are any uncertainties.

Electronic submission is not an option: In today's digital age, the misconception that forms like the Florida 3170 must be submitted in paper form persists. However, electronic submission is not only possible but also preferred in many cases for its speed and convenience.

There's no guidance available for filling out the form: People often feel left in the dark when filling out forms. For the Florida 3170 form, guidance is available through various resources, including official websites and help centers, to assist individuals through the process.

Any mistake on the form can lead to severe legal action: Mistakes happen, and while accuracy is crucial, most errors on the Florida 3170 form can be corrected without severe consequences. It's important to address mistakes promptly upon discovery.

The form only affects those residing in Florida: This form can have implications for individuals or entities outside of Florida, particularly if they're engaged in activities or transactions that fall under Florida's jurisdiction.

Once submitted, the information on the form cannot be updated: Circumstances change, and the Florida 3170 form allows for amendments. If there are significant changes after submission, updating the information is not only possible but often required.

There's a fee for every submission or amendment: The assumption that filing or amending the Florida 3170 form always incurs a fee is incorrect. While some scenarios may require a fee, not all submissions or amendments are subject to charges.

Understanding these misconceptions about the Florida 3170 form can lead to a smoother experience and ensure compliance with all relevant laws and regulations. When in doubt, seeking advice from a professional can provide clarity and guidance.

Key takeaways

The Florida 3170 form is essential for various interactions within the state's legal and administrative frameworks. Understanding how to properly fill out and use this form can streamline processes and ensure compliance with state requirements. Here are key takeaways about the Florida 3170 form:

- Accuracy is crucial when completing the Florida 3170 form. All information provided must be current and correct, including personal identifiers and pertinent dates. This precision helps in the swift processing of the form and avoids unnecessary delays or rejections due to inaccuracies.

- The form must be used within its intended context. The Florida 3170 form is designed for specific legal or administrative purposes. Users should ensure they are employing the form in the appropriate situations and that it fulfills the requirements of their specific needs.

- Timeliness in form submission plays a significant role in its processing. Deadlines are often established for the submission of forms like the Florida 3170. Adhering to these deadlines is essential to avoid penalties or the forfeiture of certain rights or privileges.

- Understanding the instructions and requirements for filling out the form is vital. The Florida 3170 form comes with guidelines that instruct the user on how to properly complete the form, including how to submit it and any supporting documents that may be required. Familiarity with these instructions ensures that the process is done correctly and efficiently.

Following these key takeaways will generally help individuals and entities to appropriately fill out and utilize the Florida 3170 form, contributing to a smoother transaction with state departments and agencies.

Popular PDF Templates

Florida Child Support Calculator 2023 - Essential information for families navigating child support arrangements in Florida, featuring instructions for Form 12.902(e).

Do You Need a Commissary for a Food Truck in Florida - A preparatory step for mobile food vendors in Florida, outlining the specifics of their commissary support to meet state guidelines for operation.

Florida Hvac Efficiency Card - Essential for HVAC contractors, this form outlines the specifications of air conditioning systems being replaced for city records.