Official Business Partner Number Florida Template

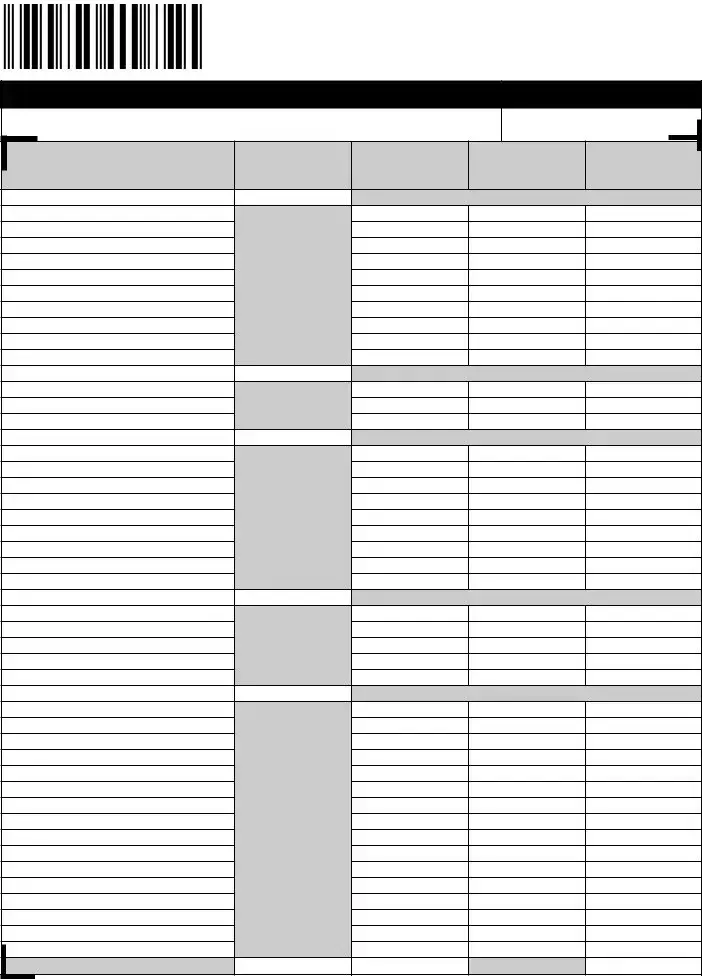

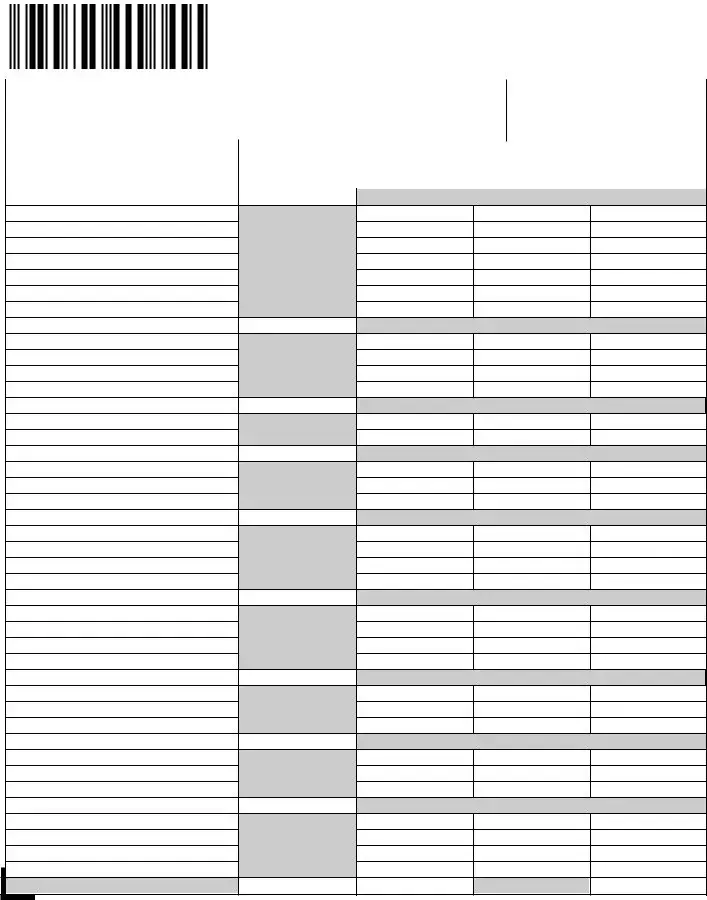

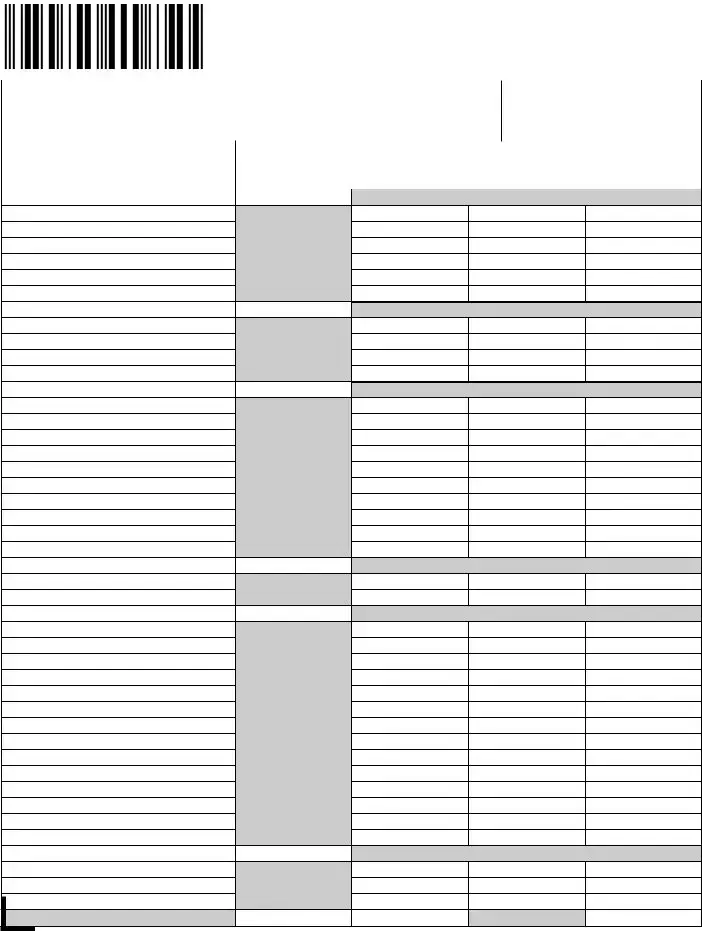

For businesses operating within Florida, understanding and managing taxes is a pivotal aspect of staying compliant with state regulations. Among the various forms and procedures that businesses need to familiarize themselves with, the Business Partner Number Florida form, specifically the DR-700016, plays a crucial role. This form is essentially utilized for the purpose of filing the Communications Services Tax Return. It encompasses detailed sections that request information on the business name, address, the reporting period for taxes, and the Business Partner Number alongside the Federal Employer Identification Number (FEIN). More so, it offers a straightforward layout for businesses to report their liabilities concerning the state, gross receipts, and local portions of the communications services tax. Businesses preparing to discontinue operations can also indicate their final return through this form, emphasizing its importance in facilitating a wide range of tax-related declarations. The meticulous structure of the form – guiding through tax due on sales, collection allowances, penalties, and adjustments with a provision for multistate credits – underscores its significance in the streamlined financial oversight of businesses engaged in the provision of communications services. Hence, getting acquainted with the features and correct completion of this form is indispensable for ensuring accurate tax reporting and compliance.

Example - Business Partner Number Florida Form

|

|

|

|

|

|

|

Florida Communications Services Tax Return |

|

|

|

|

|

|

|

|

|

|

|

Name |

|

|

|

Address |

BUSINESS PARTNER NUMBER |

FEIN |

City/State/ZIP |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Check here if you are discontinuing your business |

|||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

and this is your final return (see page 15) |

|

|

|

||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

FROM: |

|

REPORTING PERIOD |

TO: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Handwritten Example |

|

|

|

Typed Example |

|

||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

0 |

1 |

2 |

3 |

4 |

5 |

6 |

7 |

8 |

9 |

|

0123456789 |

|

|

|

||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Use black ink. |

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||

|

M M D D |

Y |

|

Y Y |

|

Y |

|

M M D D |

|

|

|

Y |

|

|

Y Y |

|

|

Y |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

US Dollars |

|

|

|

Cents |

|

|

||||

1.Tax due on sales subject to the state portion of the

communications services tax (from Summary of Sched. I, Col. F, Line 3) .... 1.

2.Tax due on sales subject to the gross receipts portion of the

communications services tax (from Summary of Sched. I, Col. G, Line 6) ... 2.

3.Tax due on sales subject to the local portion of the communications

services tax (from Summary of Sched. I, Col. H, Line 7) |

3. |

4.Tax due for

5. |

Total communications services tax (add Lines 1 through 4) |

5. |

6. |

Collection allowance. Rate:________________ |

6. |

|

(If rate above is blank, check one) ❑ None applies ❑ .0025 ❑ .0075 |

|

7. |

Net communications services tax due (subtract Line 6 from Line 5) |

7. |

8.Penalty D..........................................................................................................R - 7 0 0 0 1 68.

9.Interest .......................................................................................................... 9.

10. |

Adjustments (from Schedule III, Column G and/or Schedule IV, Column U)10. |

|

11. |

Multistate credits (from Schedule V) |

11. |

12. |

Amount due with return |

12. |

,

,

,

,

,

,

,

,

,

,

,

,

,

,

,

,

,

,

,

,

,

,

,

,

,

,

,

,

,

,

,

,

,

,

,

,

|

AUTHORIZATION |

Under penalties of perjury, I hereby certify that this return has been examined by me and to the best of my knowledge and belief is a true and complete return. [ ss. 92.525(2), |

|||

|

|

|

203.01(1), and 837.06, Florida Statutes]. |

|

|

|

Type or print name |

Authorized signature |

Date |

||

|

|

|

|

|

|

|

Preparer (type or print name) |

Preparer’s signature |

Date |

||

|

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

Contact name (type or print name) |

Contact phone number |

|

||

|

|

|

|

|

|

|

|

|

|

|

|

Payment Coupon |

|

|

|

|

DO NOT DETACH |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||

|

|

|

|

|

To ensure proper credit to your account, attach your check |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

R. 12/01 |

||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||||||

|

|

|

|

|

|

to this payment coupon and mail with tax return. |

|

|

|

|

|

|

|

|

|

|

|

|

DOR USE ONLY |

|||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||

|

|

|

|

|

|

|

D |

|

|

Check here if your address or |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||

|

|

Business Partner Number |

|

|

Reporting Period |

|

|

business information changed |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

postmark or hand delivery date |

||||||||||||||||||||||||

|

|

|

|

|

|

|

R |

|

|

and enter changes below. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

|

|

|

|

|

|

|

- |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Business Address |

|

|

|

|

|

|

Location/mailing address changes: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||

|

7 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||

|

|

|

|

|

|

|

|

|

New location address: ______________________________________ |

|||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||||||

|

|

|

|

|

0 |

_________________________________________________________ |

||||||||||||||||||||||||||||||||||

|

|

|

|

|

0 |

_________________________________________________________ |

||||||||||||||||||||||||||||||||||

|

|

|

|

|

0 |

|

|

|

|

Telephone number: (______)__________________________________ |

||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

1 |

|

|

|

|

New mailing address: ________________________________________ |

||||||||||||||||||||||||||||||

|

|

|

|

|

_________________________________________________________ |

|||||||||||||||||||||||||||||||||||

|

|

|

|

|

6 |

|||||||||||||||||||||||||||||||||||

|

|

Electronic Funds Transfer: |

|

|

|

|

_________________________________________________________ |

|||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

Check here if payment was transmitted electronically. |

|

|

|

|

Amount due |

|

|

|

|

|

, |

|

|

|

|

|

|

|

|

, |

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

|

Payment is due on the 1st and LATE |

|

|

|

|

|

|

|

from Line 12 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||

if postmarked or hand delivered after

Where to send payments and returns

Make check payable to and send with return to:

FLORIDA DEPARTMENT OF REVENUE PO BOX 6520

TALLAHASSEE FL

File online via our Internet site at www.myflorida.com/dor

File electronically . . .

it’s easy!

All dealers are encouraged to file using an electronic method. Filing communications services tax returns electronically ensures quick, efficient, and accurate processing.

Internet filing: The DOR Internet site will guide dealers easily through the filing process. Dealers should visit www.myflorida.com/dor or call the Department’s

Hearing or speech impaired persons may call the TDD line at

EFT and EDI filing: Some dealers are required to file using this method. If, in the previous state fiscal year (July 1 through June 30), a dealer paid $50,000 or more in gross receipts tax, sales tax, or communications services tax, that dealer must file the return using electronic data interchange (EDI) and remit funds using electronic funds transfer (EFT), or may both file and remit using the Internet.

N. 10/01

Page 3

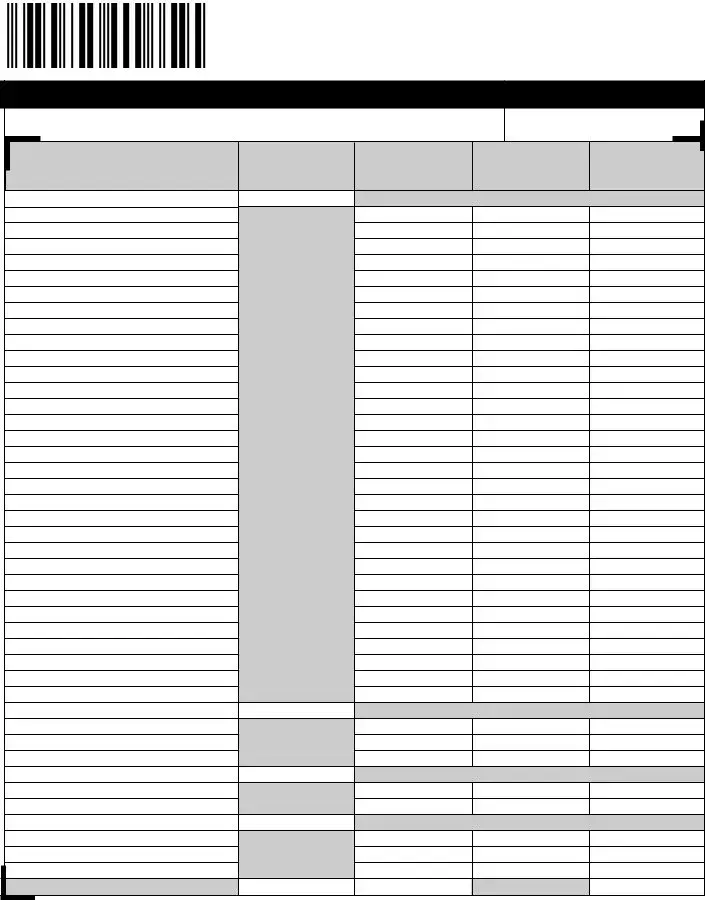

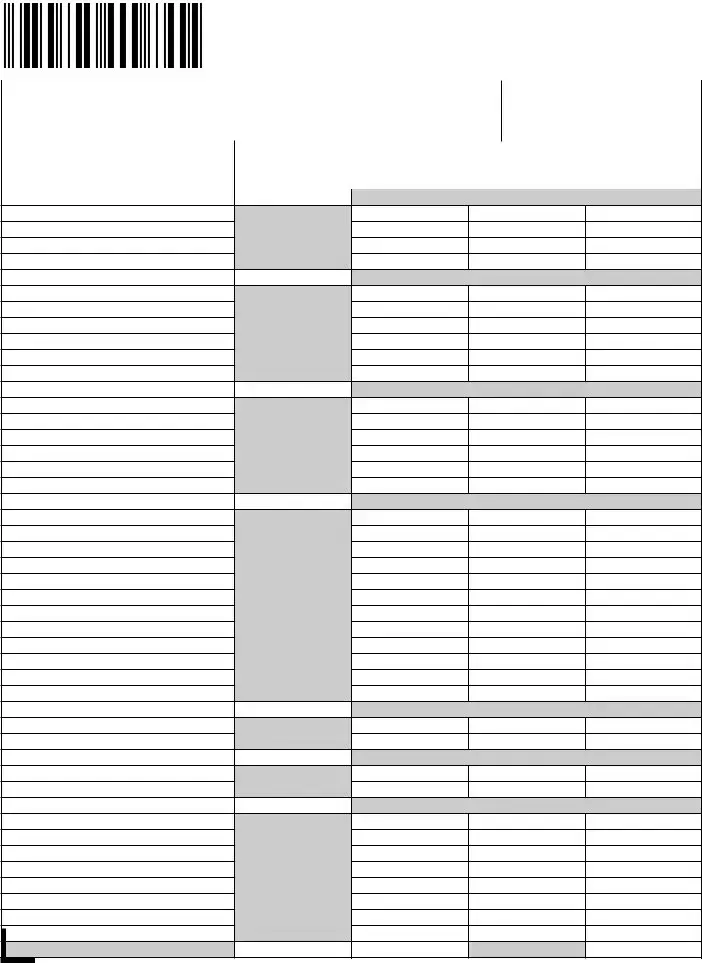

Schedule I - State, Gross Receipts, and Local Taxes Due

Business name |

Business partner number |

A. |

B. |

C. |

D. |

E. |

Local jurisdiction |

Taxable sales |

Taxable sales subject |

Local tax rates |

Local tax due |

|

subject to state tax |

to local taxes |

|

|

ALACHUA |

|

|

|

|

Unincorporated area |

|

|

0.0552 |

|

Alachua |

|

|

0.0410 |

|

Archer |

|

|

0.0542 |

|

Gainesville |

|

|

0.0542 |

|

Hawthorne |

|

|

0.0212 |

|

High Springs |

|

|

0.0542 |

|

La Crosse |

|

|

0.0372 |

|

Micanopy |

|

|

0.0282 |

|

Newberry |

|

|

0.0460 |

|

Waldo |

|

|

0.0152 |

|

BAKER |

|

|

|

|

Unincorporated area |

|

|

0.0124 |

|

Glen St. Mary |

|

|

0.0620 |

|

Macclenny |

|

|

0.0702 |

|

BAY |

|

|

|

|

Unincorporated area |

|

|

0.0234 |

|

Callaway |

|

|

0.0600 |

|

Cedar Grove |

|

|

0.0582 |

|

Lynn Haven |

|

|

0.0612 |

|

Mexico Beach |

|

|

0.0358 |

|

Panama City |

|

|

0.0612 |

|

Panama City Beach |

|

|

0.0602 |

|

Parker |

|

|

0.0602 |

|

Springfield |

|

|

0.0612 |

|

BRADFORD |

|

|

|

|

Unincorporated area |

|

|

0.0134 |

|

Brooker |

|

|

0.0380 |

|

Hampton |

|

|

0.0300 |

|

Lawtey |

|

|

0.0180 |

|

Starke |

|

|

0.0452 |

|

BREVARD |

|

|

|

|

Unincorporated area |

|

|

0.0166 |

|

Cape Canaveral |

|

|

0.0562 |

|

Cocoa |

|

|

0.0430 |

|

Cocoa Beach |

|

|

0.0562 |

|

Indialantic |

|

|

0.0670 |

|

Indian Harbour Beach |

|

|

0.0534 |

|

Malabar |

|

|

0.0562 |

|

Melbourne |

|

|

0.0572 |

|

Melbourne Beach |

|

|

0.0562 |

|

Melbourne Village |

|

|

0.0562 |

|

Palm Bay |

|

|

0.0562 |

|

Palm Shores |

|

|

0.0520 |

|

Rockledge |

|

|

0.0552 |

|

Satellite Beach |

|

|

0.0532 |

|

Titusville |

|

|

0.0582 |

|

West Melbourne |

|

|

0.0592 |

|

PAGE TOTAL |

|

|

|

|

N. 10/01

Page 4

Schedule I - State, Gross Receipts, and Local Taxes Due

Business name |

Business partner number |

A. |

B. |

C. |

D. |

E. |

Local jurisdiction |

Taxable sales |

Taxable sales subject |

Local tax rates |

Local tax due |

|

subject to state tax |

to local taxes |

|

|

BROWARD |

|

|

|

|

Unincorporated area |

|

|

0.0522 |

|

Coconut Creek |

|

|

0.0562 |

|

Cooper City |

|

|

0.0532 |

|

Coral Springs |

|

|

0.0562 |

|

Dania |

|

|

0.0572 |

|

Davie |

|

|

0.0560 |

|

Deerfield Beach |

|

|

0.0162 |

|

Fort Lauderdale |

|

|

0.0562 |

|

Hallandale Beach |

|

|

0.0562 |

|

Hillsboro Beach |

|

|

0.0130 |

|

Hollywood |

|

|

0.0562 |

|

Lauderdale Lakes |

|

|

0.0572 |

|

|

|

0.0562 |

|

|

Lauderhill |

|

|

0.0562 |

|

Lazy Lakes |

|

|

0.0060 |

|

Lighthouse Point |

|

|

0.0672 |

|

Margate |

|

|

0.0572 |

|

Miramar |

|

|

0.0562 |

|

North Lauderdale |

|

|

0.0552 |

|

Oakland Park |

|

|

0.0582 |

|

Parkland |

|

|

0.0532 |

|

Pembroke Park |

|

|

0.0562 |

|

Pembroke Pines |

|

|

0.0582 |

|

Plantation |

|

|

0.0562 |

|

Pompano Beach |

|

|

0.0562 |

|

Sea Ranch Lakes |

|

|

0.0532 |

|

Southwest Ranches |

|

|

0.0490 |

|

Sunrise |

|

|

0.0562 |

|

Tamarac |

|

|

0.0542 |

|

Weston |

|

|

0.0572 |

|

Wilton Manors |

|

|

0.0602 |

|

CALHOUN |

|

|

|

|

Unincorporated area |

|

|

0.0050 |

|

Altha |

|

|

0.0602 |

|

Blountstown |

|

|

0.0582 |

|

CHARLOTTE |

|

|

|

|

Unincorporated area |

|

|

0.0602 |

|

Punta Gorda |

|

|

0.0622 |

|

CITRUS |

|

|

|

|

Unincorporated area |

|

|

0.0234 |

|

Crystal River |

|

|

0.0572 |

|

Inverness |

|

|

0.0572 |

|

PAGE TOTAL |

|

|

|

|

N. 10/01

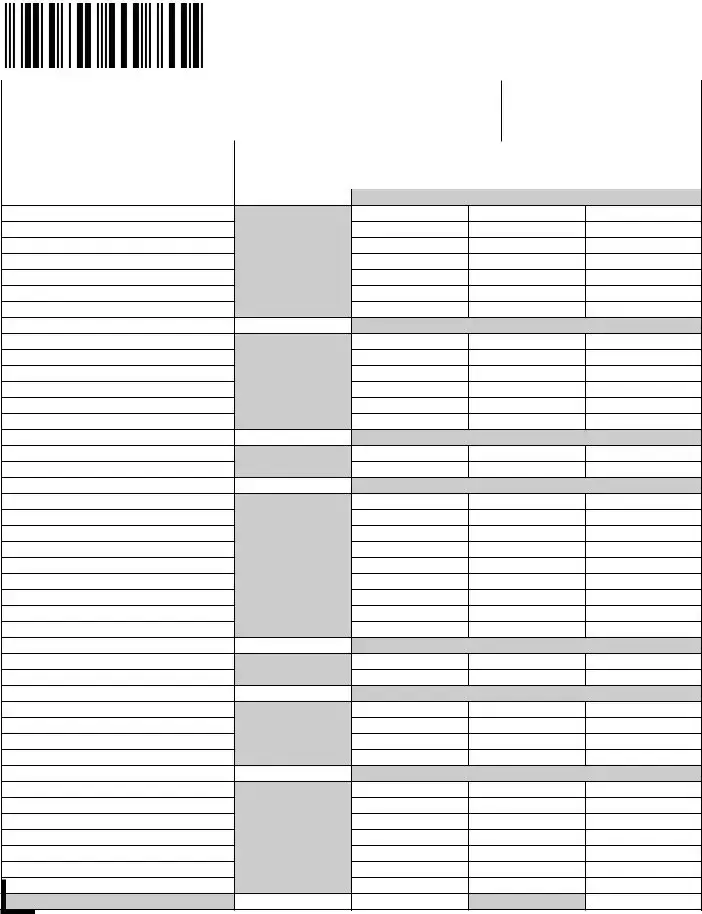

Page 5

|

|

Schedule I - State, Gross Receipts, and Local Taxes Due |

|

|

|

|||||

Business name |

|

|

|

Business partner number |

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

A. |

B. |

C. |

|

D. |

|

E. |

|

|

|

|

|

|

|||||||

|

|

Local jurisdiction |

Taxable sales |

Taxable sales subject |

Local tax rates |

|

Local tax due |

|||

|

|

|

subject to state tax |

to local taxes |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

CLAY |

|

Unincorporated area |

0.0702 |

Green Cove Springs |

0.0612 |

Keystone Heights |

0.0302 |

Orange Park |

0.0582 |

Penney Farms |

0.0592 |

COLLIER |

|

Unincorporated area |

0.0230 |

Everglades |

0.0420 |

Marco Island |

0.0542 |

Naples |

0.0360 |

COLUMBIA |

|

Unincorporated area |

0.0200 |

Fort White |

0.0130 |

Lake City |

0.0612 |

DESOTO |

|

Unincorporated area |

0.0304 |

Arcadia |

0.0612 |

DIXIE |

|

Unincorporated area |

0.0234 |

Cross City |

0.0320 |

Horseshoe Beach |

0.0720 |

DUVAL |

|

Atlantic Beach |

0.0712 |

Baldwin |

0.0732 |

Jacksonville Beach |

0.0582 |

Jax Duval |

0.0582 |

Neptune Beach |

0.0612 |

ESCAMBIA |

|

Unincorporated area |

0.0284 |

Century |

0.0320 |

Pensacola |

0.0640 |

FLAGLER |

|

Unincorporated area |

0.0264 |

Beverly Beach |

0.0612 |

Bunnell |

0.0612 |

Flagler Beach |

0.0630 |

Marineland |

0.0110 |

Palm Coast |

0.0602 |

FRANKLIN |

|

Unincorporated area |

0.0090 |

Apalachicola |

0.0390 |

Carrabelle |

0.0632 |

PAGE TOTAL |

|

N. 10/01

Page 6

|

|

Schedule I - State, Gross Receipts, and Local Taxes Due |

|

|

|

|||||

Business name |

|

|

|

Business partner number |

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

A. |

B. |

C. |

|

D. |

|

E. |

|

|

|

|

|

|

|||||||

|

|

Local jurisdiction |

Taxable sales |

Taxable sales subject |

Local tax rates |

|

Local tax due |

|||

|

|

|

subject to state tax |

to local taxes |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

GADSDEN |

|

Unincorporated area |

0.0104 |

Chattahoochee |

0.0582 |

Greensboro |

0.0562 |

Gretna |

0.0602 |

Havana |

0.0572 |

Midway |

0.0450 |

Quincy |

0.0582 |

GILCHRIST |

|

Unincorporated area |

0.0234 |

Bell |

0.0530 |

Fanning Springs |

0.0662 |

Trenton |

0.0602 |

GLADES |

|

Unincorporated area |

0.0110 |

Moore Haven |

0.0190 |

GULF |

|

Unincorporated area |

0.0094 |

Port St. Joe |

0.0582 |

Wewahitchka |

0.0582 |

HAMILTON |

|

Unincorporated area |

0.0090 |

Jasper |

0.0580 |

Jennings |

0.0570 |

White Springs |

0.0600 |

HARDEE |

|

Unincorporated area |

0.0194 |

Bowling Green |

0.0390 |

Wauchula |

0.0612 |

Zolfo Springs |

0.0302 |

HENDRY |

|

Unincorporated area |

0.0244 |

Clewiston |

0.0612 |

La Belle |

0.0512 |

HERNANDO |

|

Unincorporated area |

0.0180 |

Brooksville |

0.0562 |

Weeki Wachee |

0.0040 |

HIGHLANDS |

|

Unincorporated area |

0.0244 |

Avon Park |

0.0612 |

Lake Placid |

0.0160 |

Sebring |

0.0582 |

PAGE TOTAL |

|

N. 10/01

Page 7

|

|

Schedule I - State, Gross Receipts, and Local Taxes Due |

|

|

|

|||||

Business name |

|

|

|

Business partner number |

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

A. |

B. |

C. |

|

D. |

|

E. |

|

|

|

|

|

|

|||||||

|

|

Local jurisdiction |

Taxable sales |

Taxable sales subject |

Local tax rates |

|

Local tax due |

|||

|

|

|

subject to state tax |

to local taxes |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

HILLSBOROUGH |

|

Unincorporated area |

0.0280 |

Plant City |

0.0682 |

Tampa |

0.0632 |

Temple Terrace |

0.0640 |

HOLMES |

|

Unincorporated area |

0.0080 |

Bonifay |

0.0692 |

Esto |

0.0150 |

Noma |

0.0080 |

Ponce De Leon |

0.0350 |

Westville |

0.0160 |

INDIAN RIVER |

|

Unincorporated area |

0.0254 |

Fellsmere |

0.0582 |

Indian River Shores |

0.0360 |

Orchid |

0.0290 |

Sebastian |

0.0602 |

Vero Beach |

0.0612 |

JACKSON |

|

Unincorporated area |

0.0254 |

Alford |

0.0220 |

Bascom |

0.0212 |

Campbellton |

0.0592 |

Cottondale |

0.0632 |

Graceville |

0.0632 |

Grand Ridge |

0.0592 |

Greenwood |

0.0592 |

Jacob City |

0.0070 |

Malone |

0.0592 |

Marianna |

0.0622 |

Sneads |

0.0430 |

JEFFERSON |

|

Unincorporated area |

0.0174 |

Monticello |

0.0540 |

LAFAYETTE |

|

Unincorporated area |

0.0234 |

Mayo |

0.0260 |

LAKE |

|

Unincorporated area |

0.0274 |

Astatula |

0.0540 |

Clermont |

0.0612 |

Eustis |

0.0622 |

Fruitland Park |

0.0622 |

Groveland |

0.0610 |

0.0612 |

|

Lady Lake |

0.0592 |

PAGE TOTAL |

|

N. 10/01

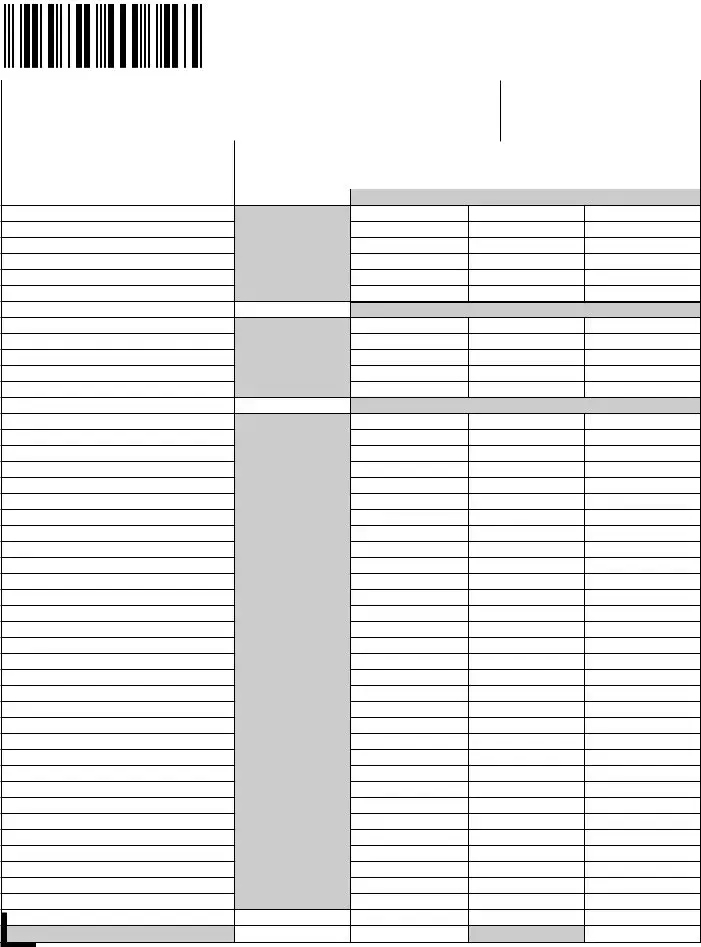

Page 8

|

|

Schedule I - State, Gross Receipts, and Local Taxes Due |

|

|

|

|||||

Business name |

|

|

|

Business partner number |

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

A. |

B. |

C. |

|

D. |

|

E. |

|

|

|

|

|

|

|||||||

|

|

Local jurisdiction |

Taxable sales |

Taxable sales subject |

Local tax rates |

|

Local tax due |

|||

|

|

|

subject to state tax |

to local taxes |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

LAKE - continued |

|

Leesburg |

0.0592 |

Mascotte |

0.0480 |

Minneola |

0.0612 |

Montverde |

0.0250 |

Mount Dora |

0.0602 |

Tavares |

0.0632 |

Umatilla |

0.0612 |

LEE |

|

Unincorporated area |

0.0542 |

Bonita Springs |

0.0202 |

Cape Coral |

0.0448 |

Fort Myers |

0.0562 |

Fort Myers Beach |

0.0542 |

Sanibel |

0.0542 |

LEON |

|

Unincorporated area |

0.0244 |

Tallahassee |

0.0612 |

LEVY |

|

Unincorporated area |

0.0050 |

Bronson |

0.0330 |

Cedar Key |

0.0280 |

Chiefland |

0.0592 |

Fanning Springs |

0.0662 |

Inglis |

0.0602 |

Otter Creek |

0.0120 |

Williston |

0.0592 |

Yankeetown |

0.0662 |

LIBERTY |

|

Unincorporated area |

0.0144 |

Bristol |

0.0582 |

MADISON |

|

Unincorporated area |

0.0234 |

Greenville |

0.0512 |

Lee |

0.0572 |

Madison |

0.0612 |

MANATEE |

|

Unincorporated area |

0.0194 |

Anna Maria |

0.0150 |

Bradenton |

0.0622 |

Bradenton Beach |

0.0612 |

Holmes Beach |

0.0552 |

Longboat Key |

0.0552 |

Palmetto |

0.0592 |

PAGE TOTAL |

|

N. 10/01

Page 9

|

|

Schedule I - State, Gross Receipts, and Local Taxes Due |

|

|

|

|||||

Business name |

|

|

|

Business partner number |

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

A. |

B. |

C. |

|

D. |

|

E. |

|

|

|

|

|

|

|||||||

|

|

Local jurisdiction |

Taxable sales |

Taxable sales subject |

Local tax rates |

|

Local tax due |

|||

|

|

|

subject to state tax |

to local taxes |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

MARION |

|

Unincorporated area |

0.01735 |

Belleview |

0.0222 |

Dunnellon |

0.0552 |

McIntosh |

0.0140 |

Ocala |

0.0562 |

Reddick |

0.0140 |

MARTIN |

|

Unincorporated area |

0.0264 |

Jupiter Island |

0.0592 |

Ocean Breeze Park |

0.0300 |

Sewalls Point |

0.0382 |

Stuart |

0.0592 |

|

|

Unincorporated area |

0.0582 |

Aventura |

0.0590 |

Bal Harbour |

0.0602 |

Bay Harbour Island |

0.0592 |

Biscayne Park |

0.0500 |

Coral Gables |

0.0582 |

El Portal |

0.0630 |

Florida City |

0.0622 |

Golden Beach |

0.0252 |

Hialeah |

0.0592 |

Hialeah Gardens |

0.0602 |

Homestead |

0.0612 |

Indian Creek Village |

0.0110 |

Islandia |

0.0000 |

Key Biscayne |

0.0592 |

Medley |

0.0712 |

Miami |

0.0592 |

Miami Beach |

0.0592 |

Miami Lakes |

0.0552 |

Miami Shores Village |

0.0652 |

Miami Springs |

0.0572 |

North Bay Village |

0.0560 |

North Miami |

0.0592 |

North Miami Beach |

0.0592 |

Opa Locka |

0.0582 |

Pinecrest |

0.0632 |

South Miami |

0.0592 |

Sunny Isles Beach |

0.0602 |

Surfside |

0.0562 |

Sweetwater |

0.0592 |

Virginia Gardens |

0.0552 |

West Miami |

0.0510 |

PAGE TOTAL |

|

N. 10/01

Page 10

|

|

Schedule I - State, Gross Receipts, and Local Taxes Due |

|

|

|

|||||

Business name |

|

|

|

Business partner number |

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

A. |

B. |

C. |

|

D. |

|

E. |

|

|

|

|

|

|

|||||||

|

|

Local jurisdiction |

Taxable sales |

Taxable sales subject |

Local tax rates |

|

Local tax due |

|||

|

|

|

subject to state tax |

to local taxes |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

MONROE |

|

Unincorporated area |

0.0264 |

Islamorada |

0.0612 |

Key Colony Beach |

0.0620 |

Key West |

0.0250 |

Layton |

0.0090 |

Marathon |

0.0632 |

NASSAU |

|

Unincorporated area |

0.0254 |

Callahan |

0.0550 |

Fernandina Beach |

0.0612 |

Hilliard |

0.0388 |

OKALOOSA |

|

Unincorporated area |

0.0194 |

Cinco Bayou |

0.0540 |

Crestview |

0.0542 |

Destin |

0.0542 |

Ft. Walton Beach |

0.0602 |

Laurel Hill |

0.0300 |

Mary Esther |

0.0542 |

Niceville |

0.0600 |

Shalimar |

0.0540 |

Valparaiso |

0.0552 |

OKEECHOBEE |

|

Unincorporated area |

0.0150 |

Okeechobee |

0.0594 |

ORANGE |

|

Unincorporated area |

0.0520 |

Apopka |

0.0662 |

Bay Lake |

0.0000 |

Belle Isle |

0.0192 |

Eatonville |

0.0562 |

Edgewood |

0.0522 |

Lake Buena Vista |

0.0000 |

Maitland |

0.0572 |

Oakland |

0.0562 |

Ocoee |

0.0562 |

Orlando |

0.0530 |

Windermere |

0.0562 |

Winter Garden |

0.0562 |

Winter Park |

0.0622 |

OSCEOLA |

|

Unincorporated area |

0.0612 |

Kissimmee |

0.0602 |

St. Cloud |

0.0600 |

PAGE TOTAL |

|

File Specifications

| Fact | Detail |

|---|---|

| Form Title | Florida Communications Services Tax Return |

| Form Number | DR-700016 |

| Revision Date | December 2001 |

| Required Information | Name, Address, Business Partner Number, FEIN, City/State/ZIP, and financial details for the reporting period. |

| Final Return Indicator | Option to indicate if this is the final return upon discontinuing business. |

| Collection Allowance Section | Allows for a collection allowance with specific rate options or none. |

| Penalties and Interest | Sections to report any penalties and interest due. |

| Adjustments and Credits | Includes adjustments from Schedule III and IV, and multistate credits from Schedule V. |

| Authentication Requirement | Requires signature under penalties of perjury, certifying the return's completeness and accuracy according to Florida Statutes. |

| Governing Laws | ss. 92.525(2), 203.01(1), and 837.06, Florida Statutes. |

| Electronic Filing Encouragement | Encourages electronic filing for efficient and accurate processing with details on electronic methods and security measures. |

Instructions on Filling in Business Partner Number Florida

After gathering all the necessary information for the Business Partner Number Florida form, it's crucial to follow the steps accurately to ensure a smooth submission process. This comprehensive guide will walk you through each part, reducing the possibility of errors and ensuring your form is processed efficiently.

- Begin by writing the full name and address of your business in the designated areas at the top of the form.

- Enter your Business Partner Number and Federal Employer Identification Number (FEIN) in the specified fields.

- If applicable, mark the checkbox indicating you are discontinuing your business and this submission will be your final return.

- For the Reporting Period, enter the start date (FROM:) and end date (TO:) using the format MMDDYYYY in the respective fields.

- In Section 1, input the tax due on sales subject to the state portion of the communications services tax.

- Enter the amount of tax due on sales subject to the gross receipts portion of the communications services tax in Section 2.

- In Section 3, specify the tax due on sales subject to the local portion of the communications services tax.

- For Section 4, detail the tax due for direct-to-home satellite services.

- Calculate and enter the Total communications services tax in Section 5 by adding the amounts from Lines 1 through 4.

- In Section 6, note the collection allowance and check the appropriate rate, if any.

- Subtract the collection allowance from the total tax to determine the Net communications services tax due in Section 7.

- Fill in the Penalty and Interest amounts in Sections 8 and 9 respectively, if applicable.

- Enter any Adjustments and Multistate credits in Sections 10 and 11, as necessary.

- In Section 12, provide the total Amount due with return.

- Under the AUTHORIZATION section, type or print the name of the authorized individual, then sign and date the form. Include the preparer's information, if different from the authorized individual.

- For businesses with changes in address or other basic information, complete the section labeled "Check here if your address or business information changed" and provide updated details.

- If the payment is made via electronic funds transfer, mark the corresponding checkbox.

- Lastly, ensure your payment, attached to the provided Payment Coupon, is submitted by the due date to avoid late fees. The coupon should also include your Business Partner Number and the Reporting Period.

After completing all the steps and reviewing your form for accuracy, mail your form and payment to the Florida Department of Revenue at the address provided on the form. You can also choose to file online for faster processing. Remember to keep a copy of your submission for your records.

Understanding Business Partner Number Florida

What is the Business Partner Number in Florida?

The Business Partner Number is a unique identifier assigned to businesses that file the Florida Communications Services Tax Return. It is used by the Florida Department of Revenue to identify and track tax filings and payments.

How do I find my Business Partner Number?

Your Business Partner Number is provided to you by the Florida Department of Revenue. It is included in your registration documents and on previous tax filings. If you cannot find it, contact the Department for assistance.

Why do I need to use black ink when filling out the form?

Using black ink ensures that the information is legible and can be accurately scanned and processed by the Florida Department of Revenue's systems. Legibility is crucial for accurate record-keeping and processing.

What do I do if I am discontinuing my business?

If you are closing your business, check the box stating you are discontinuing your business and this is your final return. Make sure to complete the form as usual and submit it by the due date to avoid any penalties.

Can I file the Florida Communications Services Tax Return electronically?

Yes, electronic filing is encouraged as it is faster, more efficient, and reduces errors. The Florida Department of Revenue offers electronic filing through their website at www.myflorida.com/dor. Electronic filing also ensures quick processing and secure submission of your sensitive information.

What happens if I file or pay my taxes late?

Filing or paying your taxes after the due date may result in penalties and interest charges. It is essential to file and pay on time to avoid these additional costs.

What is the Reporting Period on the form?

The Reporting Period refers to the specific period for which you are filing the Florida Communications Services Tax Return. It is marked by a From and To date at the top of the form and should match the period for which you are reporting your taxes.

What should I do if my address or business information has changed?

If there have been any changes to your address or business information, check the box indicating a change and fill in the new details in the space provided on the form. This ensures that all communication and records are up-to-date.

How is the Total Communications Services Tax calculated?

The Total Communications Services Tax is calculated by adding the tax due on sales subject to the state portion, the gross receipts portion, the local portion of the communications services tax, and the tax due for direct-to-home satellite services. Subtract any collection allowance, then add penalties, interest, and adjustments to determine the amount due.

Common mistakes

Filling out the Business Partner Number Florida form accurately is crucial for businesses to ensure compliance with state tax requirements. However, individuals often make mistakes that can lead to delays, inaccuracies in tax liability, or even penalties. Here are ten common errors:

- Failing to use black ink as instructed, which can cause issues with machine readability and processing of the form.

- Incorrectly reporting the Business Partner Number, leading to misidentification and potential processing delays.

- Entering the wrong FEIN, which is fundamental for tax identification and can lead to significant issues with tax filings.

- Misunderstanding the difference between the state portion of the communications services tax and the gross receipts portion, resulting in inaccurately calculated tax obligations.

- Forgetting to add the total communications services tax amounts from lines 1 through 4, an error that impacts the total tax due.

- Not properly selecting or calculating the collection allowance, thereby potentially overpaying or underpaying the tax due.

- Omitting or inaccurately reporting adjustments from Schedule III and/or IV, which could reflect incorrect tax amounts owed.

- Overlooking the multistate credits from Schedule V, missing out on tax credits that could reduce the overall tax liability.

- Submitting the form with missing or incorrect authorization, including type or print name, authorized signature, date, and contact information, which are essential for the form’s validation and processing.

- Failure to report changes in business address or business information, leading to miscommunication and potential issues with future correspondence.

Each of these mistakes can lead to complications in processing the form, potentially resulting in delays, incorrect tax assessments, and the imposition of penalties. It's vital for businesses to pay careful attention to the details of the form, double-checking all entries, and ensuring that they comply with all filing requirements to maintain good standing with the Florida Department of Revenue.

Documents used along the form

When handling the Business Partner Number Florida form, it's critical to be aware of additional documentation that might be necessary for a complete and comprehensive submission. These documents ensure compliance, provide detailed information, and facilitate a smoother processing of your transaction with the Florida Department of Revenue. Each document serves its unique purpose, complementing the Business Partner Number Florida form to ensure that businesses meet all state requirements efficiently.

- FEIN Documentation: This document verifies the Federal Employer Identification Number (FEIN) of the business, which is necessary for tax identification purposes.

- Florida Annual Resale Certificate for Sales Tax: This certificate allows businesses to make tax-free purchases of items and services for resale, contingent upon the items being resold as tangible personal property. It must be renewed annually.

- Application for Registration: Required for new businesses, this form registers them for the correct taxes and obtains the necessary tax account numbers.

- Schedule of Taxable Sales: This document provides a detailed breakdown of all sales subject to tax, facilitating accurate tax computation.

- Schedule of Exemptions and Deductions: Lists all qualifying exemptions and deductions claimed by the business, reducing the gross income subject to tax.

- Direct-to-Home Satellite Services Tax Form: Required for businesses providing satellite services directly to homes, specifying the tax due on such services.

- Multistate Tax Credit Form: For businesses operating in multiple states, this form helps in claiming tax credits for taxes paid in other jurisdictions.

Each of these documents plays a crucial role alongside the Business Partner Number Florida form in ensuring that businesses accurately report and pay their taxes. Understanding and gathering these forms in advance aids in streamlining the submission process, thereby helping businesses to remain in good standing with the Florida Department of Revenue. For a seamless experience, it's advisable to consult with a tax professional or the Department directly for the most up-to-date requirements and guidelines.

Similar forms

The Business Tax Receipt Application is similar because it requires business identification details, similar to the business partner number and FEIN provided on the Business Partner Number Florida form.

Sales and Use Tax Return forms resemble it closely by requiring a detailed report on taxable sales and applicable taxes due, much like the tax calculations and reporting found in the Florida form.

Like the Employer's Quarterly Federal Tax Return, it necessitates the inclusion of identification numbers and financial information pertinent to tax reporting periods.

The Local Business Tax Receipt Renewal Notice shares similarities by asking for business identification and tax reporting for a specific period, mirroring the structure and purpose of the Florida form.

Corporate Income Tax Return forms are akin to it as they require both identification numbers, like FEIN, and detailed financial reporting, which are crucial elements of tax documentation.

Commercial Rental Tax Return forms have a resemblance in that they involve reporting income from a specific category and calculating taxes due, akin to the communications services tax calculation on the Florida form.

The Utility Tax Return forms are similar because they deal with taxable services provided, requiring detailed tax calculations and schedule summaries, which is a significant part of the Business Partner Number Florida form’s content.

Annual Resale Certificate for Sales Tax involves business identification and is utilized for declaring tax exemption status on purchases for resale, paralleling the necessity for official identification and tax-related declarations in the Florida form.

Documentation like the Change of Address or Business Information forms are related as they include sections for updating business details, similar to the updates section found in the business partner form.

The Electronic Funds Transfer (EFT) Authorization shares similarities due to its incorporation into the payment process for tax returns, including the option for electronic payment detailed in the Florida form instructions.

Dos and Don'ts

When filling out the Business Partner Number Florida form (Form DR-700016), there are several dos and don'ts that can help ensure the process is smooth and error-free. By following these guidelines, filers can avoid common mistakes and ensure their tax return is processed efficiently.

Do:

- Use black ink: Whether filling out the form by hand or typing, ensure to use black ink for clarity and better digital scanning compatibility.

- Report accurate figures: Double-check all sales figures and tax calculations before submitting to ensure accuracy. Misreporting can lead to penalties or delays.

- Include authorization: Make sure the form is signed and dated by an authorized individual to confirm the veracity of the information provided.

- Electronically file (e-file) when possible: E-filing is encouraged for its efficiency, speed, and accuracy in processing. It’s also environmentally friendly compared to paper filing.

Don't:

- Forget to check the "final return" box if ending your business: If you are discontinuing your business, ensure to mark the relevant checkbox. This notifies the Florida Department of Revenue (DOR) to close your account for this tax type.

- Leave blank fields for critical information: All sections, including the business partner number, FEIN, and financial details, must be fully filled out to avoid processing delays.

- Miss the reporting period dates: Ensure the FROM and TO dates accurately reflect the period you are reporting for. Incorrect reporting periods can lead to inconsistencies and potential fines.

- Detach the payment coupon if mailing your payment: The payment coupon should be securely attached to your check to ensure proper credit to your account. This simplifies payment processing and record-keeping.

By adhering to these straightforward dos and don'ts, businesses can efficiently manage their Florida Communications Services Tax Return filings, minimizing the risk of errors and ensuring compliance with state tax laws.

Misconceptions

- Only businesses discontinuing operations need to submit the Business Partner Number Florida form. This is not correct. While there is a section indicating if the business is discontinuing and this is the final return, all businesses engaged in taxable communications services in Florida must regularly file this return, not just those closing down.

- The form is only for reporting state taxes. In reality, the form covers not just state taxes but also gross receipts and local taxes for communications services. It's a comprehensive form designed to report and calculate various tax obligations within the state.

- A Business Partner Number is unnecessary for filing. This is false. The Business Partner Number is a critical identifier used by the Florida Department of Revenue to track tax filings and payments. It ensures that submissions and payments are accurately applied to the correct account.

- Electronic filing is optional. While the form might suggest that electronic filing is encouraged and beneficial for efficiency and security, for certain thresholds of tax payment, electronic filing becomes mandatory. This ensures timely and secure processing of tax obligations.

- The form is exclusively for businesses located in Florida. Although the form is utilized by Florida-based businesses, it can also apply to businesses outside Florida that provide taxable communications services to customers within the state. These out-of-state companies must comply with Florida's tax laws for applicable services.

- Penalties and interests are only assessed for late payments. This misconception overlooks other aspects that could trigger penalties and interest, such as underreporting of taxable sales or inaccuracies on the form. Compliance with both deadlines and accurate reporting is essential to avoid extra charges.

Key takeaways

Filling out and using the Business Partner Number Florida form is an important task for businesses involved in providing communication services within the state. Here are six key takeaways to help guide you through the process:

- Accurately Provide Business Information: The form requires detailed information about your business, including the name, address, Business Partner Number, and Federal Employer Identification Number (FEIN). Ensure all information is current and accurately reflects your business profile to avoid processing delays.

- Understand the Reporting Period: You're required to fill in the reporting period, indicating the start and end dates for which you're submitting your tax return. This period must accurately reflect the timeframe for which taxes were collected and are now due to be remitted.

- Completeness is Key: Each section of the form addresses different aspects of the communications services tax, including state, gross receipts, and local taxes due. Make sure to complete every relevant section in detail to comply with state tax requirements fully.

- Calculations Must Be Precise: The form entails calculating tax amounts, adjustments, penalties, and net tax due. It's imperative to use accurate figures to determine your tax liability correctly. Errors in calculations can lead to underpayments, overpayments, or further scrutiny from the tax authority.

- Electronic Filing Options: The Florida Department of Revenue encourages electronic filing, which offers a quicker, more efficient, and accurate processing method. Electronic services are designed to be secure and provide an easier way for dealers to file their returns. Consider utilizing these options to expedite your filing process.

- Authorization and Verification: The form requires authorization under penalties of perjury, emphasizing the importance of verifying the accuracy and completeness of your return before submission. This includes a declaration that to the best of your knowledge and belief, the information provided is true and complete.

Following these guidelines will help you navigate the process of filling out and submitting the Business Partner Number Florida form. Remember, taking the time to carefully review and accurately complete every part of your submission is crucial for compliance with state tax laws.

Popular PDF Templates

Cost of Marriage License in Florida - Instructions highlight the need for timely application based on the scheduled wedding date, aiding in planning logistics.

Ucc Statement - Provides a blueprint for academic departments to communicate evolving educational needs and adjustments to the state.